ZARJPY (South African Rand vs Japanese Yen). Exchange rate and online charts.

Currency converter

28 Apr 2025 02:47

(0%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

ZAR/JPY (South African Rand vs Japanese Yen)

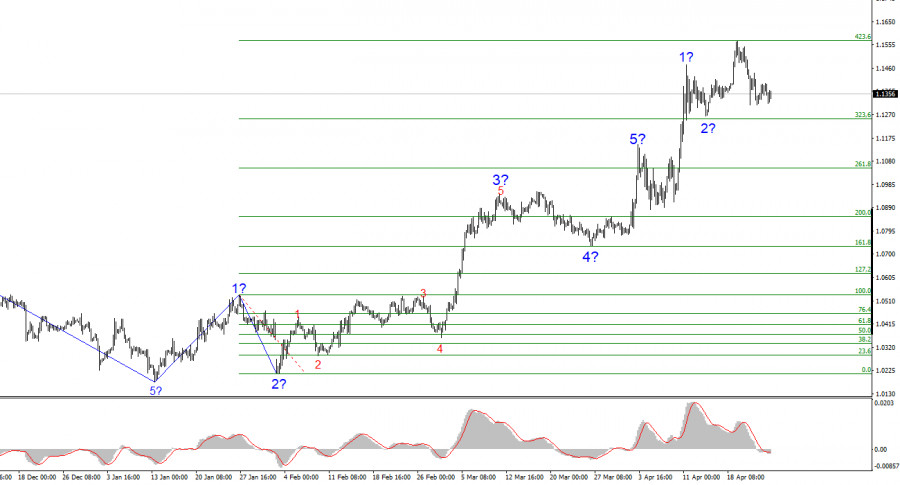

The ZAR/JPY currency pair represents a cross rate against the U.S. dollar which bears upon the further rate of ZAR/JPY. Thus, by merging the USD/JPY and USD/ZAR price charts, it is possible to get a rough ZAR/JPY price chart. However, this instrument is not actively traded on the Forex market.

The U.S. economic indicators such as the interest rate, GDP growth, unemployment rate, new vacancies, and others can serve well when analyzing ZAR/JPY movements as the greenback can influence the currency pair significantly. However, the currencies can respond differently to the changes in the U.S. economy.

South African rand is one of the most tradable currencies in the world. Thanks to the huge mineral deposits, South Africa is the richest country in its region. It is also famous for the stock exchange which is listed among the world's top ten exchanges. South African economy is based mainly on the extraction and export of minerals.

South Africa produces a great number of precious stones and metals, including gold and diamonds. In addition, it is the largest car manufacturer in Africa. South Africa is quite self-sufficient in providing itself with the necessary raw materials for production. The factors that affect the South African rand the most are the prices for the precious stones and metals, and the level of industrial production.

The ZAR/JPY currency pair is very exposed to a variety of world's major political and economic developments. For this reason, the price chart for this currency pair is poorly predictable and often goes in the opposite direction regardless of any analysis.

Beginners are not recommended to start their trading with this currency pair. To successfully project the further course rate of this trading instrument, it is necessary to know many nuances of the price chart behaviour as they can affect the pair's movement.

When compared to EUR/USD, USD/CHF, GBP/USD, and USD/JPY, the ZAR/JPY trading instrument is relatively illiquid. Hence, trying to predict the ZAR/JPY further trend, it is necessary to consider the USD/JPY and USD/JPY price charts.

As a rule, the brokers set a higher spread for cross rates rather than for major currency pairs. That is why before trading crosses, learn carefully the terms and conditions offered by the broker.

See Also

- The EUR/USD exchange rate remained virtually unchanged throughout Friday.

Author: Chin Zhao

20:26 2025-04-25 UTC+2

2488

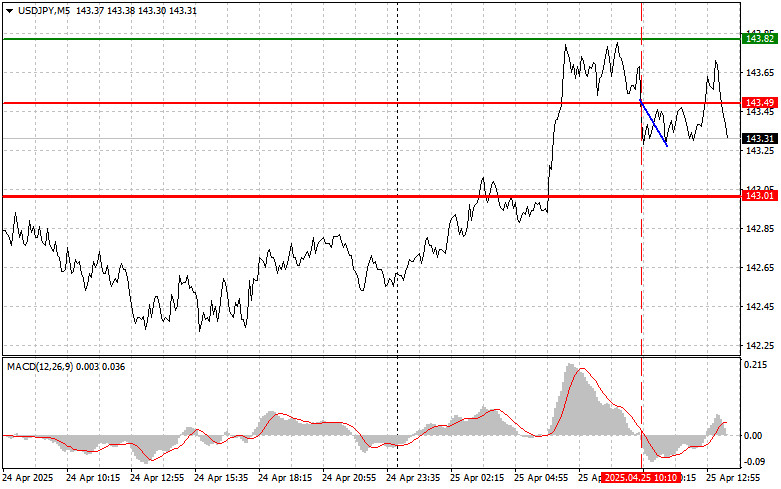

USD/JPY: Simple Trading Tips for Beginner Traders – April 25th (U.S. Session)Author: Jakub Novak

20:09 2025-04-25 UTC+2

2188

Fundamental analysisWhy Could Gold Prices Drop Significantly? (There's a chance gold will continue to decline while the CFD on the NASDAQ 100 futures contract may rise)

The beginning of actual negotiations could lead to a significant drop in gold prices in the near futureAuthor: Pati Gani

10:14 2025-04-25 UTC+2

2083

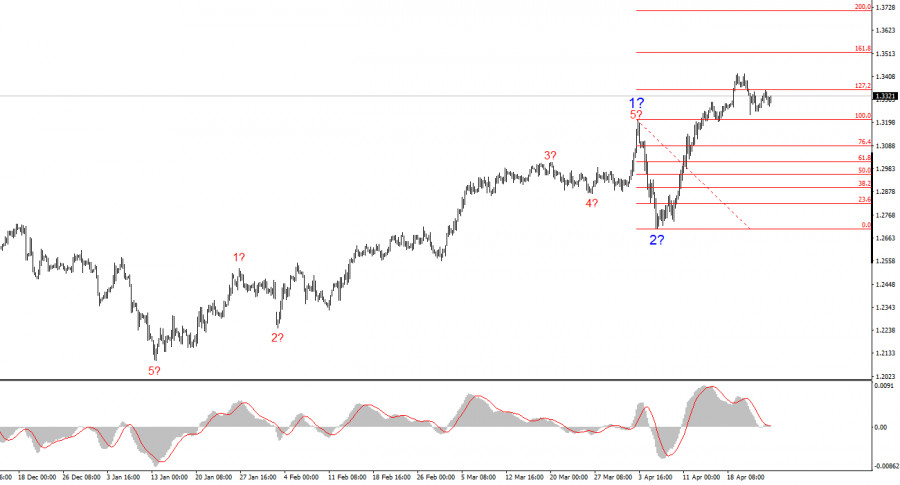

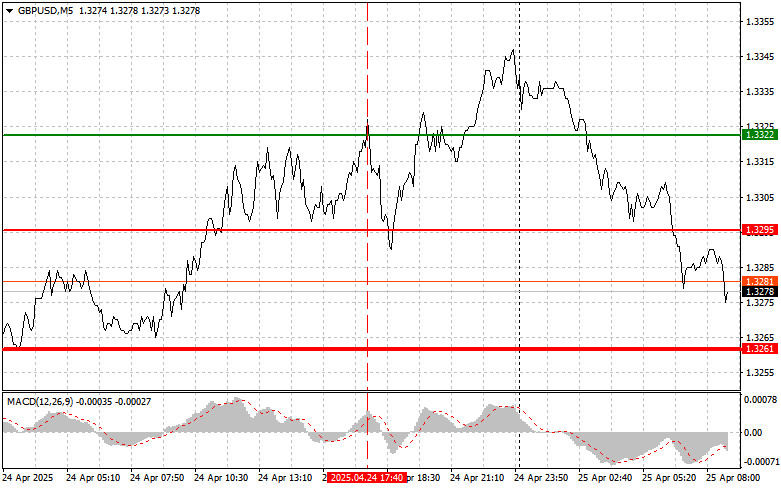

- The GBP/USD pair saw virtually no change on Friday, with price movement remaining very limited throughout the day.

Author: Chin Zhao

20:21 2025-04-25 UTC+2

2083

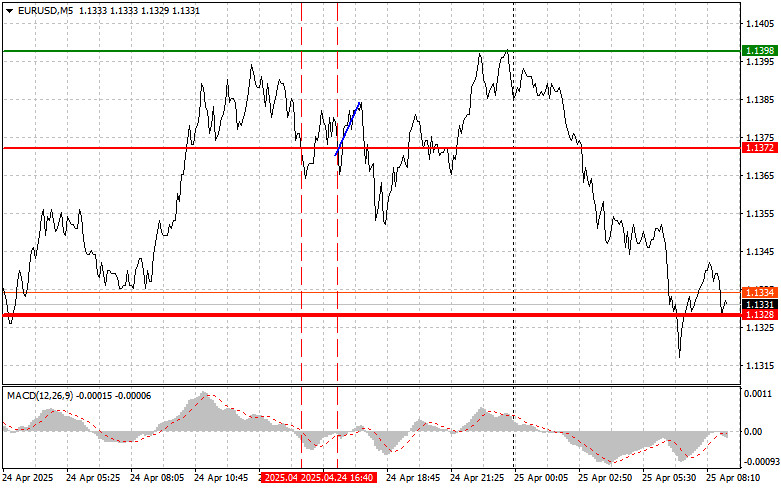

Type of analysisEUR/USD: Simple Trading Tips for Beginner Traders on April 25. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:31 2025-04-25 UTC+2

2053

Technical analysis / Video analyticsForex forecast 25/04/2025: EUR/USD, GBP/USD, USD/JPY and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY and BitcoinAuthor: Sebastian Seliga

12:25 2025-04-25 UTC+2

1993

- Type of analysis

GBP/USD: Simple Trading Tips for Beginner Traders on April 25. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on April 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:31 2025-04-25 UTC+2

1963

Gold maintains a bearish tone today, though it has slightly recovered from the daily low, climbing back above the $3300 level.Author: Irina Yanina

12:23 2025-04-25 UTC+2

1933

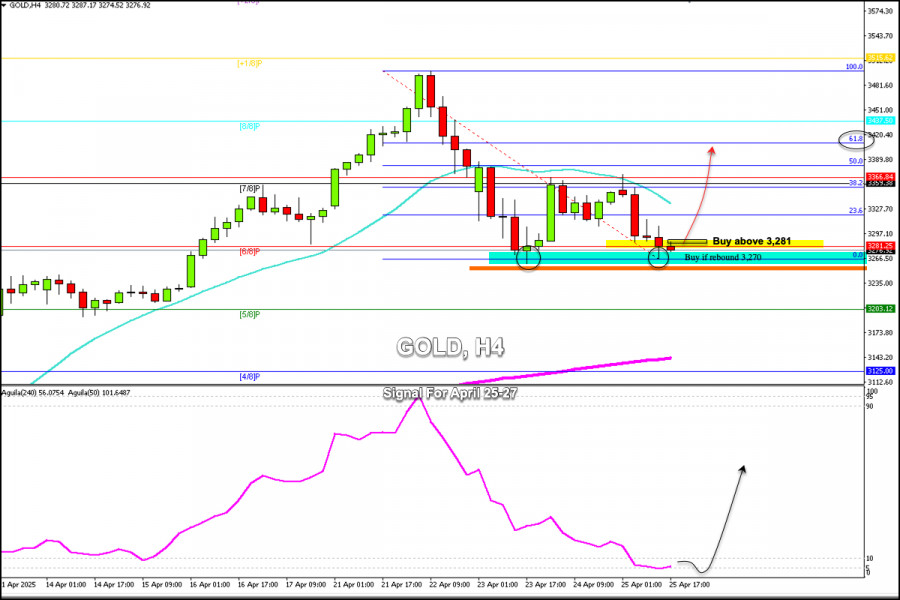

Technical analysisTrading Signals for GOLD (XAU/USD) for April 25-29, 2025: buy above $3,270 (21 SMA - rebound)

Our trading plan for the coming hours is to buy above 3,270 or above 3,281, with short-term targets around 8/8 of Murray.Author: Dimitrios Zappas

18:02 2025-04-25 UTC+2

1933

- The EUR/USD exchange rate remained virtually unchanged throughout Friday.

Author: Chin Zhao

20:26 2025-04-25 UTC+2

2488

- USD/JPY: Simple Trading Tips for Beginner Traders – April 25th (U.S. Session)

Author: Jakub Novak

20:09 2025-04-25 UTC+2

2188

- Fundamental analysis

Why Could Gold Prices Drop Significantly? (There's a chance gold will continue to decline while the CFD on the NASDAQ 100 futures contract may rise)

The beginning of actual negotiations could lead to a significant drop in gold prices in the near futureAuthor: Pati Gani

10:14 2025-04-25 UTC+2

2083

- The GBP/USD pair saw virtually no change on Friday, with price movement remaining very limited throughout the day.

Author: Chin Zhao

20:21 2025-04-25 UTC+2

2083

- Type of analysis

EUR/USD: Simple Trading Tips for Beginner Traders on April 25. Review of Yesterday's Forex Trades

EUR/USD: Simple Trading Tips for Beginner Traders on April 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:31 2025-04-25 UTC+2

2053

- Technical analysis / Video analytics

Forex forecast 25/04/2025: EUR/USD, GBP/USD, USD/JPY and Bitcoin

Technical analysis of EUR/USD, GBP/USD, USD/JPY and BitcoinAuthor: Sebastian Seliga

12:25 2025-04-25 UTC+2

1993

- Type of analysis

GBP/USD: Simple Trading Tips for Beginner Traders on April 25. Review of Yesterday's Forex Trades

GBP/USD: Simple Trading Tips for Beginner Traders on April 25. Review of Yesterday's Forex TradesAuthor: Jakub Novak

08:31 2025-04-25 UTC+2

1963

- Gold maintains a bearish tone today, though it has slightly recovered from the daily low, climbing back above the $3300 level.

Author: Irina Yanina

12:23 2025-04-25 UTC+2

1933

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 25-29, 2025: buy above $3,270 (21 SMA - rebound)

Our trading plan for the coming hours is to buy above 3,270 or above 3,281, with short-term targets around 8/8 of Murray.Author: Dimitrios Zappas

18:02 2025-04-25 UTC+2

1933