#AAPL (Apple Inc.). Exchange rate and online charts.

Currency converter

01 Apr 2025 21:59

(0.06%)

Closing price, the previous day.

Opening price.

The highest price over the last trading day.

The lowest price over the last trading day

Price range high in the last week

Price range low in the last week

Apple Inc. is the American IT-giant and the most expensive company in the world. Its capitalization exceeds $450 billion and the brand value according to different estimates reaches $98 to $185 billion. The company was established in early 70’s in California by Steve Jobs and Steve Wozniak, and first registered on April 1, 1976. The IPO was launched on December 12, 1980. In total, 4.6 bln securities were sold at the initial cost of $3.6. Until 2004 the share price did not go over $40. However, after the company refocused on the mobile devices, the share price has multiplied by 6 times. Moreover, after the release of the iPad, the shares of Apple Inc. surged to the mark of $700. Now the asset turnover is about 900 billion and the unit price fluctuates around $500.

Apple Inc. share price has been growing by approximately 16.1% for the last three years. The dividend yield equals 2.23% and EPS 42% a year. Cost of securities is directly bound to the quarterly reports and new devices releases. The main income of Apple Inc. is constituted by expanding iPhone sales, which comprise about 67% of gross income. Consequently, the company’s share value is much influenced by the success of new Apple smartphones.

See Also

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 1-3, 2025: sell below $3,144 (21 SMA - 8/8 Murray)

On the other hand, if the price consolidates below the 8/8 Murray level at 3,125, the outlook will be negative. So, we believe the instrument could reach 3,091 in the short term and eventually climb to the 7/8 Murray level at 3,046.Author: Dimitrios Zappas

15:04 2025-04-01 UTC+2

1003

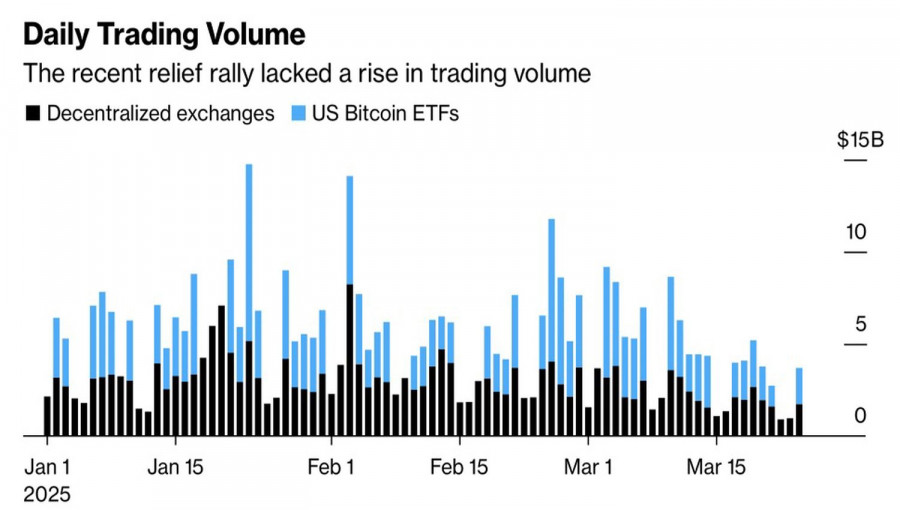

Even smart money stays cautious, holding back from building long BTC/USD positionsAuthor: Marek Petkovich

15:58 2025-04-01 UTC+2

988

Technical analysis / Video analyticsForex forecast 01/04/2025: EUR/USD, AUD/USD, NZD/USD, SP500 and Bitcoin

Technical analysis of EUR/USD, AUD/USD, NZD/USD, SP500 and BitcoinAuthor: Sebastian Seliga

11:43 2025-04-01 UTC+2

928

- Technical analysis

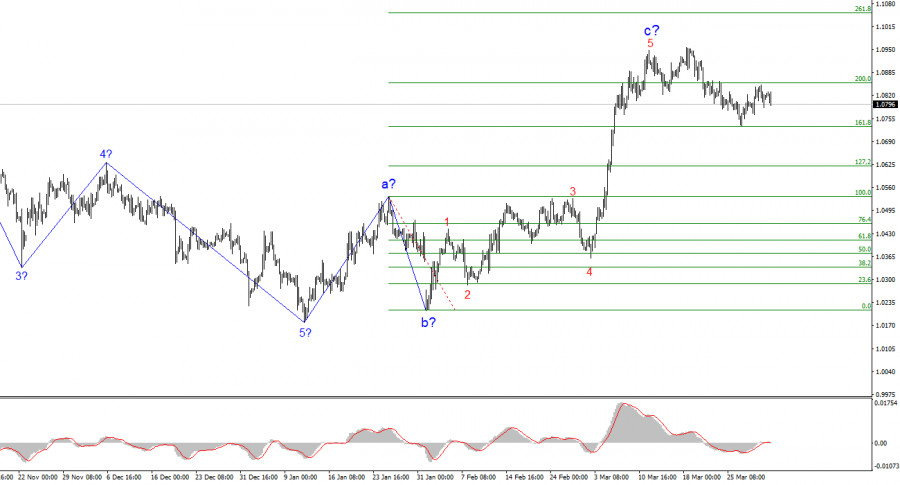

Trading Signals for EUR/USD for April 1-3, 2025: sell below 1.0804 (21 SMA - 8/8 Murray)

We expect the euro to continue its decline in the coming days, as technical levels suggest it will close the gap it left on February 28 at around 1.0365.Author: Dimitrios Zappas

15:06 2025-04-01 UTC+2

868

The EUR/USD pair declined by several dozen points on Tuesday—clearly a very modest move for the U.S. dollar.Author: Chin Zhao

20:05 2025-04-01 UTC+2

868

USD/JPY: Simple Trading Tips for Beginner Traders on April 1st (U.S. Session)Author: Jakub Novak

19:58 2025-04-01 UTC+2

853

- US stock indices closed the trading session with mixed results: the S&P 500 rose by 0.55%, while the Nasdaq 100 lost 0.14%. The reason for this uncertainty is the potential imposition of new tariffs by Trump's administration.

Author: Ekaterina Kiseleva

11:37 2025-04-01 UTC+2

808

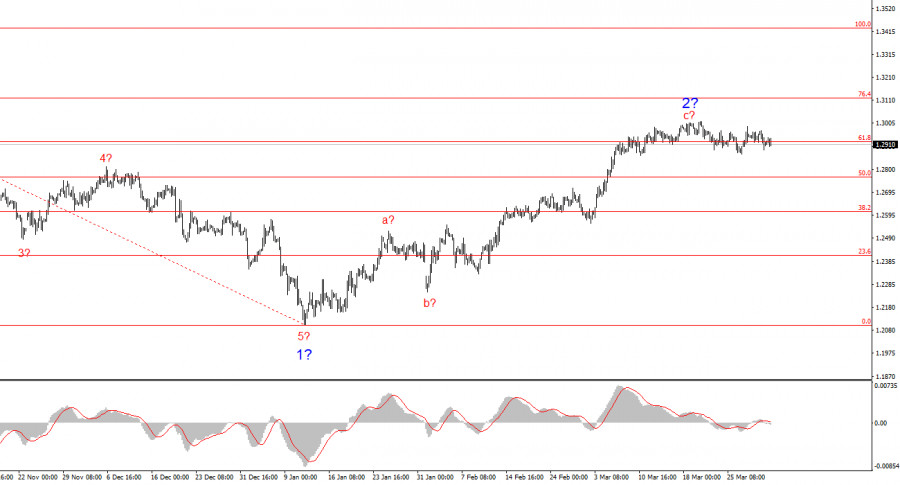

The GBP/USD pair once again showed a downward movement on Tuesday, though the momentum was very weak.Author: Chin Zhao

20:00 2025-04-01 UTC+2

808

S&P, Nasdaq post worst month since December 2022 Biggest quarterly interest rate drop: S&P since Q3 2022, Nasdaq Q2 2022 Trump tariff uncertainty weighs on markets in Q1 Trump to announce expanded tariffs on Wednesday Goldman Sachs cuts STOXX 600 forecast for 2025 European stocks jump after.Author: Thomas Frank

12:03 2025-04-01 UTC+2

778

- Technical analysis

Trading Signals for GOLD (XAU/USD) for April 1-3, 2025: sell below $3,144 (21 SMA - 8/8 Murray)

On the other hand, if the price consolidates below the 8/8 Murray level at 3,125, the outlook will be negative. So, we believe the instrument could reach 3,091 in the short term and eventually climb to the 7/8 Murray level at 3,046.Author: Dimitrios Zappas

15:04 2025-04-01 UTC+2

1003

- Even smart money stays cautious, holding back from building long BTC/USD positions

Author: Marek Petkovich

15:58 2025-04-01 UTC+2

988

- Technical analysis / Video analytics

Forex forecast 01/04/2025: EUR/USD, AUD/USD, NZD/USD, SP500 and Bitcoin

Technical analysis of EUR/USD, AUD/USD, NZD/USD, SP500 and BitcoinAuthor: Sebastian Seliga

11:43 2025-04-01 UTC+2

928

- Technical analysis

Trading Signals for EUR/USD for April 1-3, 2025: sell below 1.0804 (21 SMA - 8/8 Murray)

We expect the euro to continue its decline in the coming days, as technical levels suggest it will close the gap it left on February 28 at around 1.0365.Author: Dimitrios Zappas

15:06 2025-04-01 UTC+2

868

- The EUR/USD pair declined by several dozen points on Tuesday—clearly a very modest move for the U.S. dollar.

Author: Chin Zhao

20:05 2025-04-01 UTC+2

868

- USD/JPY: Simple Trading Tips for Beginner Traders on April 1st (U.S. Session)

Author: Jakub Novak

19:58 2025-04-01 UTC+2

853

- US stock indices closed the trading session with mixed results: the S&P 500 rose by 0.55%, while the Nasdaq 100 lost 0.14%. The reason for this uncertainty is the potential imposition of new tariffs by Trump's administration.

Author: Ekaterina Kiseleva

11:37 2025-04-01 UTC+2

808

- The GBP/USD pair once again showed a downward movement on Tuesday, though the momentum was very weak.

Author: Chin Zhao

20:00 2025-04-01 UTC+2

808

- S&P, Nasdaq post worst month since December 2022 Biggest quarterly interest rate drop: S&P since Q3 2022, Nasdaq Q2 2022 Trump tariff uncertainty weighs on markets in Q1 Trump to announce expanded tariffs on Wednesday Goldman Sachs cuts STOXX 600 forecast for 2025 European stocks jump after.

Author: Thomas Frank

12:03 2025-04-01 UTC+2

778