Veja também

02.04.2025 08:50 AM

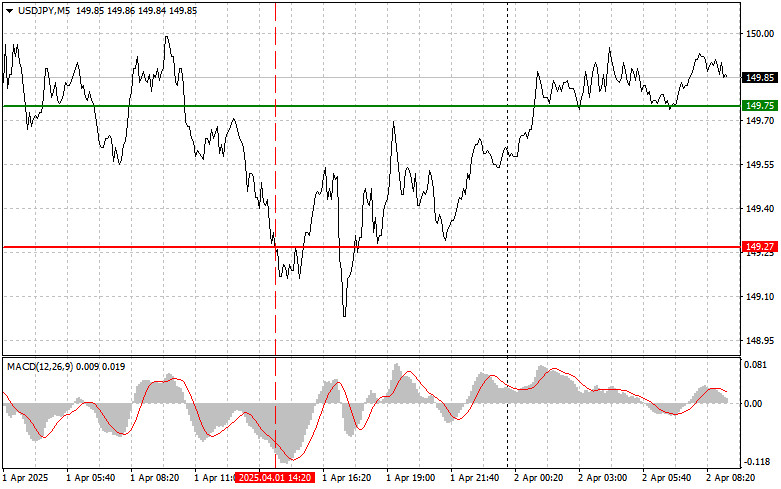

02.04.2025 08:50 AMThe price test at 149.27 occurred when the MACD indicator had already moved significantly below the zero line, which limited the pair's downside potential. For this reason, I did not sell the dollar. Throughout the day, I did not encounter any other suitable entry points.

Weak U.S. Manufacturing PMI data put pressure on the dollar and helped the Japanese yen strengthen. The PMI index, which reflects business activity in the manufacturing sector, came in below analysts' expectations, raising concerns about the outlook for U.S. economic growth. This, in turn, reduced the dollar's appeal. The yen, traditionally considered a safe-haven currency, benefited from the situation. Additional support for the yen comes from expectations of a possible shift in the Bank of Japan's monetary policy.

Today's relatively weak report on Japan's monetary base had little impact on the yen's exchange rate against the dollar. However, that does not mean the country's economy is stable. Many economists note a slowdown in growth, which could trigger more market volatility. Still, short-term fluctuations in the yen may be tied to global factors, such as changes in U.S. trade policy toward several developed nations. We'll get more details later today, so be prepared for increased market volatility.

For intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

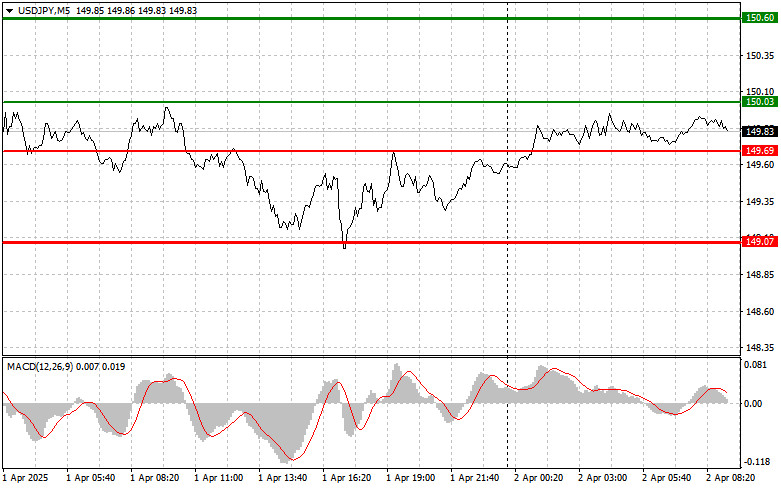

Scenario #1: I plan to buy USD/JPY today upon reaching the entry point around 150.03 (green line on the chart), targeting a rise to 150.60 (thicker green line). Near 150.60, I plan to exit long positions and open short positions in the opposite direction (expecting a 30–35 pip reversal). The best time to buy the pair is during pullbacks or significant dips. Important: Before buying, ensure the MACD indicator is above the zero line and beginning to rise.

Scenario #2: I also plan to buy USD/JPY if the price tests the 149.69 level twice in a row while the MACD is in oversold territory. This will limit the pair's downside and trigger a bullish reversal. A rise toward 150.03 and 150.60 can then be expected.

Scenario #1: I plan to sell USD/JPY only after breaking below 149.69 (red line on the chart), which could lead to a rapid decline. The key target for sellers will be 149.07, where I intend to exit short positions and open immediate longs (expecting a 20–25 pip bounce). Important: Before selling, ensure the MACD is below the zero line and starting to fall from it.

Scenario #2: I also plan to sell USD/JPY if the price tests 150.03 twice in a row, with the MACD in overbought territory. This will limit upside potential and lead to a bearish reversal. A decline toward 149.69 and 149.07 may follow.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Análise das operações e dicas para negociar o Iene japonês O teste do nível 143,25 ocorreu justamente quando o indicador MACD havia começado a se mover para cima a partir

Análise da operação e dicas para negociar a libra esterlina O teste do nível de 1,3225 ocorreu exatamente quando o indicador MACD começou a subir a partir da linha zero

Análise da operação e dicas para negociar o euro O teste do nível de preço de 1,1336 ocorreu quando o indicador MACD já havia se deslocado significativamente abaixo da linha

O teste do nível 142,69 ocorreu quando o MACD já havia se deslocado significativamente abaixo da linha zero, o que limitou o potencial de queda do par. Por esse motivo

Análise das operações e dicas para negociar a libra britância O teste do nível 1,3136 ocorreu quando o indicador MACD já havia se deslocado significativamente acima da linha zero

O teste do preço em 1,1397 ocorreu quando o indicador MACD já havia se deslocado significativamente acima da linha zero, o que limitou o potencial de alta do par. Diante

Análise das operações e recomendações para negociar o iene japonês Trading the Japanese Yen O teste do nível de preço de 143,49 coincidiu com o momento em que o indicador

Detalhamento da negociação e dicas para negociar com a libra esterlina O teste do nível de preço de 1,3024 ocorreu exatamente quando o indicador MACD começava a subir a partir

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Contas PAMM

da InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.