Voir aussi

The situation in the world is not easy, the markets have not managed to get out of the coronavirus crisis, and a new financial crisis is on the way. Massive information and news flow, sanctions, the flight of companies and assets lead to panic among investors who, in bewilderment from what is happening, run wherever they look.

The situation is ambiguous, first of all, investors prefer the U.S. dollar due to its political and financial stability. This decision is fair, but a new vector called "digital ark" is already visible.

Cryptocurrency was created as an idea of complete decentralization, where there is no administration, sanctions, and politics. Transactions work while the network is running. The modern world needs decentralization, and now many investors have begun to understand this better.

In this article, we are not talking about the fact that with the help of cryptocurrencies it is possible to circumvent sanctions, this is not so. Bitcoin/Ethereum, as well as altcoins, popular among traders, leave a digital footprint, and it is almost impossible to get around the law with them. The essence of our reasoning is that the cryptocurrency can get a new round of development, where investors can consider it as a tool of stability from external chaos.

In this case, the crypto market can increase its volume, attract new users and expand its use in everyday life.

Example: the other day there was news that the issue of digital wallets was being studied at a meeting of representatives of eBay. In fact, this is a step in favor of cryptocurrencies, which in the near future may become a monetary equivalent for users of the online store.

At the same time, investors who are afraid of political and financial instability may well consider a stake in digital assets, which will become part of the risk hedging.

This is a long way that the cryptocurrency has to go, and do not forget that not so long ago Bitcoin was considered a SCAM, and now it is a full-fledged asset in the financial markets.

Bitcoin, despite the general panic, keeps quite stable. The asset moves in a wide range of 33,000/46,000, where the process of accumulation of trading forces has been observed recently. In fact, this indicates the interest of market participants in a digital asset. It is still very early to say that the downward cycle from November 2021 is over. The financial markets are going through hard times, and the global downward trend may well pull the cryptocurrency market with it.

The borders of the lateral amplitude serve as signal levels, where a breakdown of one of the key values may indicate a subsequent price path.

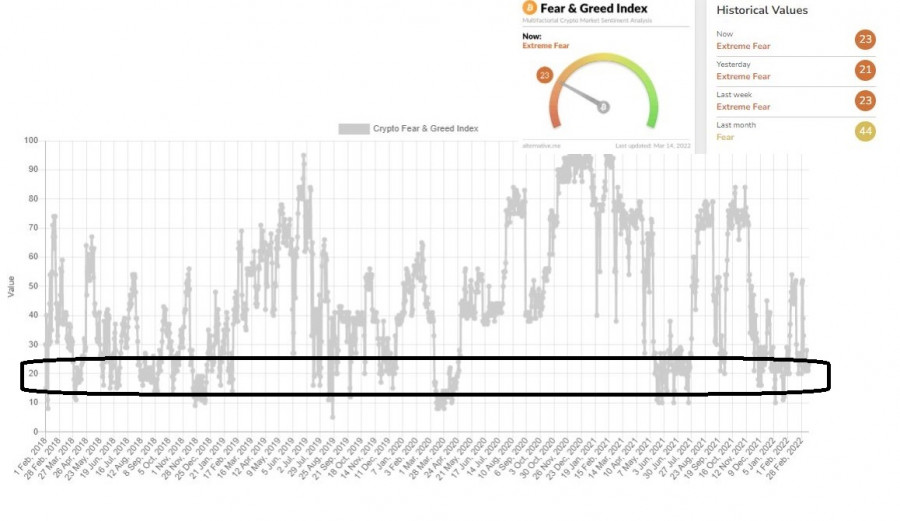

The index of emotions (aka fear and greed) of the crypto market is moving near the base, which may signal an oversold asset and fear of the subsequent formation of a downward cycle. In this case, the index plays a secondary role and may not coincide with reality in the financial market.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin et Ethereum continuent de croître suite à des nouvelles législatives positives sur les cryptomonnaies Le Bitcoin est actuellement coté à 96 700 $, après un rebond depuis un creux

Bitcoin et Ethereum ont passé la journée dans un canal horizontal, bien que des signes de ventes actives lors de la session américaine d'hier suscitent certaines questions quant aux perspectives

Avec l'apparition du modèle Bullish 123 suivie de l'apparition du Bullish Ross Hook qui a réussi à briser la ligne de tendance baissière précédente et l'indicateur Stochastic Oscillator

Alors que les pièces continuent de quitter les plateformes d'échange, l'activité renouvelée sur le marché des contrats à terme et l'augmentation des détenteurs à court terme, la plus grande cryptomonnaie

InstaForex en chiffres

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.