See also

24.04.2025 10:34 AM

24.04.2025 10:34 AMThe wave pattern on the 24-hour chart for #SPX is generally clear. The global five-wave structure doesn't even fit on the terminal screen at the smallest scale. In simple terms, U.S. stock indices had been rising for a very long time—but we know that trends alternate. At this point, the upward trend segment appears to be complete. The instrument has made four unsuccessful attempts to break through the 6,093 level, which corresponds to 200.0% Fibonacci from wave 4. In my view, we will soon see the continuation of a corrective wave series. The U.S. stock market had been overheated for too long, and Trump triggered a chain reaction.

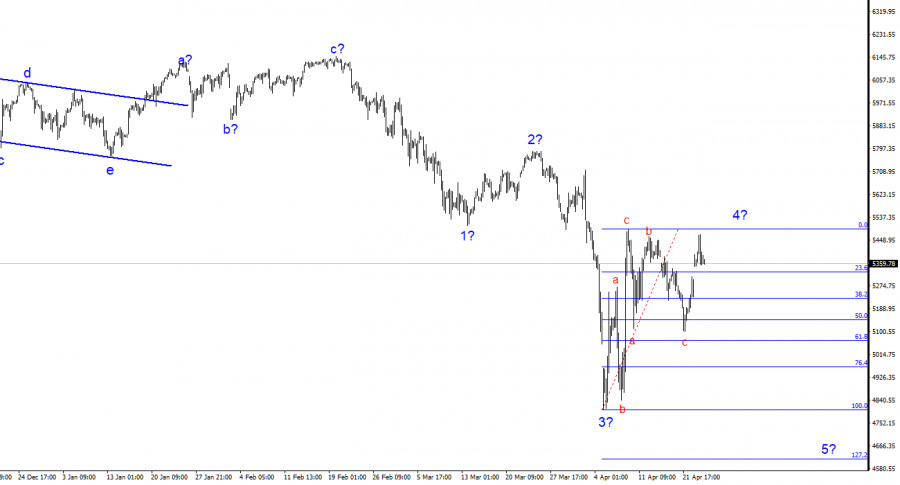

Switching to the 4-hour chart (image above), we can observe the development of a new downward trend segment, which could be quite extensive. The fifth wave is still missing from the structure, so I believe the decline in the S&P 500 index is not yet over. It's also important to keep in mind that any new tariffs introduced by Trump—or retaliatory tariffs imposed on the U.S.—could logically trigger new rounds of sell-offs in the U.S. stock market. Currently, the presumed wave 4 is still forming and may turn out to be quite complex in its internal structure.

The #SPX has recovered sharply, but the downtrend formation is still in progress. We are now witnessing the construction of a complex corrective structure within the presumed wave 4. I see no signs of a trend reversal at this time.

The recent recovery in the S&P 500 is primarily due to Trump's softened rhetoric regarding the trade war. Recall that a couple of weeks ago, Trump announced a 90-day grace period for 75 countries previously hit with import tariffs. Earlier this week, the U.S. President stated that tariffs on China would be reduced. It's still unclear by how much, when, or under what conditions, but the tone toward China—and many other countries—has clearly shifted.

The market sensed that the harshest trade war scenario may be avoided, and stopped selling off U.S. stocks. However, it's too early to speak of full de-escalation, as Trump is not planning to repeal all tariffs. I also doubt that every country will succeed in reaching trade deals with the U.S. I'm particularly concerned about the outcomes for the European Union and China, where negotiations remain extremely difficult.

As such, the recent market recovery is quite logical, but further growth will depend on positive news related to trade tensions. If such news is limited, continued growth in the S&P 500 becomes questionable.

Based on the analysis of #SPX, I conclude that the upward trend segment has ended. Trump continues to make decisions that threaten the stability of the U.S. economy and American corporations (e.g., trade wars, tariffs, import restrictions, and export controls), which is why we are now observing the start of a new downward trend. The "bubble" in the U.S. stock market had been inflating for years—and Trump has popped it.

The 4-hour chart also supports the likelihood of further declines. At this point, we expect the formation of wave 5, which implies another leg down, targeting the area around 4,614.

On the higher time frame, the wave structure is much clearer: a clean five-wave structure, including a five-wave substructure within wave 5. The upward trend segment is complete. Therefore, I would prepare for a new long-term downward segment, which is already underway.

Core Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

At the close of the previous regular session, U.S. stock indices ended mixed. The S&P 500 gained 0.13%, while the Nasdaq 100 slipped 0.13%. The industrial Dow Jones dropped 1.33%

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.