#PEP (PepsiCo Inc.). Exchange rate and online charts.

Currency converter

28 Mar 2025 21:59

(-0.04%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

PepsiCo Inc. (#PEP) is a world’s leading multinational food and beverage corporation. The company was founded in 1965 in the US. It is the second largest corporation in the global food business in terms of net revenue.

PepsiCo produces and sells fizzy and still drinks, snacks, and other products in the US and around the world. The company owns several popular brands such as Pepsi, 7Up, Gatorade, Tropicana, Lay’s, Cheetos and others. At present, the company is committed to healthy nutrition, thus reducing dubious ingredients in its products.

In the 2008 fiscal year, PepsiCo revenues surged 9.6% to $43,251 billion whereas net profits on the contrary slumped 9.1% to $5,142 billion. Nowadays, its market capitalization equals $9,773.06 billion.

PepsiCo is included in the S&P 500 index. The company’s shares are traded on the NYSE under the #PEP ticker. In 2017, 99.57% of PepsiCo shares have been in free circulation.

The global producer of soft drinks and snacks suggests lucrative investment opportunities. According to expert estimates, PepsiCo’s shares gain 1.54% on average per month.

See Also

- Technical analysis / Video analytics

Forex forecast 28/03/2025: EUR/USD, GBP/USD, USD/JPY, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Oil and BitcoinAuthor: Sebastian Seliga

00:24 2025-03-29 UTC+2

2008

Technical analysisTrading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

1948

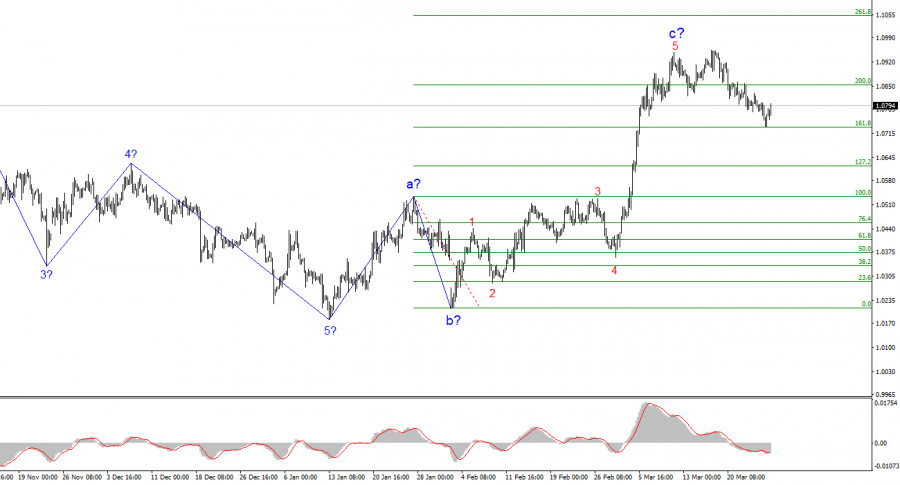

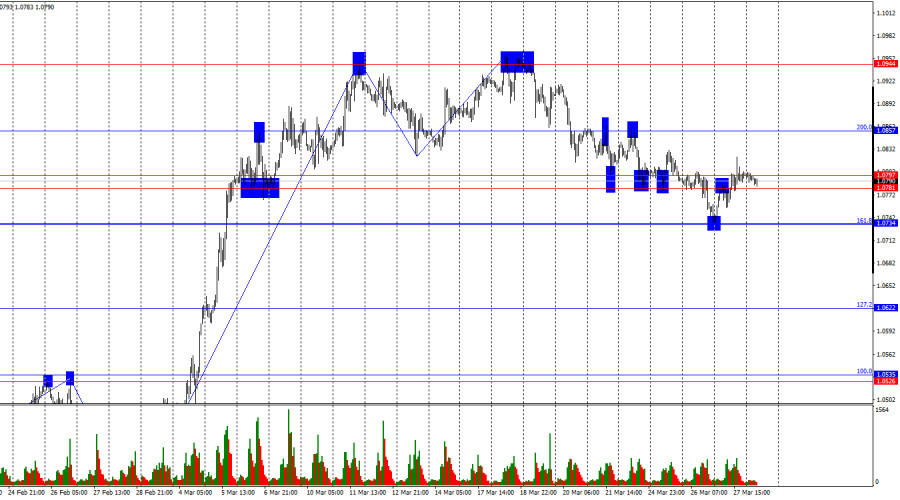

The EUR/USD pair rose by 60 basis points over the course of Thursday.Author: Chin Zhao

20:10 2025-03-28 UTC+2

1858

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

1798

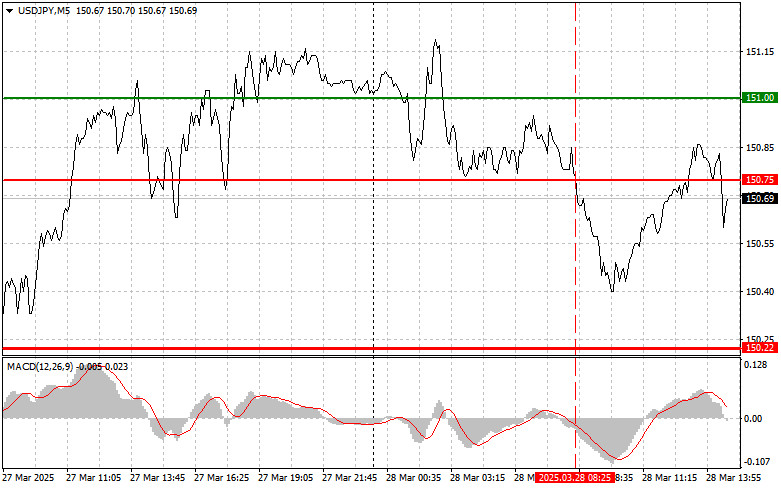

USDJPY: Simple Trading Tips for Beginner Traders on March 28th (U.S. Session)Author: Jakub Novak

20:04 2025-03-28 UTC+2

1663

EUR/USD. Analysis and ForecastAuthor: Irina Yanina

11:45 2025-03-28 UTC+2

1603

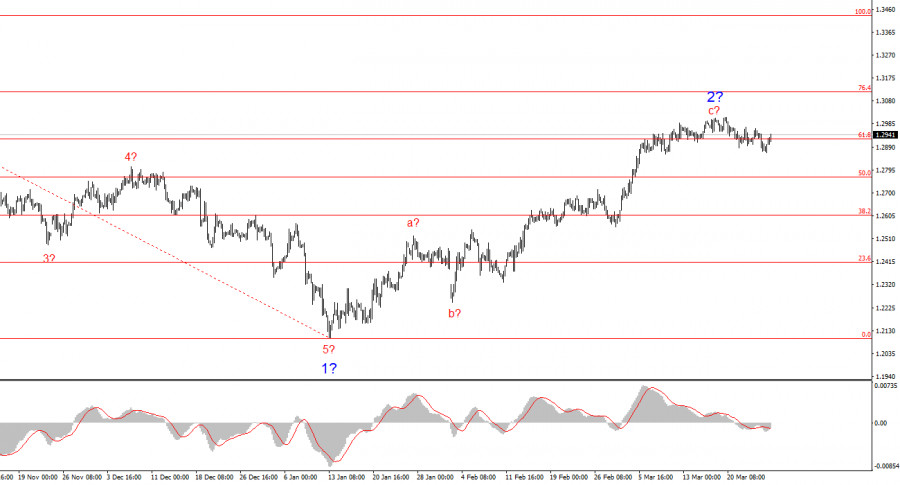

- The GBP/USD pair rose by 70 basis points on Thursday and added a symbolic 10 points on Friday.

Author: Chin Zhao

20:07 2025-03-28 UTC+2

1573

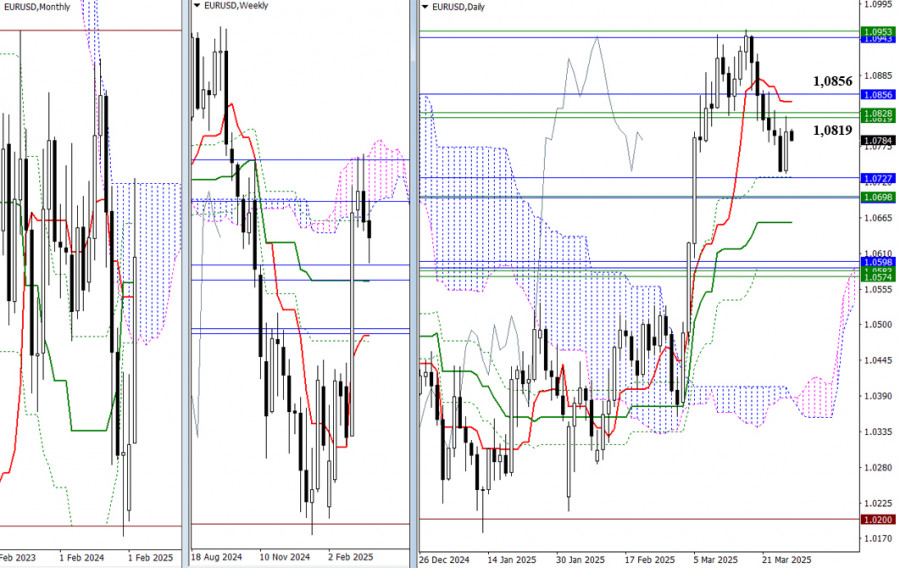

As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframesAuthor: Evangelos Poulakis

10:09 2025-03-28 UTC+2

1483

Technical analysisTrading Signals for EUR/USD for March 28-31, 2025: sell below 1.0775 (21 SMA - 6/8 Murray)

The euro's outlook is still bearish. We believe that the decline could continue below 1.08 in the coming days toward 1.0620.Author: Dimitrios Zappas

15:09 2025-03-28 UTC+2

1468

- Technical analysis / Video analytics

Forex forecast 28/03/2025: EUR/USD, GBP/USD, USD/JPY, Oil and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY, Oil and BitcoinAuthor: Sebastian Seliga

00:24 2025-03-29 UTC+2

2008

- Technical analysis

Trading Signals for GOLD (XAU/USD) for March 28-31, 2025: sell below $3,078 (technical correction - 21 SMA)

Important support is located around the 21 SMA at 3,035. This level coincides with the bottom of the uptrend channel, which could suggest a technical rebound in the coming days.Author: Dimitrios Zappas

15:12 2025-03-28 UTC+2

1948

- The EUR/USD pair rose by 60 basis points over the course of Thursday.

Author: Chin Zhao

20:10 2025-03-28 UTC+2

1858

- Bulls have been attacking for two weeks, but they've run out of steam

Author: Samir Klishi

11:48 2025-03-28 UTC+2

1798

- USDJPY: Simple Trading Tips for Beginner Traders on March 28th (U.S. Session)

Author: Jakub Novak

20:04 2025-03-28 UTC+2

1663

- EUR/USD. Analysis and Forecast

Author: Irina Yanina

11:45 2025-03-28 UTC+2

1603

- The GBP/USD pair rose by 70 basis points on Thursday and added a symbolic 10 points on Friday.

Author: Chin Zhao

20:07 2025-03-28 UTC+2

1573

- As the week comes to an end, the market remains indecisive, with no clear preferences evident. Yesterday, the bulls made some progress, adjusting the prevailing bearish sentiment. To confirm and consolidate the result, they need to overcome the cluster of resistance levels from various timeframes

Author: Evangelos Poulakis

10:09 2025-03-28 UTC+2

1483

- Technical analysis

Trading Signals for EUR/USD for March 28-31, 2025: sell below 1.0775 (21 SMA - 6/8 Murray)

The euro's outlook is still bearish. We believe that the decline could continue below 1.08 in the coming days toward 1.0620.Author: Dimitrios Zappas

15:09 2025-03-28 UTC+2

1468