Lihat juga

02.03.2025 10:47 PM

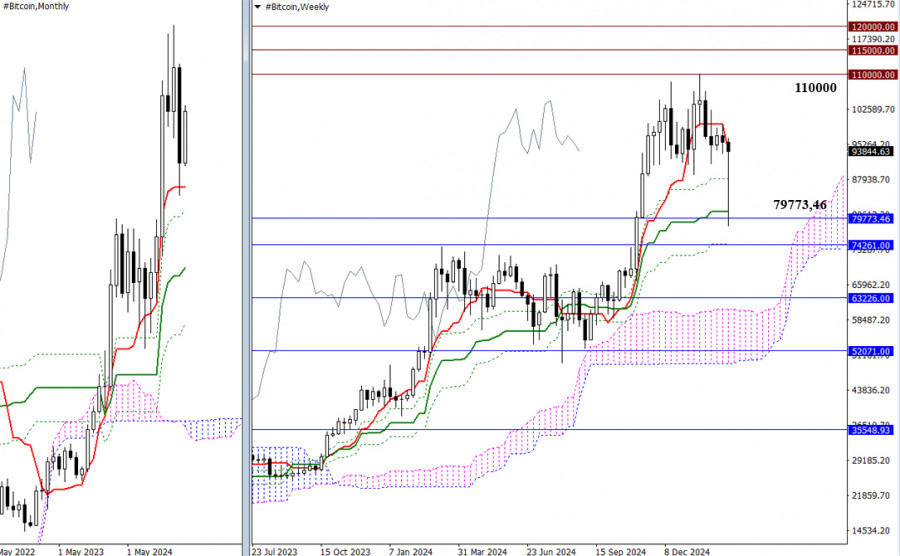

02.03.2025 10:47 PMIn February, the bears managed to push Bitcoin into a correction, testing support at the monthly short-term trend at 79,773.46, making it a bearish month in history. However, at the start of March, the situation changed despite the weekend. The bulls have actively regained ground and returned to the previous consolidation zone. Continued growth could lead to a new all-time high, with psychological targets at 110,000 – 115,000 – 120,000.

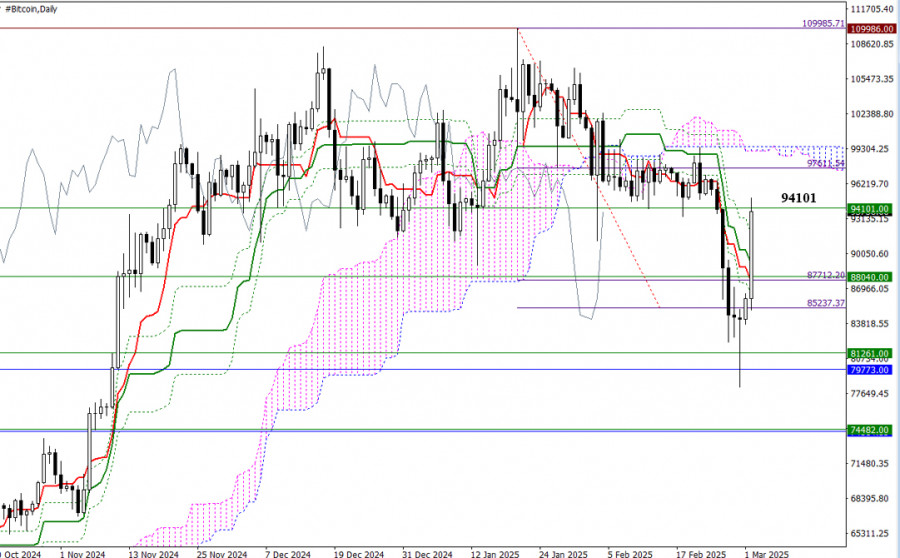

On the daily timeframe, Bitcoin initially exceeded bearish expectations. The bears achieved their target of breaking below the Ichimoku cloud at 85,237.37 and reached two key support levels: the weekly medium-term trend at 81,261 and the monthly short-term trend at 79,773.46. However, at that point, the bulls regained control. A combination of political and fundamental factors aligned with technical conditions, allowing the bulls to initiate a strong rebound from these support levels.

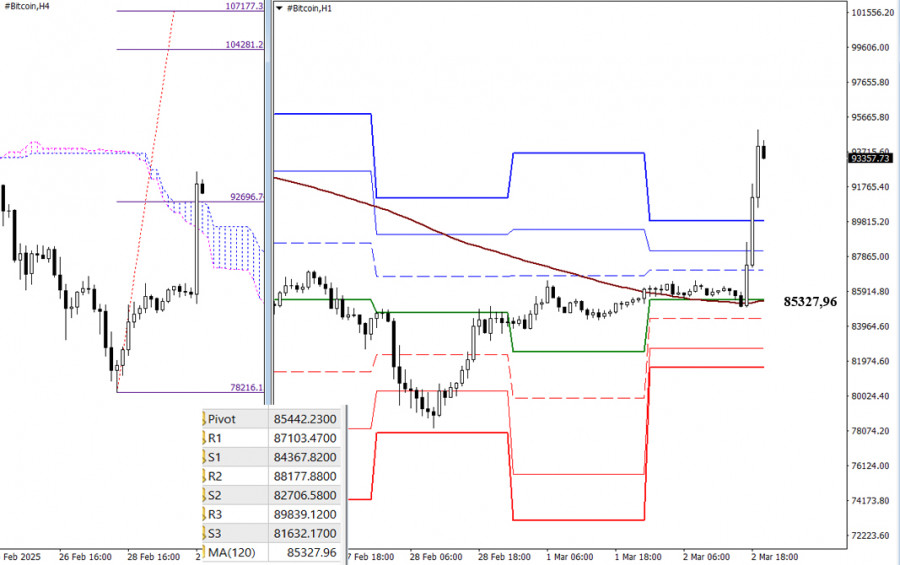

At this moment, Bitcoin is experiencing a solid recovery. The primary objective now is to invalidate the daily Ichimoku death cross at 91,748.70, reinforced by the weekly short-term trend at 94,101. There is potential for consolidation at this stage. The next major resistance will be the daily Ichimoku cloud at 99,497, beyond which Bitcoin would move toward testing its all-time high.

On lower timeframes, the bulls successfully held above the weekly long-term trend at 85,327.96, which triggered a significant rally. Currently, Bitcoin is in the bullish zone relative to the H4 Ichimoku cloud. If this bullish momentum continues, alongside classic intraday resistance levels, a new target will emerge: breaking through the H4 cloud at 104,281 – 107,177.

***

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Pembeli Bitcoin dan Ethereum telah mencapai tahap rintangan utama baru, menunjukkan permintaan yang kukuh. Bitcoin telah mencapai tahap $97,400, manakala Ethereum menghampiri tahap $1,870. Sementara itu, perbincangan mengenai stablecoin semakin

Dengan kemunculan corak 123 Menaik yang disusuli oleh kemunculan Ross Hook Menaik yang berjaya menembusi garisan aliran menurun sebelumnya, serta penunjuk Pengayun Stochastic yang turut berada dalam keadaan Crossing

Penurunan mendadak harga harian Bitcoin dan Ether semalam dengan cepat dibeli semula, menandakan kecenderungan berterusan daripada pedagang dan pelabur yang sekadar menunggu tahap pembelian yang lebih menarik. Sementara itu, penggubal

Pembeli Bitcoin dan Ethereum terus memanfaatkan saat-saat baik ketika pasaran merosot untuk membeli dengan cepat, seperti yang ditunjukkan hari ini semasa perdagangan di Asia. Yang penting, Bitcoin masih cuba untuk

Pembeli Bitcoin dan Ethereum Sedang Mencuba Mengawal Pasaran — dan Setakat Ini, Mereka Berjaya Namun, adalah penting untuk diperhatikan bahawa semakin lama kita berada di bawah $95,000 dan sering gagal

Selepas seminggu penuh dengan kegelisahan, pasaran mata wang kripto nampaknya telah menarik nafas lega. Indeks Ketakutan dan Kegembiraan telah direkodkan pada 51 — suatu zon neutral yang jarang berlaku, menunjukkan

Bitcoin terus menerima tekanan, namun ia masih bertahan dengan agak yakin. Selepas melonjak semula dari paras $92,000, mata wang kripto utama ini kembali ke kawasan $94,000, sekali gus mengekalkan prospek

Carta Forex

Versi-Web

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.