See also

23.04.2025 06:44 PM

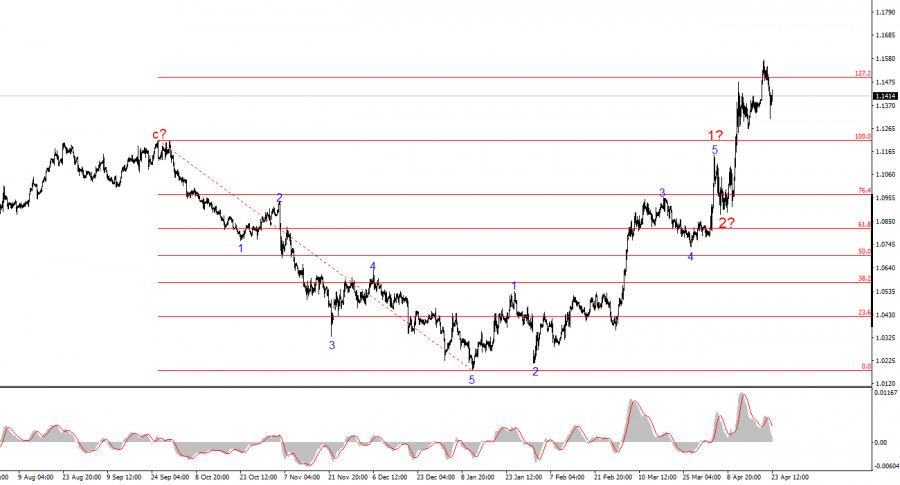

23.04.2025 06:44 PMThe wave structure on the 4-hour chart for EUR/USD has transitioned into a bullish, impulsive formation. I believe no one doubts that this transformation occurred solely due to the new trade policy of the United States. Prior to February 28, when the US dollar began a steep decline, the entire wave structure looked like a solid downward trend — forming a corrective wave 2. However, Donald Trump's weekly announcements of various tariffs did their job. Demand for the US dollar began to collapse rapidly, and the entire trend segment, beginning on January 13, has now formed a five-wave impulse.

Moreover, the market failed to construct a convincing wave 2 within the new upward trend. We only saw a small pullback — even smaller than any of the corrective waves within wave 1. The US dollar could continue its decline unless Donald Trump completely reverses his trade policy. We've already seen an example where news flow forced a change in wave structure. It could happen again.

The EUR/USD pair rose by 70 basis points on Wednesday, but this move shouldn't be viewed in isolation — there are many possible interpretations. First, the pair had fallen by 200 points before that. And on Monday, it rose by 200 points. So, the overnight and daytime movement on Wednesday is simply part of a broader trend that can't be considered separately. Looking specifically at the European session, when economic data started to come out, there was little change in the pair's value.

PMI readings in Germany and the Eurozone came in well below expectations. All four indicators declined in April and are now below the 50.0 mark. It's worth noting that any value below 50.0 is considered negative and forecasts economic slowdown — in an economy that hasn't grown much in recent years. A slowdown in an economy that could deteriorate further due to the Global Trade War — even though that hasn't fully started yet. I've said many times that the weakening of the US dollar doesn't reflect the broader news background. It's purely a reaction to Trump's protectionist policies — which the rest of the world rejects. Market participants don't want to deal with the dollar, don't trust Trump, and see no prospects or stability in the US economy under his leadership.

However, when comparing the current state of the US economy to that of the EU, the US still appears much healthier. But that no longer matters — because the market is guided by entirely different motives when making trading decisions.

Based on the EUR/USD analysis above, I conclude that the pair continues to develop a new bullish wave segment. Donald Trump's actions reversed the prior downtrend. Therefore, in the near future, the wave structure will entirely depend on the US president's decisions. This should be constantly kept in mind.

Based purely on wave structure, I had expected a three-wave correction within wave 2. However, wave 2 has already been completed as a single wave. Wave 3 of the bullish segment is now underway, with potential targets reaching as far as the 1.25 area. Achieving these targets will depend entirely on Trump, while the internal structure of this wave is already becoming quite "awkward."

At the higher wave scale, the structure has also shifted to bullish. We are likely entering a long-term upward series of waves — but Trump's statements could easily flip everything upside down again.

Core Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start

Ferrari F8 TRIBUTO

from InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.