Lihat juga

30.05.2022 01:02 PM

30.05.2022 01:02 PMMay was one of the hardest months in the crypto industry, and several events contributed to this. The bearish trend is in full swing, what could be worse than this? That's right, the collapse of one of the largest projects in the industry. The collapse of the UST algorithmic stablecoin and the LUNA token was a real shock to the market. In a matter of days, one of the largest dollar stablecoins with a capitalization of more than $ 16 billion in vain depreciated, as did the LUNA token, which lost 99.99% of its value.

The cause and consequences of the collapse lie in several suspicious transactions, where experts suggest that this was a coordinated attack on the project tokens.To support the value of the UST stablecoin, the project began to sell off its reserves, which is about 80 thousand BTC, creating additional pressure on the market.As a result, it was not possible to save the tokens, and the Terra project decided to create a new Terra 2.0 network, partially paying off losses to investors with new tokens.

This story clearly showed the market how fragile the cryptocurrency is and where to be careful when investing in it.

Despite all the events, the head of MicroStrategy, Michael Saylor, said in an interview with Fox News: "Bitcoin remains an asset free from government and corporate interference, instilling confidence in this uncertain world."

According to the head of Saylor, financial markets are in a bearish trend, but this will not stop him and the company from further investing in BTC.

Let me remind you that MicroStrategy holds 129,218 BTC on its balance sheet - almost $ 4 billion.

Major players, including institutional investors, continue to be interested in digital assets. The CFTC report demonstrates the growth of long positions on Bitcoin futures on CME. This indicates that the market situation is gradually stabilizing after a prolonged decline.

At the same time, ARK Invest founder Cathie Wood said that the growing correlation between cryptocurrency and traditional assets indicates that the bear market will end soon.

"Cryptocurrency is a new asset class, it should not be similar to Nasdaq, but similar. Now they are strongly interconnected. You know that you are in a bear market and are close to its end when everything will start behaving the same way, and we are witnessing the capitulation of one market after another," she said.

What happens on the Bitcoin trading chart?

Bitcoin has been declining in value for 9 weeks in a row - this is one of the longest declines in the history of cryptocurrency. Panic prevailed in the market, thereby reinforcing the bearish trend. As a result, a clear flat of $ 28,000 / $ 31,500 appeared on the BTC chart, within the boundaries of which the quote closed.

At the moment, traders are analyzing the boundaries of the flat with special attention, since holding the price beyond the aisles of a particular frame will indicate the subsequent price move. This strategy is considered to be the most optimal and in the future can bring not a small profit.

At the same time, the 9-week decline indicates that short positions on BTC are overheated, which may provoke buyers to change direction. This movement will lead to a correction of the downward trend.

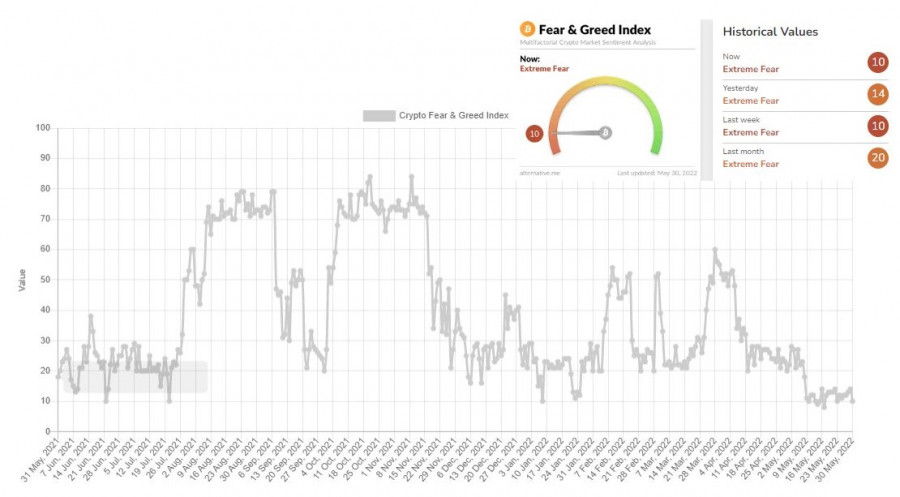

The index of emotions (aka fear and euphoria) of the crypto market moves within the critical level of 10 throughout May. This indicates a high degree of fear among traders. Such prolonged pessimism may eventually lead to a correction in the market.

You have already liked this post today

* Analisis pasaran yang disiarkan di sini adalah bertujuan untuk meningkatkan kesedaran anda, tetapi tidak untuk memberi arahan untuk membuat perdagangan.

Bitcoin dan Ethereum Menunjukkan Pertumbuhan Lebih Jauh Di Tengah Berita Legislasi Kripto Positif Bitcoin kini diperdagangkan pada $96,700, setelah pulih dari paras terendah $93,400, manakala Ethereum telah pulih ke kawasan

Bitcoin kini didagangkan dalam lingkungan $93,000–$94,000, kira-kira 0.5% di bawah paras tertinggi tempatan terkininya sebanyak $97,900, yang direkodkan pada 2 Mei. Volatiliti telah berkurang, dan pasaran nampaknya berada dalam keadaan

Bitcoin dan Ethereum menghabiskan hari dalam saluran mendatar, walaupun terdapat tanda-tanda penjualan aktif semasa sesi Amerika semalam yang menimbulkan beberapa persoalan tentang prospek kenaikan jangka pendek instrumen perdagangan tersebut. Bitcoin

Bitcoin sekali lagi berada di bawah tekanan. Pada hari Isnin, harga mata wang kripto terbesar di dunia jatuh di bawah $95,000, dan ini lebih daripada sekadar pembetulan biasa. Ia adalah

Bitcoin dan Ethereum telah menurun, dan pasaran mata wang kripto yang lebih luas memberi reaksi negatif kepada berita bahawa GENIUS Act yang bipartisan—Guiding and Enabling National Innovations for Unleashing Stablecoins—dijangka

Pembeli Bitcoin dan Ethereum telah mencapai tahap rintangan utama baru, menunjukkan permintaan yang kukuh. Bitcoin telah mencapai tahap $97,400, manakala Ethereum menghampiri tahap $1,870. Sementara itu, perbincangan mengenai stablecoin semakin

Dengan kemunculan corak 123 Menaik yang disusuli oleh kemunculan Ross Hook Menaik yang berjaya menembusi garisan aliran menurun sebelumnya, serta penunjuk Pengayun Stochastic yang turut berada dalam keadaan Crossing

Penurunan mendadak harga harian Bitcoin dan Ether semalam dengan cepat dibeli semula, menandakan kecenderungan berterusan daripada pedagang dan pelabur yang sekadar menunggu tahap pembelian yang lebih menarik. Sementara itu, penggubal

Pembeli Bitcoin dan Ethereum terus memanfaatkan saat-saat baik ketika pasaran merosot untuk membeli dengan cepat, seperti yang ditunjukkan hari ini semasa perdagangan di Asia. Yang penting, Bitcoin masih cuba untuk

InstaTrade

Akaun PAMM

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.