Lihat juga

09.02.2024 04:39 PM

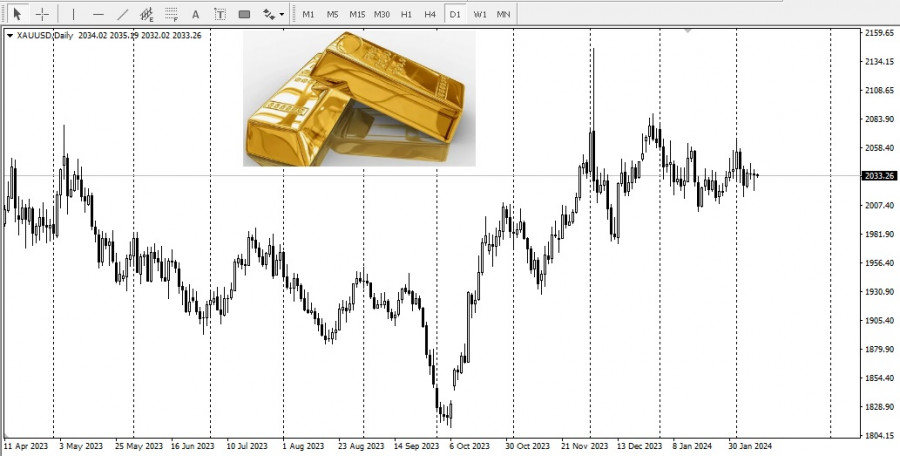

09.02.2024 04:39 PMAccording to the latest data from analysts of the World Gold Council (WGC), the outflow from gold ETFs continued in January 2024, following the trend observed in 2023, led by North America. European funds also continued to suffer significant losses, while Asia experienced another monthly inflow.

Global physically backed gold ETFs started 2024 with a fund outflow of USD 2.8 billion. This streak of misfortune has persisted for eight consecutive months. The report also notes that this outflow is equivalent to a reduction of global reserves by 51 tonnes by the end of January, reaching a total of 3,175 tonnes.

North American funds incurred losses of USD 2.3 billion in January, thereby concluding a short two-month period of fund inflow into the region. Analysts also consider the fact that the first Federal Reserve rate cut in March is unlikely. As a result, both the dollar and the yield of 10-year Treasury bonds have rebounded, putting pressure on the price of gold and leading to the sale of gold ETFs. Additionally, as U.S. stock prices reached new highs, the interest of local investors in gold further diminished.

As a result of the January decline, the collective assets of North American funds dropped to the lowest level observed since April 2020. The most significant outflow was observed from the largest funds.

On the other side of the ocean, Europe extended its series of consecutive net outflows of gold to eight months. Although the region liquidated gold reserves worth USD 730 million in January, it was still significantly less than the net outflow of USD 2 billion the previous month.

Meanwhile, Asian funds increased their net inflow by USD 215 million, extending the streak of consecutive net inflows to 11 months. China continues to dominate investment inflows into the region, as the sixth consecutive monthly decline in local stocks and a weaker currency heightened investor demand for safe-haven assets.

In another region, there were minor changes in the demand for gold ETFs. Adding USD 8 million in the month, with a significant portion of the demand coming from South Africa.

Gold-backed ETFs and similar products constitute a significant portion of the gold market. ETF flows often highlight short-term and long-term opinions and the desire to hold onto gold. The data in the report tracks gold held in physical form in open ETFs and other products, such as closed-end funds and mutual funds. Most funds included in the dataset are fully backed by physical gold.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Euro meningkat selepas berita defisit dagangan A.S. mencapai tahap rekod pada bulan Mac tahun ini, kerana syarikat-syarikat tergesa-gesa mengimport barang-barang, termasuk farmaseutikal. Punca masalah ini dikaitkan dengan pentadbiran Trump, yang

Pasaran ekuiti telah bertambah baik, permintaan untuk mata wang kripto meningkat, namun harga emas jatuh mendadak selepas kenaikan tempatan. Sementara itu, dolar AS kekal hampir tidak berubah berbanding mata wang

Bank of Japan mengekalkan dasar monetarinya tanpa perubahan semasa mesyuarat dasar monetari pada 1 Mei. Dalam laporan "Outlook for Economic Activity and Prices", Bank menurunkan ramalan pertumbuhan KDNK sebenar bagi

Emas telah kembali bergerak ke atas apabila pelabur menganalisis kenyataan berkaitan perdagangan daripada Setiausaha Perbendaharaan Amerika Syarikat Scott Bessent sambil menunggu keputusan Rizab Persekutuan berkenaan kadar faedah. Bessent baru-baru

Peristiwa makroekonomi yang dijadualkan pada hari Rabu adalah sangat terhad, dan walau apapun, ia tidak mungkin memberi impak yang bermakna kepada mana-mana pasangan mata wang. Euro kekal dalam keadaan mendatar

Pada hari Selasa, sementara euro kekal dalam aliran mendatar, pasangan mata wang GBP/USD mula bergerak menaik. Kenaikan ini bermula pada hari Isnin, tetapi semasa sesi A.S. hari itu, ISM Perkhidmatan

Pasangan mata wang EUR/USD terus bergerak secara mendatar sepenuhnya pada hari Selasa. Keadaan mendatar dalam pasaran secara keseluruhan kini telah berlarutan hampir sebulan, dan selain itu, pasaran juga dilihat membentuk

Ramai yang mungkin percaya bahawa perang perdagangan yang dimulakan oleh Donald Trump hanyalah alat untuk mengurangkan defisit bajet dan hutang negara. Namun, apabila diteliti dengan lebih dekat, jelas bahawa

Perang perdagangan lebih penting daripada politik. Cadangan Friedrich Merz untuk menyemak semula peraturan brek fiskal Jerman meletakkan asas untuk aliran menaik EUR/USD. Secara teorinya, kegagalannya untuk menjadi canselor sepatutnya mencetuskan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.