See also

23.04.2025 07:01 AM

23.04.2025 07:01 AMA considerable number of macroeconomic events are scheduled for Wednesday. All of them are Purchasing Managers' Index (PMI) reports for April in the services and manufacturing sectors. The indices will be published across many European countries, including the Eurozone as a whole, the UK, and the US. In Europe, a slowdown in business activity is expected, unlikely to please the bulls. At the same time, Donald Trump continues to dominate the market sentiment. Macroeconomic data rarely reflect price movements and cannot significantly influence traders' moods. A decline in PMIs in Europe and the UK may trigger a continued drop in the euro and the pound.

As before, there is no point in discussing any fundamental events other than Trump's trade war. The fall of the dollar can continue indefinitely as long as Trump keeps imposing new tariffs or raising existing ones. We would advise traders to closely follow speeches from top officials of the world's largest countries and economic alliances regarding tariffs. Any escalation could lead to a new drop in the dollar. Any sign of de-escalation would likely strengthen the dollar. However, there have been no signs of de-escalation, and the dollar could still fall without new developments.

Yesterday, Trump announced that he does not intend to maintain trade tariffs on China at the 145% level, which sparked a wave of relief across all markets. Bitcoin, the US dollar, and US stock indices immediately moved higher. However, Trump did not clarify when or under what conditions the tariffs would be lowered. And if a trade deal with China fails to materialize, the White House is unlikely to de-escalate the conflict. Then again, with Trump, nothing can be ruled out.

Both currency pairs may move in either direction during the third trading day of the week. On Tuesday, we saw the US dollar strengthen, which could continue into the first half of Wednesday, as the market has not yet fully digested Trump's latest statements. Additionally, pressure on the euro and pound may come from April's business activity indices, which are expected to show a slowdown.

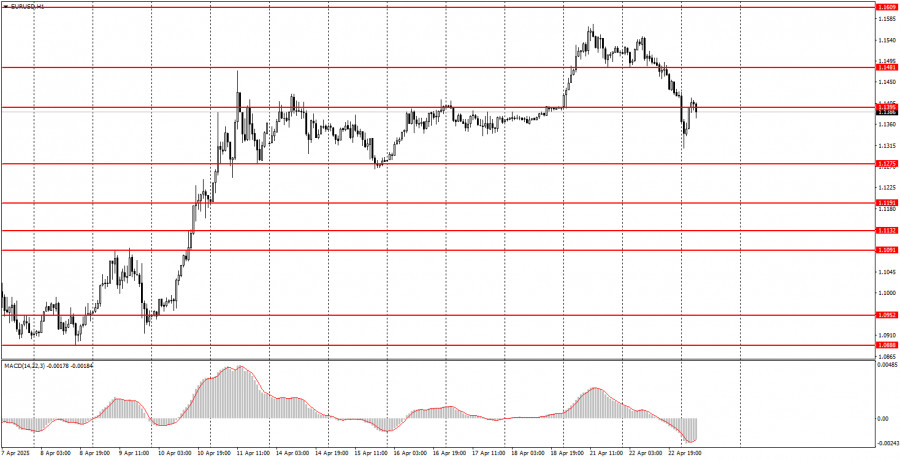

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to? Amid the geopolitical

The upcoming week's economic calendar is packed with important releases. As usual, the beginning of a new month brings significant macroeconomic reports from the U.S. and the Eurozone, typically triggering

No macroeconomic events are scheduled for Monday. If the market barely reacted to macroeconomic data last week, there is nothing to expect on Monday. Of course, Donald Trump could make

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.