Voir aussi

21.06.2022 03:14 PM

21.06.2022 03:14 PMMarket participants as a whole reacted rather restrainedly to the decision of the central bank to raise the interest rate and to today's speech of the head of the RBA, and the publication of minutes from the June meeting of the bank.

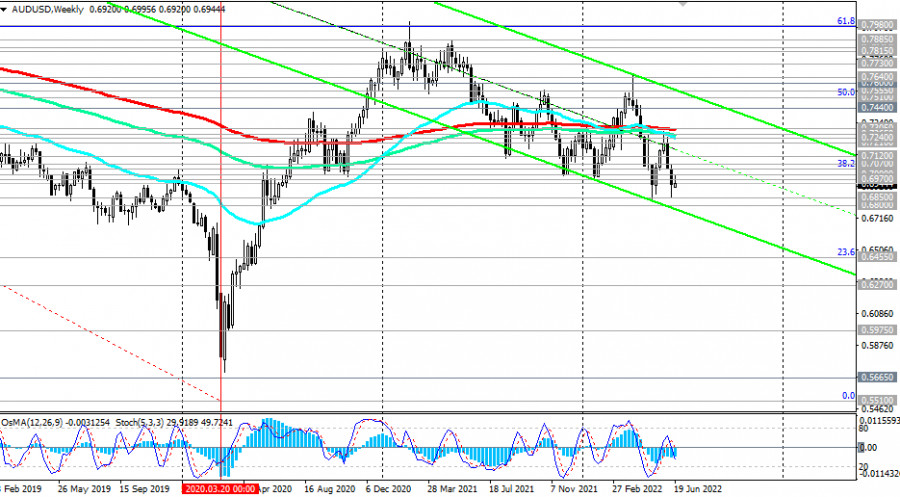

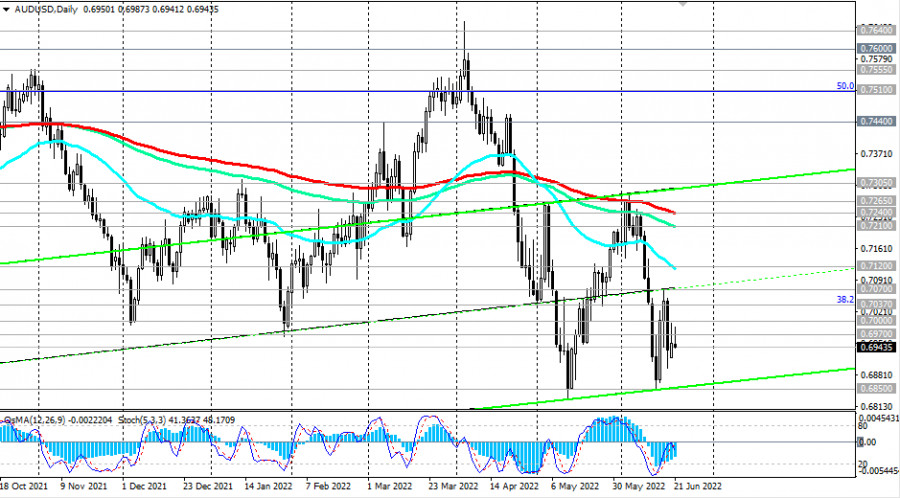

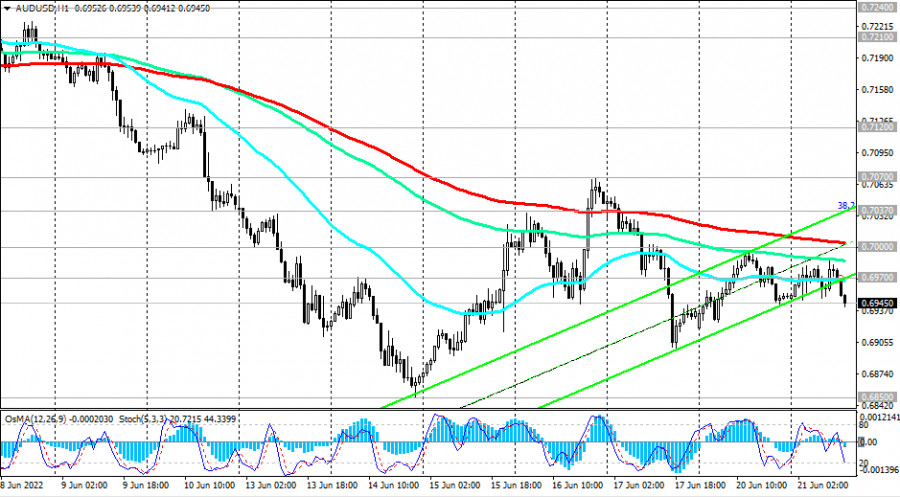

AUD remains under pressure, primarily against the US dollar. As of this writing, AUD/USD is trading near 0.6945, continuing to decline towards the lower border of the descending channel on the weekly chart, which is currently below 0.6800.

Given the Fed's propensity to pursue a tighter monetary policy and in anticipation of further strengthening of the US dollar, a deeper decline in AUD/USD should be expected.

A breakdown of local support levels 0.6850, 0.6800 will confirm our assumption, and AUD/USD will head towards multi-year lows reached in March 2020 near 0.5665, 0.5510 with intermediate targets at support levels 0.6500, 0.6455 (23.6% Fibonacci retracement to the wave of the pair's decline from 0.9500 in July 2014 to 2020 lows near 0.5510), 0.6270, 0.5975.

The continued positive upward trend in 10-year US bond yields makes the dollar an attractive asset for investment, given the prospects for further tightening of the Fed's monetary policy. The dollar is also actively used as a defensive asset, winning over traditional defensive assets such as gold, franc, and yen.

In an alternative scenario, AUD/USD will again try to break through the key resistance levels 0.7240 (200 EMA on the daily chart), 0.7210 (144 EMA on the daily chart), 0.7305 (200 EMA on the weekly chart, 50 EMA on the monthly chart). A breakdown of the resistance levels 0.7600 (200 EMA on the monthly chart), 0.7640 (144 EMA on the monthly chart) will bring AUD/USD into the zone of a long-term bull market.

Support levels: 0.6900, 0.6850, 0.6800, 0.6455, 0.6270, 0.5975, 0.5665, 0.5510

Resistance levels: 0.6970, 0.7000, 0.7037, 0.7070, 0.7120, 0.7210, 0.7240, 0.7265, 0.7305

Trading Tips

Sell Stop 0.6915. Stop-Loss 0.7010. Take-Profit 0.6900, 0.6850, 0.6800, 0.6455, 0.6270, 0.5975, 0.5665, 0.5510

Buy Stop 0.7010. Stop-Loss 0.6915. Take-Profit 0.7037, 0.7070, 0.7120, 0.7210, 0.7240, 0.7265, 0.7305

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Mardi, la paire GBP/USD a corrigé à la baisse après un nouvel élan lundi. Aucun facteur fondamental ou macroéconomique ne justifiait de tels mouvements ni lundi, ni mardi. Il n'y

Mardi, la paire de devises EUR/USD a continué de se déplacer dans un canal horizontal, désormais visible sur pratiquement toutes les unités de temps et facilement reconnaissable même d'un simple

Mardi, la paire de devises GBP/USD n'a pas réussi à poursuivre le mouvement haussier qu'elle avait démarré si vigoureusement lundi. Il convient de rappeler qu'il n'y avait pas de raisons

La paire de devises EUR/USD a continué de se négocier dans un canal latéral tout au long de la journée de mardi. Le mouvement stable est visible sur le graphique

Dans mes prévisions du matin, j'ai mis en avant le niveau de 1.3421 et prévu de prendre des décisions de trading basées sur celui-ci. Jetons un coup d'œil au graphique

Dans ma prévision matinale, j'ai attiré l'attention sur le niveau de 1.1378 et j'ai prévu de prendre des décisions de trading en fonction de celui-ci. Examinons le graphique

Lundi, la paire GBP/USD a augmenté de 130 pips. C'était donc ce « lundi ennuyeux » sans rapport macroéconomique ni discours important. La livre sterling a gagné plus d'un centime

Le lundi, la paire de devises EUR/USD a montré des mouvements quelque peu mitigés, peu importe comment vous la regardez. D'une part, la paire a démontré une forte hausse malgré

Ce lundi, la paire de devises GBP/USD a de nouveau progressé malgré l'absence de raisons fondamentales. Cependant, d'ici là, tous les traders devraient être habitués à de telles évolutions. Alors

Ce lundi, le couple de devises EUR/USD a montré un mouvement à la hausse relativement appréciable au cours de la journée, mais est resté à l'intérieur du canal étroit entre

Comptes PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.