See also

24.04.2025 10:15 AM

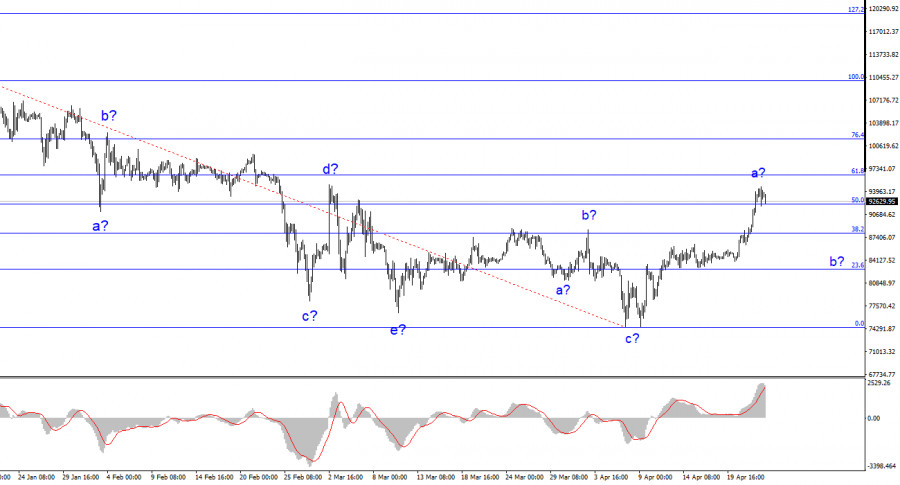

24.04.2025 10:15 AMThe wave pattern on the 4-hour chart for BTC/USD has become somewhat more complex. We observed a corrective downward structure that completed its formation around the $75,000 mark. Following this, a rather strong upward movement began, which could be the start of a new impulsive trend. Currently, the first wave appears to be complete, so a corrective wave 2 or b should be expected next. After that, Bitcoin's upward movement will likely resume, at least within the framework of wave c.

Bitcoin has long been supported by a steady flow of news about institutional investment, government involvement, and even pension funds. However, Trump's policies have recently driven some investors out of the market. Nonetheless, with the U.S. stock market and bond market in decline, investors may turn to Bitcoin as a hedge, as it is less influenced by Trump's decisions. Once again, Bitcoin is being viewed as a "crisis hedge," increasing the probability of renewed growth for the digital asset.

BTC/USD has surged by $19,000 in a short period, which is substantial considering the current global economic instability. The reasons for this rally are varied, but each of them can be reasonably questioned. For instance, Bitcoin began rising after reports emerged that Trump is not planning to fire Fed Chair Jerome Powell. But how exactly does Powell's job security relate to Bitcoin?

Many economists now expect the Fed to begin cutting rates. However, Powell has consistently stated that the FOMC will respond to changes in economic data, not to shifts in Trump's trade policies. Some are even anticipating a new round of quantitative easing (QE), which would inject new liquidity into the economy—similar to what we saw during the COVID-19 era. While such policies could benefit cryptocurrencies, especially Bitcoin, there is no sign of QE being launched yet. Moreover, it is highly questionable whether the Fed—after years of battling inflation—would now take steps that could reignite it.

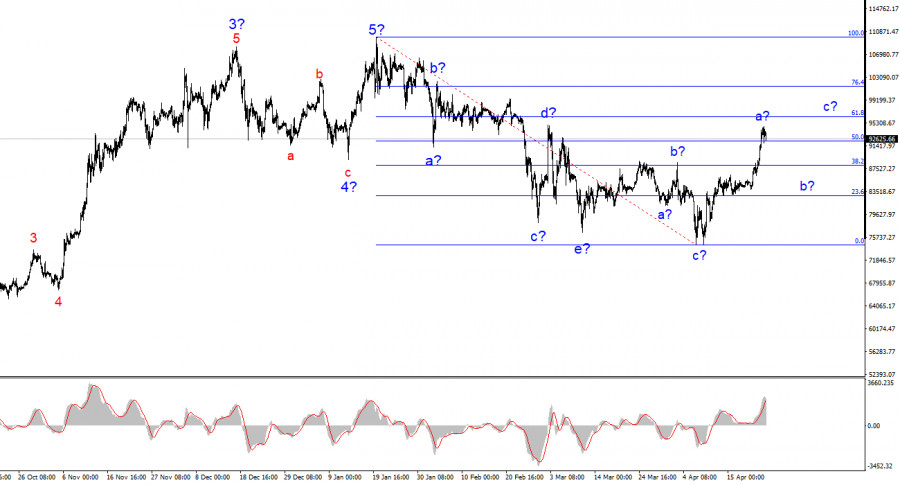

So, much of the reasoning behind Bitcoin's rally seems speculative or, at the very least, highly debatable. Based on this, I believe we are more likely to see the formation of a corrective wave structure, rather than a new impulsive one. As I've stated in previous months, a prolonged and complex corrective phase still lies ahead.

Based on the analysis of BTC/USD, I conclude that the downward segment of the trend is still developing. All signs point toward a complex, multi-month correction. Therefore, I have not recommended buying Bitcoin before, and I see even less reason to do so now. In my view, the best approach remains looking for selling opportunities.

At this stage, Bitcoin appears to be forming a corrective upward sequence of waves, which has not yet completed. Once wave c concludes, I would begin to seek short positions, targeting the $75,000 level.

On the higher wave scale, we can still see a completed five-wave upward structure. What is currently unfolding looks like the beginning of a corrective, downward phase or potentially a full-blown bearish cycle.

Core Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin is being pressured, but it still holds up quite confidently. After rebounding from the $92,000 mark, the first cryptocurrency returned to the $94,000 area, maintaining good growth prospects

Yesterday's unsuccessful attempt to stay above $94,000 demonstrates that there is still significant buying interest. Ethereum is also holding up quite well, although yesterday's correction during the European session likely

With the condition of the Stochastic Oscillator indicator which is already above the Overbought level (80) even though it is currently still moving above the WMA (30 Shift 2) which

Although currently the Solana cryptocurrency is moving in a strengthening condition which is indicated by its price movement moving above the WMA (30 Shift 2) but with the appearance

Bitcoin failed to hold above the $94,000 level and corrected to the $92,500 area, where it appears more comfortable. Ethereum also pulled back to around $1,769 after briefly climbing above

Bitcoin has successfully pushed above $90,000, while Ethereum added more than 10% in just one day, rebounding to $1800. The main catalyst was Donald Trump's statement yesterday, clarifying that firing

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.