Lihat juga

07.06.2022 12:31 PM

07.06.2022 12:31 PMBut the British pound sterling, unlike the single European currency, showed a strengthening against the US dollar at yesterday's auction. However, it should be noted that yesterday's growth of the "Briton" was very modest and far from ambiguous. More details about this in the technical part of this article, but for now briefly about the external background and upcoming macroeconomic events that can affect the price dynamics of GBP/USD.

As for the external background, it is relatively calm. There is no particularly important news and those that were and continue to have long been taken into account in the price. Regarding macroeconomic statistics, I would like to note that yesterday's calendar almost did not contain any releases. Today, data on the PMI index in the services sector came out of the UK, which turned out to be better than the forecast value of 51.8 and amounted to 53.4. Let me remind you that the value of this indicator above 50.0 has a positive effect on the national currency rate. From the United States of America, today I advise you to pay attention to the data on the trade balance, which will be presented to the court of traders at 13:30 London time. That's probably all, and now let's look at the charts of the pound/dollar currency pair.

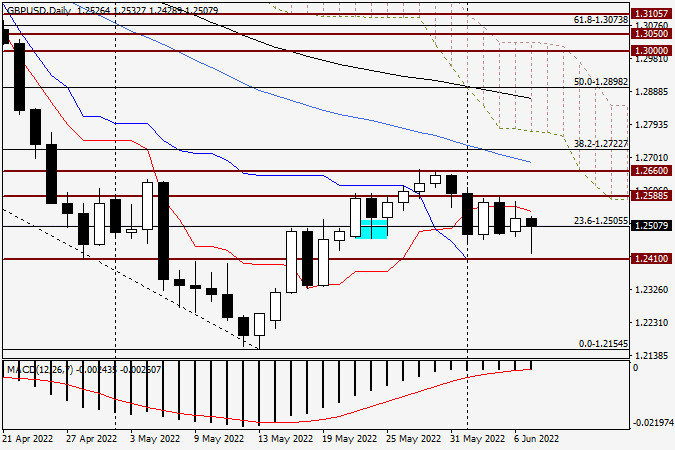

Daily

As already noted at the very beginning of this article, yesterday's growth of the British pound sterling is certainly not confident, much less strong. The bulls on the pound intended to test Friday's highs at 1.2588, but they could not do it. The pair reached 1.2576 on the rise, after which it lost a significant part of the growth and ended Monday's trading at 1.2526. The long upper shadow of yesterday's candle, which exceeds the size of the bullish body, clearly indicates the resistance strength of sellers in the area of 1.2576-1.2588. I believe that the red line of the Tenkan Ichimoku indicator played an important role in the quality of resistance. The graph clearly shows that the attempts of the players to upgrade the course to go up this line failed. Despite the stronger-than-expected data on the PMI index in the UK services sector, the pound initially sank slightly, but after gaining support at 1.2429, it began to actively reduce the losses incurred. Now, at the time of the completion of this article, today's daily candle already has a significantly lower shadow. It seems that the "Briton" has recovered and is aiming for the opening price of today's trading at 1.2526. If this goal is achieved, then the bullish body of today's daily candle may begin to form after that. The bulls' targets for the pound are the price zone 1.2576-1.2588, and if it passes, the pair will rush to 1.2600. But fixing above this mark will open the way to the key resistance of 1.2660 at this stage of trading, on which the further prospects for the price movement of the GBP/USD currency pair will depend. According to trading recommendations, I consider purchases after fixing above 1.2540 to be the most relevant. If bearish candlestick analysis patterns start to appear below this level or slightly lower at smaller time intervals, this will be a signal to open sales. That's all for now.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Pada carta 4 jam pasangan mata wang utama USD/JPY, dapat dilihat bahawa penunjuk Pengayun Stochastic membentuk corak Gandaan Bawah (Double Bottom) manakala pergerakan harga USD/JPY membentuk corak Higher High, justeru

Sebaliknya, jika tekanan penurunan berterusan dan euro mengukuh di bawah 1.1370, ia boleh dianggap sebagai isyarat jual dengan sasaran pada 6/8 Murray terletak pada 1.1230 dan akhirnya di bahagian bawah

Pada awal sesi dagangan Amerika, emas didagangkan sekitar paras 3,299 dalam saluran aliran menurun yang terbentuk sejak 21 April, menunjukkan pemulihan di atas sokongan pada paras 3,270. Pada carta

Minggu lepas, pasaran mencatat paras terendah baru, tetapi penjual gagal meneruskan pergerakan turun sepenuhnya. Ini mungkin terjadi kerana paras terendah minggu sebelumnya (141.63) disokong oleh paras sokongan bulanan (141.96). Akibatnya

Pada awal sesi Amerika, emas sedang didagangkan sekitar 3,276 dengan tekanan menurun selepas mengalami rintangan kuat sekitar 3,270, tahap yang bertepatan dengan penarikan semula Fibonacci 38.2%. Emas kini mungkin mencapai

Pada awal sesi dagangan Amerika, pasangan EUR/USD didagangkan sekitar paras 1.1358 dalam saluran menurun yang terbentuk sejak 18 April. Pasangan ini masih berada di bawah tekanan menurun. Kami berpendapat instrumen

Harga emas baru-baru ini mengalami pembetulan yang ketara berikutan jangkaan pasaran terhadap permulaan rundingan sebenar antara Amerika Syarikat dan China berhubung tarif serta perdagangan secara keseluruhan. Kenyataan Setiausaha Perbendaharaan

Pada carta 4 jam, instrumen komoditi Silver kelihatan meskipun keadaannya mengukuh di mana ini disahkan oleh pergerakan harga Silver yang bergerak di atas WMA (30 Shift 2) yang juga mempunyai

Walaupun pada carta 4 jam indeks Nasdaq 100 berada dalam keadaan mendatar (Sideways), julat pergerakannya masih cukup luas, sekali gus menawarkan peluang yang agak menarik pada indeks ini. Ketika

Video latihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.