Lihat juga

31.03.2025 12:27 PM

31.03.2025 12:27 PMAt the close of Friday's regular trading session, US stock indices ended in negative territory. The S&P 500 fell by 1.97%, while the Nasdaq 100 declined by 2.70%. The Dow Jones Industrial Average lost 1.69%.

The market continues to experience a sharp downturn. The S&P 500 is now within striking distance of its lowest point this year. The sell-off is occurring amid escalating fears regarding the economic consequences of an intensifying trade war. President Donald Trump is expected to announce additional tariffs later this week. Equities declined from Sydney to Hong Kong, with the Nikkei 225 dropping to its lowest level in over six months. Futures for US and European stock indices extended losses early Monday morning. Gold reached a new all-time high, while yields on US Treasuries declined amid growing demand for safe-haven assets.

Portfolio managers around the world are reducing exposure to risk or avoiding large positions altogether, as they remain cautious about the potential implementation of reciprocal trade tariffs and their impact on the global economy. Economists at Goldman Sachs Group Inc. now forecast that both the US Federal Reserve and the European Central Bank will cut interest rates three times this year, as trade restrictions continue to weigh on economic momentum.

This revised outlook reflects mounting concern over the effects of trade tensions on global growth. Economists note that trade barriers implemented by various countries are beginning to affect manufacturing activity and business investment, which in turn is slowing overall economic momentum. Interest rate cuts by central banks would reduce borrowing costs, likely encouraging companies to boost capital expenditures and consumers to increase spending—developments that could help halt the current bear market in risk assets. However, the effectiveness of these measures will depend on the severity of the trade impact and the speed with which the economy adapts to the new environment. There is also a risk that lower interest rates could stoke inflation, which would require central banks to adopt a more cautious stance on monetary policy.

Last week, President Trump stated that he plans to begin implementing reciprocal tariff rates on all countries starting April 2, dismissing speculation that he might limit the initial scope of the trade restrictions.

Oil prices declined after Trump announced that he would consider secondary tariffs on Russian crude and its buyers if a resolution with Ukraine cannot be reached. It is worth noting that Russia is the world's third-largest crude oil producer, and such tariffs could have significant implications for the global economy.

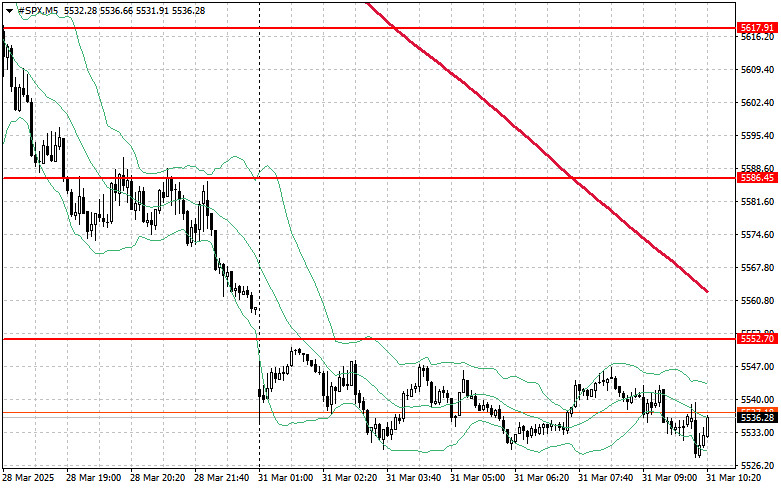

Regarding the technical outlook for the S&P 500, the downtrend continues. The primary objective for buyers today will be to break through the nearest resistance at $5,552. This would support continued upward movement and open the way for a push toward $5,586. Equally important for bulls will be gaining control over the $5,617 level, which would strengthen their position. In the event of a decline amid weakening risk appetite, buyers must step in near the $5,520 zone. A breakdown below this area would likely push the index down to $5,483, with a further drop toward $5,443 becoming possible.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Pasar global telah tersapu dalam badai tarif, dan pusat badai tersebut sekali lagi berada di Washington. Trump, dengan satu goresan penanya, dapat membuat indeks anjlok atau memberinya pemulihan, tetapi

Indeks saham utama AS menutup sesi reguler di Amerika Utara pada hari Jumat dengan hasil positif. S&P 500 naik sebesar 1,81%, sementara Nasdaq 100 meningkat 2,06%. Dow Jones industri naik

S&P500 Gambaran singkat indeks saham acuan AS pada hari Kamis: * Dow -2,5%, * NASDAQ -4,3%, * S&P 500 -3,5% S&P 500 ditutup pada 5.268, dalam rentang 4.800 hingga 5.800

Pasar saham AS baru saja mengalami salah satu gelombang optimisme terkuat dalam beberapa tahun terakhir. Pada hari Rabu, setelah pernyataan dari Presiden Donald Trump, indeks-indeks saham utama mencatatkan kenaikan yang

S&P 500 Ringkasan untuk 10 April Pasar AS bangkit kembali dengan kuat, tetapi perang dagang Trump dengan Tiongkok tetap belum terselesaikan Indeks utama AS pada hari Rabu: Dow +8%, NASDAQ

Pada penutupan sesi trading reguler kemarin, indeks saham AS berakhir dengan kenaikan yang solid. S&P 500 melonjak sebesar 9,52%, sementara Nasdaq 100 meroket sebesar 12,15%. Indeks industri Dow Jones naik

Pasar global kembali bergejolak: eskalasi perang dagang antara AS dan Tiongkok telah mengguncang pasar saham, emas mencetak rekor, Meta terjebak dalam skandal AI, dan Apple berisiko kehilangan hingga $40 miliar

InstaFutures

Make money with a new promising instrument!

InstaFutures

Make money with a new promising instrument!

Akun PAMM

InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.