Lihat juga

10.05.2022 12:16 PM

10.05.2022 12:16 PMAnalysis of transactions in the EUR / USD pair

Weak data on EU investor confidence limited the upward potential of EUR/USD yesterday, however, the fact that the pair hit new daily highs and returned to Friday's prices mean that the quote will climb up again after a slight downward correction.

Today, markets will focus on the reports on industrial orders in Italy, followed by the data on business sentiment in Germany and the Eurozone. A sharp jump in the indicators will lead to a further increase in euro, along with hawkish statements from ECB members Joachim Nagel and Luis de Guindos. In the afternoon, the US will release its own report on economic optimism, but that will not really shake the markets. Instead, the upcoming speeches of Fed members John Williams, Raphael Bostic and Loretta Mester will be decisive, especially if their statements are hawkish. Such rhetoric will ramp up dollar demand, which, in turn, will lead to another decline in EUR/USD.

For long positions:

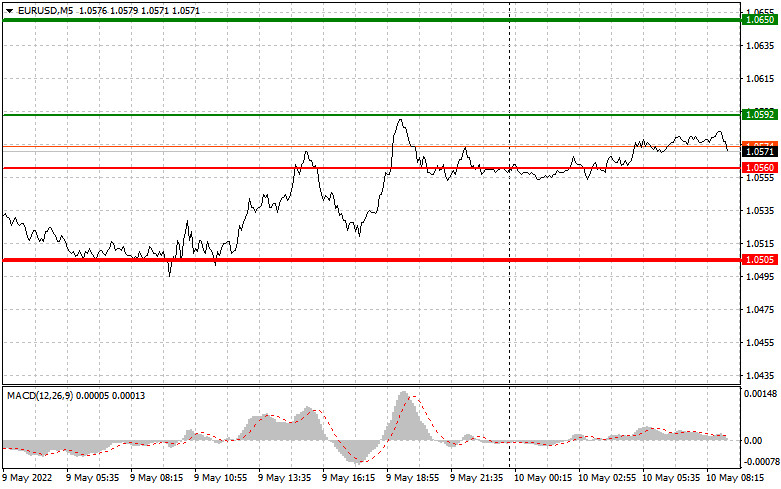

Buy euro when the quote reaches 1.0592 (green line on the chart) and take profit at the price of 1.0650 (thicker green line on the chart). A rally is possible if upcoming economic data on the eurozone exceeds expectations. But note that when buying, make sure that the MACD line is above zero or is starting to rise from it. It is also possible to buy at 1.0560, but the MACD line should be in the oversold area as only by that will the market reverse to 1.0592 and 1.0650.

For short positions:

Sell euro when the quote reaches 1.0560 (red line on the chart) and take profit at the price of 1.0505. Pressure will return if data on the Euro area turns out weaker than expected and if the Fed representatives say hawkish statements during their speeches. In any case, when selling, make sure that the MACD line is below zero, or is starting to move down from it. Euro can also be sold at 1.0592, however, the MACD line should be in the overbought area, as only by that will the market reverse to 1.0560 and 1.0505.

What's on the chart:

The thin green line is the key level at which you can place long positions in the EUR/USD pair.

The thick green line is the target price, since the quote is unlikely to move above this level.

The thin red line is the level at which you can place short positions in the EUR/USD pair.

The thick red line is the target price, since the quote is unlikely to move below this level. MACD line - when entering the market, it is important to be guided by the overbought and oversold zones.

Important: Novice traders need to be very careful when making decisions about entering the market. Before the release of important reports, it is best to stay out of the market to avoid being caught in sharp fluctuations in the rate. If you decide to trade during the release of news, then always place stop orders to minimize losses. Without placing stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

And remember that for successful trading, you need to have a clear trading plan. Spontaneous trading decisions based on the current market situation is an inherently losing strategy for an intraday trader.

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.

Analisis dan Saran Trading untuk Pound Inggris Pengujian level 1,3294 pada paruh pertama hari terjadi ketika indikator MACD sudah bergerak jauh di bawah angka nol, yang membatasi potensi penurunan pasangan

Analisis dan Saran Trading untuk Euro Uji harga 1,1320 pada paruh pertama hari terjadi ketika indikator MACD sudah bergerak jauh di atas level nol, yang membatasi potensi kenaikan pasangan

Uji level 144.79 terjadi pada saat indikator MACD sudah bergerak jauh di atas garis nol, yang membatasi potensi kenaikan pasangan ini. Oleh karena itu, saya tidak membeli dolar dan melewatkan

Pengujian level 1,3311 pada paruh kedua hari terjadi tepat saat indikator MACD mulai bergerak turun dari garis nol, mengonfirmasi titik masuk pasar yang valid. Akibatnya, pound jatuh menuju level target

Uji level 1,1305 pada paruh kedua hari terjadi ketika indikator MACD sudah bergerak jauh di bawah garis nol, yang membatasi potensi penurunan pasangan ini. Oleh karena itu, saya tidak menjual

Uji level 142,54 pada paruh kedua hari itu bertepatan dengan indikator MACD yang baru mulai bergerak turun dari level nol, mengonfirmasi titik entri yang tepat untuk menjual dolar dan mengakibatkan

Pengujian level 1,3400 pada paruh kedua hari bertepatan dengan dimulainya pergerakan naik indikator MACD dari garis nol, mengonfirmasi titik masuk yang tepat untuk membeli pound dan menghasilkan kenaikan

Uji level 1.1398 pada paruh kedua hari terjadi ketika indikator MACD baru saja mulai bergerak naik dari garis nol, mengonfirmasi titik masuk yang tepat untuk membeli euro. Ini menghasilkan kenaikan

Kenaikan euro dan pound terhenti. Data kepercayaan konsumen AS yang lemah kemarin gagal memberikan tekanan serius pada dolar, yang mengakibatkan penguatan euro dan pound Inggris yang hanya sedikit. Namun, selama

Video pelatihan

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.