Voir aussi

03.06.2022 12:23 PM

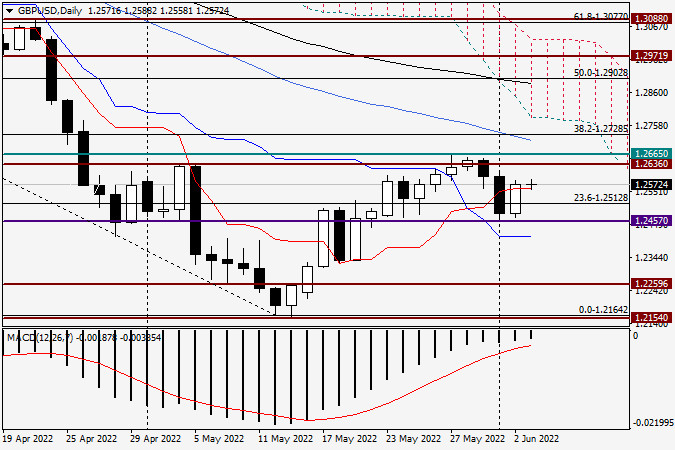

03.06.2022 12:23 PMToday's review of the GBP/USD currency pair will begin with the fact that quite interesting and not always clear things sometimes happen on the market. Although the Bank of England has already raised the main interest rate several times and will continue to do so, the British pound sterling shows a weaker strengthening against the US dollar when such a strengthening takes place.

Daily

So at yesterday's trading, the growth of GBP/USD was more modest than that of the euro/dollar. The factors contributing to such price dynamics of the "Briton" are called different. Likely, the technical picture of the main pound/dollar currency pair and the movement in the euro/pound cross-rate play an important role in this. Before proceeding to the technical analysis of GBP/USD, let me remind you once again that today at 13:30 London time, labor reports for May will be received from the United States of America. You can learn more about the expectations for the US labor market by reading today's article on the euro/dollar. In order not to repeat, I will only note that the forecasts for the unemployment rate, the creation of new jobs in non-agricultural sectors of the economy, as well as the growth of average hourly wages cannot be called too high. At the same time, I assume that a deviation from forecasts towards their weaker actual figures may put pressure on the US dollar across a wide range of the market.

A characteristic technical feature of yesterday's trades was their closing over the red line of the Tenkan Ichimoku indicator. However, this can only be perceived as the first signal regarding the subsequent strengthening of the quote. In my personal opinion, the bullish prospects of GBP/USD will become most obvious only in the case of a true breakdown of the strong resistance of sellers at 1.2665, as well as the 50-simple moving average, which is now passing at 1.2709. The bearish scenario will have a good chance of its further implementation only in the case of a true breakdown of the support of 1.2657 (June 1 lows) and the subsequent passage down of the blue Kijun line, which is at 1.2410. That's the story. There are more questions than answers regarding today's positioning for the GBP/USD pair. For sure, data on the US labor market will play a decisive role relative to the closing of today and weekly trading. Given this factor, I will not give any specific trading recommendations today, so as not to mislead respected traders. Already on Monday, taking into account the actual figures on the US labor market, the reaction of market participants to them, as well as the closing prices of today's and weekly trading, we will determine the prospects for the price dynamics of the pound/dollar currency pair. The only thing I would like to draw attention to is the inexpediency of transferring open positions to Monday.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Liens utiles : Mes autres articles sont disponibles dans cette section Cours InstaForex pour débutants Analyses Populaires Ouvrir un compte de trading Important : Les débutants en trading forex doivent

Avec l'apparition des figures de "Divergent" et de "Descending Broadening Wedge" sur le graphique de 4 heures de la paire de devises croisées AUD/JPY, bien que le mouvement

Sur le graphique de 4 heures de la paire de devises principale USD/JPY, on peut observer que l'indicateur Stochastic Oscillator forme un modèle de Double Bottom tandis que le mouvement

Tôt dans la session américaine, l'or se négocie autour du niveau de 3 310, où il se situe à la 21SMA et à l'intérieur d'un motif en triangle symétrique formé

Notre plan de trading pour les prochaines heures est de vendre en dessous de 1.1410 avec des cibles à 1.1370 et 1.1230. L'indicateur eagle donne un signal négatif, nous pensons

Liens utiles : Mes autres articles sont disponibles dans cette section Cours InstaForex pour débutants Analyses Populaires Ouvrir un compte de trading Important : Les débutants en trading forex doivent

D'un autre côté, si la pression baissière prévaut et que l'euro se consolide en dessous de 1.1370, cela pourrait être interprété comme un signal de vente avec des objectifs

L'indicateur Eagle montre des signaux de survente, nous pensons donc que l'or pourrait reprendre son cycle haussier à court terme après une correction technique et atteindre le seuil psychologique

Comptes PAMM

InstaForex

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.