Lihat juga

18.07.2024 04:53 PM

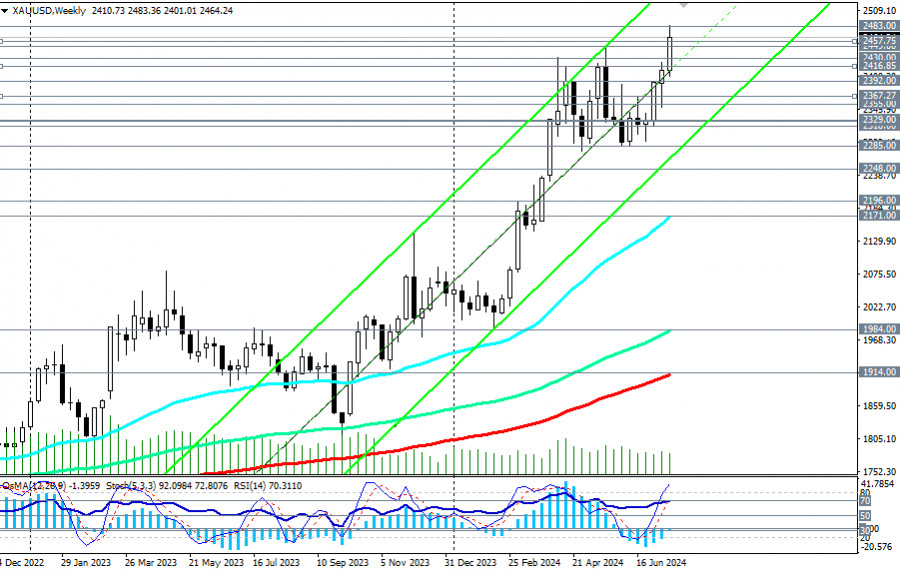

18.07.2024 04:53 PMDespite gold reaching record levels on Wednesday, some economists expect prices to approach $3000.00 per ounce by the end of the year.

Today, market participants will focus on the ECB meeting and its press conference, which starts at 12:45 (GMT). If ECB President Christine Lagarde makes "dovish" statements or if the ECB interest rates are unexpectedly lowered at today's meeting, we can expect a new surge in gold and the XAU/USD pair (gold prices are susceptible to changes in the monetary policies of the world's major central banks).

A break of today's high at 2475.00 will be the first signal to increase long positions in XAU/USD, and a break of yesterday's record high at 2483.00 will be the confirming signal.Despite gold reaching record levels on Wednesday, some economists expect prices to approach $3000.00 per ounce by the end of the year.

Today, market participants will focus on the ECB meeting and its press conference, which starts at 12:45 (GMT). If ECB President Christine Lagarde makes "dovish" statements or if the ECB interest rates are unexpectedly lowered at today's meeting, we can expect a new surge in gold and the XAU/USD pair (gold prices are susceptible to changes in the monetary policies of the world's major central banks).

A break of today's high at 2475.00 will be the first signal to increase long positions in XAU/USD, and a break of yesterday's record high at 2483.00 will be the confirming signal.The dollar and the markets, in general, continue to be volatile, and investors are trying to find new benchmarks in a situation of slowing inflation, ambiguous statements from politicians and representatives of central banks in key economies, and the US presidential race.

Recently, US presidential candidate Trump, whose prospects for re-election have sharply increased after an assassination attempt, spoke about the undesirability of a strong dollar, as it makes it difficult for American products to compete successfully in the global commodity market. Economists are also analyzing the prospects of the American economy in the event of his re-election. Overall, they believe the American economy should benefit from Trump's return to the presidency, and that the Fed will remain independent of politics. The dollar could also benefit from this, as Trump is likely to resume protectionist and pro-American policies in the global market and implement domestic economic policies that include tax cuts and wage increases. This should, in turn, result in higher inflation, which means a return to a more stringent monetary policy by the Fed. Although Trump, as president, repeatedly criticized the Fed for what he perceived as overly tight monetary policy, he recently stated that the Fed should refrain from lowering rates, which would boost the economy and, consequently, help his rival Biden.

According to media reports, Trump also wants to introduce a 15% corporate tax. However, "if he is elected president, he will not seek to remove Powell from his post as Fed chairman until Powell's term expires."

At the same time, the unstable political situation in the Eurozone and geopolitical risks are forcing investors to seek refuge in traditional safe-haven assets – government bonds and gold.

Against this backdrop, prices for US government bonds are rising, thus lowering their yields. Gold futures reached a new record high above 2488.00 on Wednesday, and the XAU/USD pair is near the 2483.00 mark.

Meanwhile, despite Powell's recent moderately hawkish statements about the need to wait for clearer signals of declining inflation and its movement towards the target level of 2%, the markets stubbornly believe that the Fed will begin lowering its interest rates in September.

Despite gold reaching record levels on Wednesday, some economists expect prices to approach $3000.00 per ounce by the end of the year.

Today, market participants will focus on the ECB meeting and its press conference, which starts at 12:45 (GMT). If ECB President Christine Lagarde makes "dovish" statements or if the ECB interest rates are unexpectedly lowered at today's meeting, we can expect a new surge in gold and the XAU/USD pair (gold prices are susceptible to changes in the monetary policies of the world's major central banks).

A break of today's high at 2475.00 will be the first signal to increase long positions in XAU/USD, and a break of yesterday's record high at 2483.00 will be the confirming signal.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Ujian pada tahap 142.54 pada separuh hari kedua bertepatan dengan penunjuk MACD yang baru mula bergerak ke bawah dari garisan sifar, mengesahkan titik kemasukan yang betul untuk menjual dolar

Ujian tahap 1.3400 pada separuh kedua hari tersebut bertepatan dengan penunjuk MACD yang baru sahaja mula bergerak ke atas dari garis sifar, mengesahkan titik kemasukan yang betul untuk membeli pound

Ujian tahap 1.1398 pada separuh kedua hari berlaku ketika penunjuk MACD baru sahaja mula bergerak ke atas dari garisan sifar, mengesahkan titik masuk yang betul untuk membeli euro. Ini mengakibatkan

Kenaikan euro dan pound telah terhenti. Data keyakinan pengguna A.S. yang lemah semalam gagal memberikan tekanan besar pada dolar, menghasilkan pengukuhan sederhana hanya pada euro dan pound British. Namun, semasa

Analisis Dagangan dan Petua untuk Berdagang Yen Jepun Ujian harga pada paras 142.69 berlaku serentak dengan penunjuk MACD yang telah bergerak jauh melepasi paras sifar, sekali gus mengehadkan potensi kenaikan

Analisis Dagangan dan Petua untuk Berdagang Pound British Ujian harga pada paras 1.3383 berlaku serentak dengan penunjuk MACD yang bergerak jauh di bawah paras sifar, sekali gus mengehadkan potensi penurunan

Analisis Dagangan dan Petua untuk Dagangan Euro Tiada sebarang ujian terhadap paras-paras yang saya tandakan pada separuh pertama hari ini. Statistik aktiviti kredit di Eropah tidak memberi kesan ketara terhadap

Analisis Dagangan dan Petua Dagangan untuk Yen Jepun Ujian paras harga 143.21 bertepatan dengan penunjuk MACD yang baru sahaja mula bergerak menurun dari garis sifar, mengesahkan titik masuk yang betul

Analisis Dagangan dan Petua Dagangan untuk Pound British Ujian paras harga 1.3352 berlaku ketika penunjuk MACD telah pun bergerak jauh di atas garis sifar, sekali gus mengehadkan potensi kenaikan pasangan

Analisis Dagangan dan Petua Dagangan untuk Euro Ujian paras harga 1.1371 pada separuh kedua hari semalam bertepatan dengan penunjuk MACD yang baru sahaja mula bergerak naik dari garis sifar, mengesahkan

Kelab InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.