Lihat juga

03.04.2025 08:01 AM

03.04.2025 08:01 AMThe euro and the pound resumed growth after news that the reciprocal trade tariffs imposed by the U.S. were roughly in line with market expectations. Although the U.S. stock market encountered new issues, such developments were not observed in the currency market.

Speaking from the White House Rose Garden, Trump announced a 10% tariff on all imports from countries considered key U.S. trading partners. The European Union expects new customs duties to raise current tariffs by 20%. This will undoubtedly force Brussels to prepare for increased import tariffs, increasing costs for European consumers and businesses.

This move could become modern U.S. trade history's most radical protectionist decision. Trump justified his stance by citing the need to protect American manufacturers and jobs from unfair competition by foreign companies. He also emphasized that the current trade system is unfair to the U.S. and that change is long overdue.

Today, demand for the euro may persist, but this will depend on solid fundamental data from the eurozone. Services PMI and composite indices are expected. If the data disappoints, the euro could come under pressure. Traders will also be watching trade tariff headlines, as today marks the start of new car tariffs and potentially the EU's response to these developments.

In the second half of the day, attention will shift to the U.S. ISM Services PMI. The index is expected to remain strong, which could support the U.S. dollar. The eurozone PPI data will also be a focus, which provides key insights into regional inflation trends. Traders closely monitor these figures as they may precede changes in consumer prices and influence future European Central Bank policy. The ECB's monetary policy meeting minutes will also be published, which could offer more clarity on the rate outlook. However, it is already evident that no further rate cuts are expected, suggesting that the euro's strength may continue.

If data aligns with economist expectations, the Mean Reversion strategy is preferable. If data deviates significantly from forecasts, a Momentum strategy is more effective.

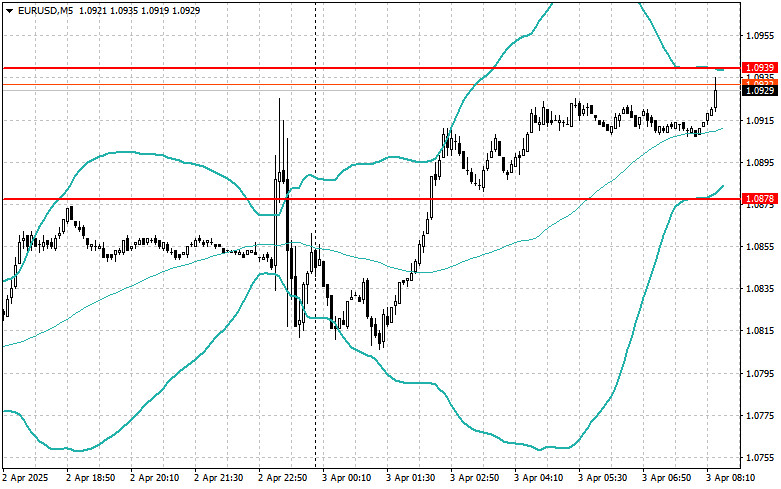

Buy on breakout above 1.0925, target: 1.0952 and 1.0997

Sell on breakout below 1.0884, target: 1.0845 and 1.0810

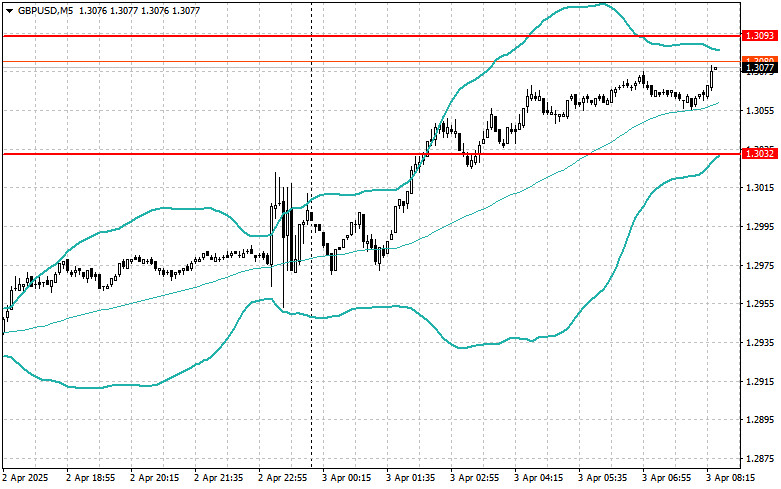

Buy on breakout above 1.3098, target: 1.3131 and 1.3171

Sell on breakout below 1.3050, target: 1.3005 and 1.2955

Buy on breakout above 147.52, target: 148.20 and 148.80

Sell on breakout below 147.15, target: 146.78 and 146.49

Look to sell after a failed breakout above 1.0939 with a return below

Look to buy after a failed breakout below 1.0878 with a return above

Look to sell after a failed breakout above 1.3093 with a return below

Look to buy after a failed breakout below 1.3032 with a return above

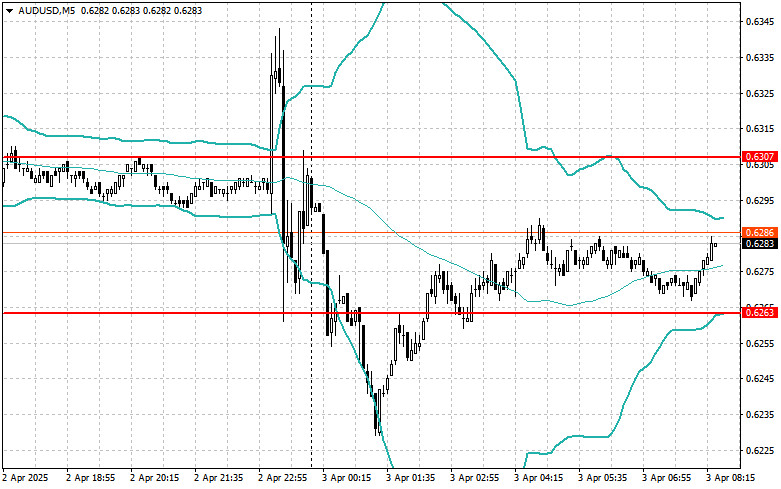

Look to sell after a failed breakout above 0.6307 with a return below

Look to buy after a failed breakout below 0.6263 with a return above

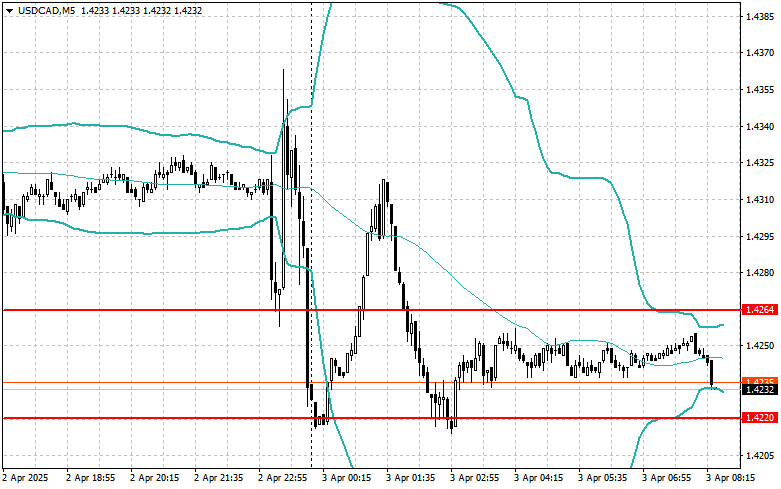

Look to sell after a failed breakout above 1.4264 with a return below

Look to buy after a failed breakout below 1.4220 with a return above

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Analisis Perdagangan dan Tips untuk Berdagang Pound Inggris Uji harga di 1.3399 bertepatan dengan MACD yang mulai naik dari garis nol, mengonfirmasi titik masuk yang valid. Mengingat betapa aktifnya pasangan

Rincian Trading dan Kiat-kiat untuk Trading Euro Pengujian harga pada 1,1545 terjadi ketika indikator MACD sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Oleh karena

Pengujian harga pada 142,20 terjadi ketika indikator MACD sudah bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Oleh karena itu, saya tidak menjual dolar. Saya juga

Uji harga di 1,3268 terjadi ketika indikator MACD bergerak jauh di atas garis nol, membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli pound. Hari ini, dolar

Level yang saya tandai tidak diuji pada paruh kedua hari. Hal ini disebabkan oleh libur pasar dan penutupan beberapa bursa utama. Selama sesi Asia hari ini, dolar AS mengalami penurunan

Analisis trading dan kiat-kiat trading untuk yen Jepang Pengujian level harga 142,51 terjadi ketika indikator MACD sudah bergerak jauh di bawah angka nol, yang membatasi potensi penurunan pasangan ini. Oleh

Analisis trading dan tips trading untuk pound Inggris Uji level harga 1.3257 terjadi ketika indikator MACD sudah bergerak jauh di bawah tanda nol, yang membatasi potensi penurunan pasangan ini. Oleh

Analisis dan Kiat-kiat Trading Euro Uji level harga 1,1344 terjadi ketika indikator MACD sudah bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Oleh karena itu, saya

Uji harga pada 142,69 terjadi tepat saat indikator MACD mulai bergerak naik dari garis nol, mengonfirmasi titik entri yang tepat untuk membeli dolar. Akibatnya, pasangan ini hanya naik 15 poin

Akun PAMM

InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.