See also

23.04.2025 12:01 PM

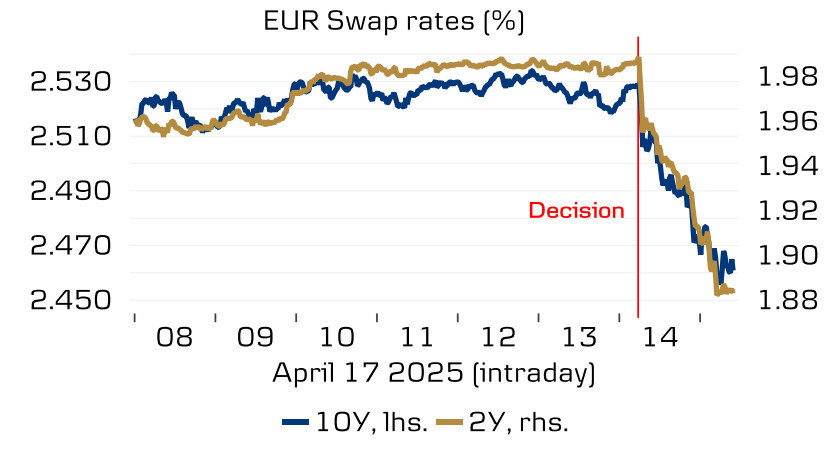

23.04.2025 12:01 PMAs expected, the ECB cut all key interest rates by a quarter-point, bringing the deposit rate down to 2.25%.

At this meeting, no new staff projections were released, and given the disruptions in global trade due to "Liberation Day," the previous March forecasts were clearly outdated, as reflected in the rather vague outlook presented.

The ECB took a distinctly dovish stance—highlighting that the risk of rising inflation has diminished, which automatically implies readiness for faster rate cuts. Additionally, the implications of the unfolding trade war are being viewed as negative, posing a threat to future economic growth. ECB President Christine Lagarde clearly expressed all these concerns during the post-meeting press conference. She also hinted that a 50 basis point rate cut was discussed during the meeting. Although this option did not gain support, the mere fact that it was considered signals the ECB's willingness not to delay normalization. Looking ahead, this constitutes a sustained bearish factor for the euro due to the high likelihood of falling yields, and markets immediately reacted to the shift in Lagarde's rhetoric.

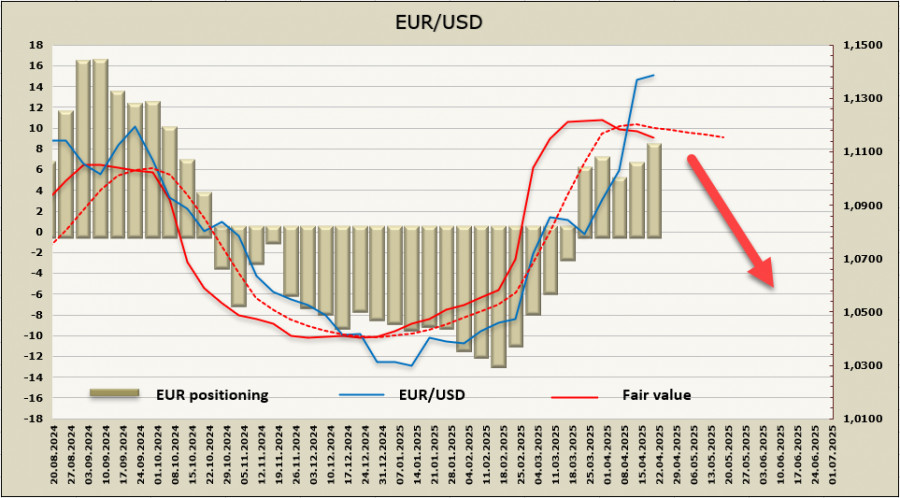

All signs pointed toward consolidation and the formation of a downward reversal in EUR/USD, but U.S. President Trump once again rattled the markets by raising the question of how to remove Fed Chair Jerome Powell from office. This led to a large-scale dollar sell-off and increased demand for safe-haven assets—particularly gold—since Trump essentially called into question the dollar's credibility as the world's leading reserve currency. The euro reacted in line with broader market movements, which explains the upward spike. However, in the long term, the risks of a downward reversal have not disappeared and, in fact, continue to grow.

The net long position in the euro rose by $1.55 billion over the reporting week to $9.77 billion. Positioning remains confidently bullish, yet the fair value continues to trend downward.

Despite speculative positioning favoring the euro, faster-moving indicators such as the reaction of stock indices to recent events and bond yields in the eurozone are performing worse than their U.S. counterparts. Last week, we assumed that EUR/USD would reverse near the 1.1445 resistance level, but Trump's verbal assault on the Fed's leadership triggered dollar selling and enabled the euro to post another high. Nonetheless, we maintain the view that once this period of high volatility passes, the euro will turn south. We expect a correction toward the 1.1210 support level, with the next target in the 1.0930/50 range.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to? Amid the geopolitical

The upcoming week's economic calendar is packed with important releases. As usual, the beginning of a new month brings significant macroeconomic reports from the U.S. and the Eurozone, typically triggering

No macroeconomic events are scheduled for Monday. If the market barely reacted to macroeconomic data last week, there is nothing to expect on Monday. Of course, Donald Trump could make

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.