Veja também

18.10.2021 11:02 AM

18.10.2021 11:02 AMLast week, the Japanese yen became one of the major currencies that showed a decline against the US dollar. At the same time, it should be noted that the dollar/yen currency pair showed rather impressive growth. Perhaps this is caused by the aggravated epidemiological situation in the world, where the fourth wave of COVID-19 is rampant. It is unknown how many more waves of this hated and annoying pandemic will be. However, during the exacerbation of COVID-19, it was the US dollar that investors preferred and still prefer as a protective asset. This factor likely caused the growth of the USD/JPY pair. However, since this review is devoted to the technical component, we proceed to analyze price charts, and let's start with a weekly scale.

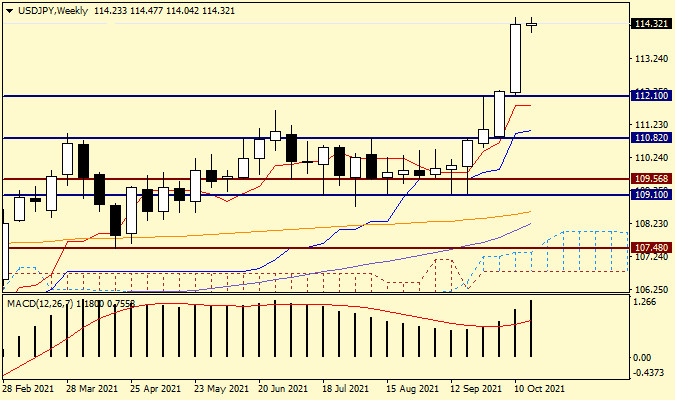

Weekly

As a result of the impressive growth shown at the auction on October 11-15, a large bullish candle appeared on the weekly chart with a closing price of 114.26. Thus, the hated resistance of sellers in the area of 112.00-112.25 was more than confidently broken through. However, one should not discount another interesting and quite strong mark of 113.00. We may see a pullback to this significant level during the trading of the current five-day period. If this happens, then there will be a good option for buying a pair. However, it is incorrect to determine the points for entering the market using a weekly timeframe. In the absence of the expected pullback and continuation of the rise from current prices, another landmark psychological level of 115.00 looms on the horizon of buyers. The task of bears in the current situation looks extremely difficult. To take control of the pair, they will need to absorb the hefty last white candle and close the weekly trading below the level of 112.00. In my opinion, such a task is almost impossible, although, as we know, everything happens on the market and nothing is particularly surprising.

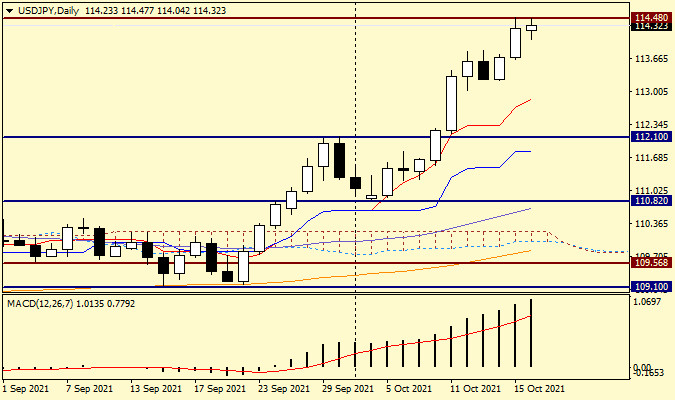

Daily

On this chart, all technical indicators turn up following the price, which can be characterized as support for growth and with a high probability of its continuation. The closest to the price (at 112.86) is the red Tenkan line of the Ichimoku indicator, so a pullback to Tenkan could be used to open long positions. However, given that the pair is currently trading near 114.28, such a deep pullback can be perceived as a change of course. As a more acceptable option for purchases, you can use a breakdown of the resistance of 114.48, fixing above this level and rolling back to it, after which you can try opening long positions. I am sure that this week we will return to the consideration of this currency pair. However, for now, I will outline the overall priority, which of course, comes down to purchases. Support levels: 114.00,113.40, and 113.00. Resistance passes at 114.60, 115.00, and 115.40. The general recommendation - we are looking for options to open purchases after corrective pullbacks, possibly to the designated support levels.

You have already liked this post today

*A análise de mercado aqui postada destina-se a aumentar o seu conhecimento, mas não dar instruções para fazer uma negociação.

Com base na análise do gráfico de 4 horas do índice Nasdaq 100, destacam-se três pontos principais: primeiro, o movimento dos preços ocorre abaixo da média móvel de 100 períodos

Os preços do ouro continuam sustentados pela névoa de incertezas que cerca o desdobramento das guerras tarifárias iniciadas por Donald Trump. O metal precioso vem apresentando uma valorização quase vertical

O indicador Eagle está atingindo uma sobrecompra extrema. Portanto, nos níveis de preço atuais, abaixo de sua maior alta de todos os tempos, será possível vender visando chegar a 3.281

No gráfico de 4 horas, o par de moedas USD/CAD (moeda de commodities) apresenta movimentação abaixo da média móvel exponencial de 100 períodos (EMA 100), com a formação

Com o Oscilador Estocástico se aproximando da zona de sobrevenda (nível 20) no gráfico de 4 horas do par cruzado AUD/JPY, existe potencial de enfraquecimento de curto prazo

Clube InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.