यह भी देखें

28.10.2024 11:04 AM

28.10.2024 11:04 AMBrief Analysis:

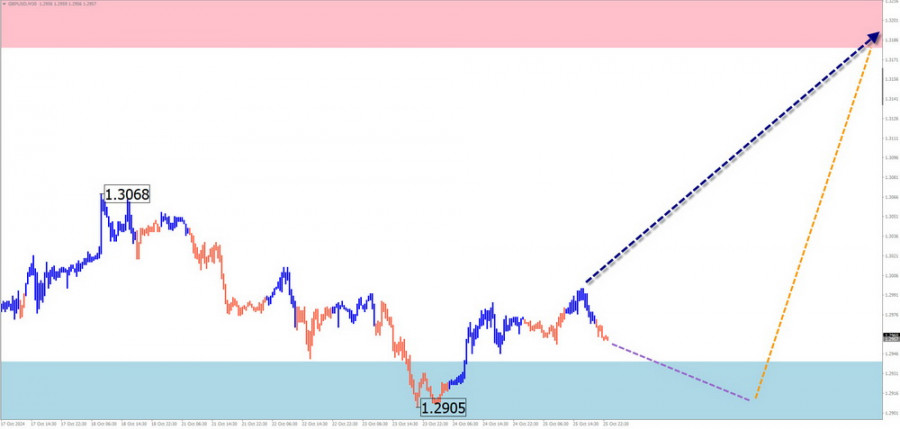

Since September 26, a downward corrective wave has been forming for the British pound. The wave structure is developing as an extended flat and appears complete. At the time of analysis, no reversal signals are observed, and the price is near the lower boundary of a strong potential reversal zone on the daily timeframe.

Weekly Forecast:

At the beginning of the upcoming week, the British pound is expected to complete its movement along the support zone. A reversal and price increase may follow, with the resistance zone marking the most likely upper boundary for the weekly price range.

Potential Reversal Zones

Recommendations:

Brief Analysis:

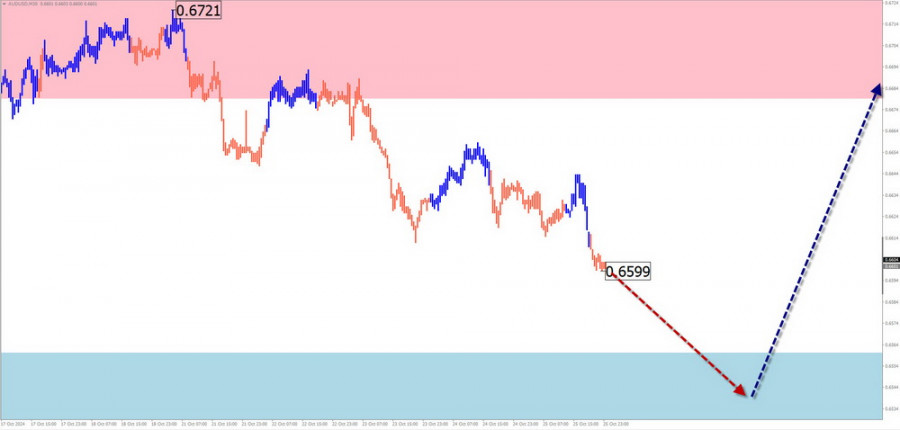

An upward wave model has been forming for the Australian dollar since August 3. This month, a counter-correction has evolved as an extended flat and is now in its final phase.

Weekly Forecast:

The price is expected to move towards the upper boundary of the support zone early in the week. Price fluctuations may transition to a sideways trend, with a reversal and price increase more likely toward the weekend.

Potential Reversal Zones

Recommendations:

Brief Analysis:

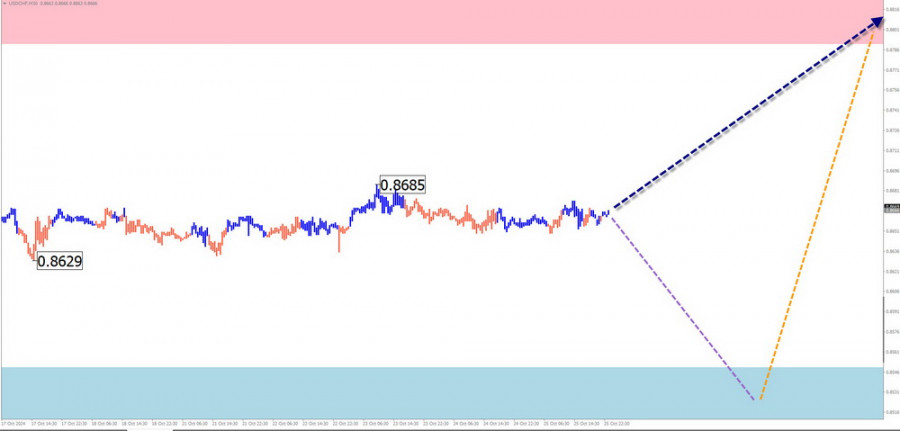

The incomplete bullish wave for the Swiss franc started in early August. Since mid-July, a corrective zigzag has been forming from a strong support level. The middle part of the wave structure is currently underway.

Weekly Forecast:

A continuation of the sideways movement is expected in the next couple of days. Increased volatility and a downward movement may follow, with an anticipated reversal and resumed upward movement after contacting the support zone. The weekly price is expected to reach the resistance zone high.

Potential Reversal Zones

Recommendations:

Brief Analysis:

Since March, the euro-yen cross has been driven by an upward wave, with the most recent unfinished segment beginning on September 16. In the past two weeks, the price has reached a strong resistance zone and is nearing its upper edge. The current middle segment (B) remains incomplete.

Weekly Forecast:

In the coming days, a sideways movement along the resistance levels is expected. Closer to the weekend, volatility may increase, leading to a reversal and decline toward the support boundaries.

Potential Reversal Zones

Recommendations:

Brief Analysis:

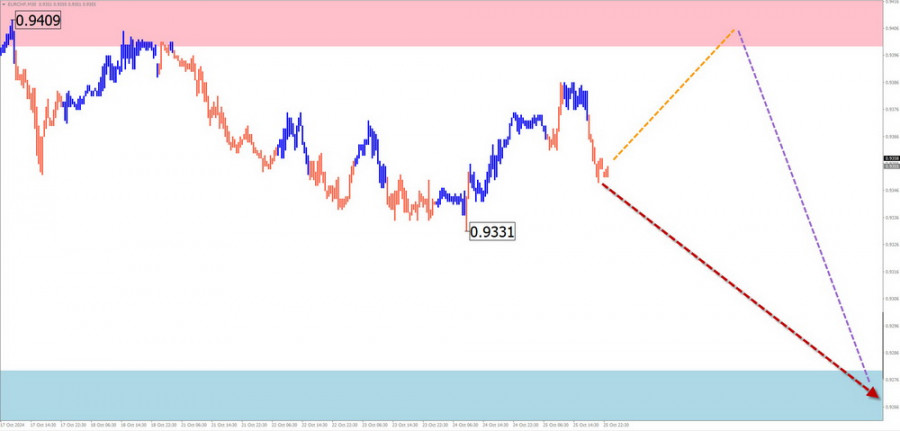

An upward wave has been forming for the EUR/CHF pair. A corrective wave structure began in mid-August but remains incomplete.

Weekly Forecast:

In the next few days, a sideways trend with a brief pullback toward the resistance zone is expected. The trend is likely to turn sideways with a reversal. A continued decline toward the support boundaries is likely by week's end.

Potential Reversal Zones

Recommendations:

Brief Analysis:

The US Dollar Index continues to recover previously lost positions. Last week, prices fell from the lower boundary of a strong resistance zone, forming a corrective flat. The current level shows limited reversal potential, with the counter-movement staying within the recent trend correction.

Weekly Forecast:

A brief decline to support levels may occur early in the week, followed by resumed upward movement amid rising volatility, potentially reaching resistance boundaries.

Potential Reversal Zones

Recommendations:

Confidence in sustained growth for major currency pairs may be premature. In the second half of the week, selling major currencies is likely preferable across all pairs.

Explanation: In simplified wave analysis, each wave consists of three parts (A-B-C), with the last unfinished wave analyzed on each timeframe. Dashed lines indicate anticipated movements.

Note: The wave algorithm does not account for the duration of instrument movements over time.

You have already liked this post today

*यहां पर लिखा गया बाजार विश्लेषण आपकी जागरूकता बढ़ाने के लिए किया है, लेकिन व्यापार करने के लिए निर्देश देने के लिए नहीं |

EUR/USD विश्लेषण: फरवरी से, EUR/USD एक ऊपर की ओर वेव बना रहा है, जिसकी अंतिम अवस्था (C) वर्तमान में चल रही है। हाल ही में इस जोड़ी ने एक मजबूत

आने वाले दिनों में यूरो विनिमय दर में गिरावट का दौर पूरा होने की संभावना है, जो संभावित रूप से गणना किए गए समर्थन क्षेत्र की निचली सीमा तक पहुंच

विश्लेषण: फरवरी की शुरुआत से ही, यूरो एक ऊपर की ओर टेढ़ी-मेढ़ी लहर बना रहा है, जो एक नए तेजी के रुझान की शुरुआत को दर्शाता है। यह जोड़ी साप्ताहिक

विश्लेषण: 13 जनवरी को शुरू हुई ऊपर की लहर अभी भी अधूरी है, जो प्रमुख वैश्विक अपट्रेंड का एक नया खंड बनाती है। यह जोड़ी वर्तमान में समर्थन और प्रतिरोध

पिछले छह महीनों में, GBP/USD में गिरावट का रुख रहा है। जनवरी के मध्य से, कीमत एक मजबूत समर्थन क्षेत्र से उलटफेर की संभावना के साथ एक काउंटर-वेव बना रही

ब्रिटिश पाउंड के लिए प्रमुख मंदी की लहर, जो पिछले साल अगस्त में शुरू हुई थी, दो सप्ताह पहले शुरू हुए सुधारात्मक, बदलते फ्लैट पैटर्न के माध्यम से विकसित होना

विश्लेषण: पिछले साल अक्टूबर से, यूरो की कीमत में उतार-चढ़ाव की लहर चल रही है। साल की शुरुआत से ही एक काउंटर-करेक्शन बन रहा है, जो एक विस्तारित फ्लैट पैटर्न

GBP/USD विश्लेषण: पिछले साल अगस्त से, GBP/USD चार्ट को नीचे की ओर लहर द्वारा परिभाषित किया गया है। 13 जनवरी से, प्राथमिक प्रवृत्ति के विरुद्ध एक काउंटर-करेक्शन बना है, जो

ईमेल/एसएमएस संबंधी

अधिसूचनाएँ

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.