Lihat juga

11.02.2025 07:26 AM

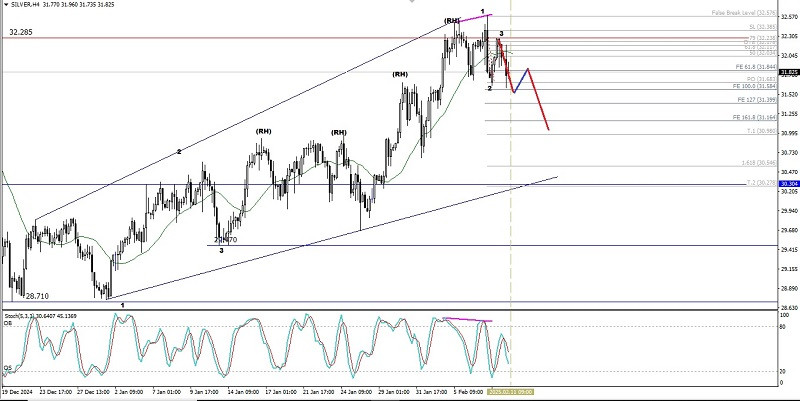

11.02.2025 07:26 AMDari yang nampak di chart 4 jamnya instrument komoditi Perak terlihat muncul pola Bullish 123 yang diikuti oleh Bullish Ross Hook (RH) dimana hal ini berarti Perak tengah menguat. Namun meski pergerakan harga Perak masih berada dalam kondisi yang menguat akan tetapi dengan munculnya divergence antara pergerakan harga dengan indikator Stochastic Oscillator serta munculnya pula pola Bearish 123 memberi petunjuk dan pola Ascending Broadening Wedge memberi petunjuk kalau dalam waktu dekat ini ada potensi pelemahan yang akan terjadi di instrumen komoditi tersebut dimana selama tidak terjadi penguatan kembali yang tembus dan menutup diatas level 32,576 maka Perak akan turun hingga ke level 31,584 bila level ini berhasil ditembus dan menutup dibawahnya maka Perak akan melanjutkan pelemahannya tersebut hingga ke level 31.164.

(Disclaimer)

You have already liked this post today

*Analisis pasar yang diposting disini dimaksudkan untuk meningkatkan pengetahuan Anda namun tidak untuk memberi instruksi trading.