See also

22.04.2025 07:15 PM

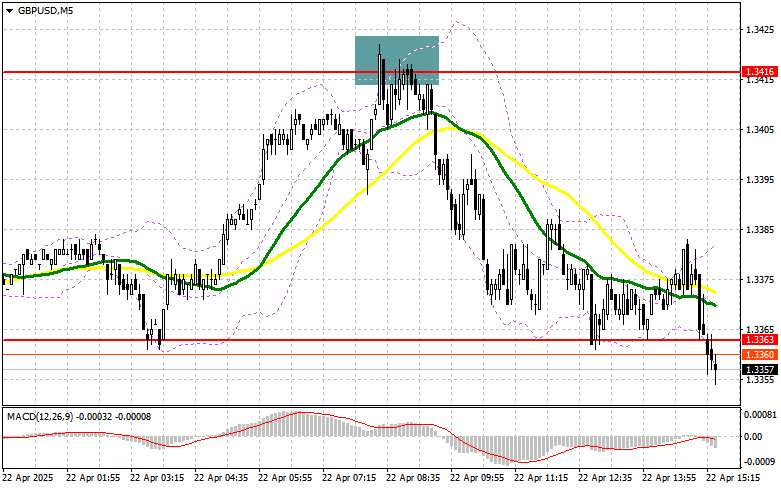

22.04.2025 07:15 PMIn my morning forecast, I highlighted the 1.3416 level as a key point for market entry. Let's look at the 5-minute chart and break down what happened. The pair climbed and formed a false breakout around 1.3416, providing a solid entry point for short positions, which led to a decline toward the 1.3363 level. The technical outlook for the second half of the day has not changed significantly.

To open long positions on GBP/USD:

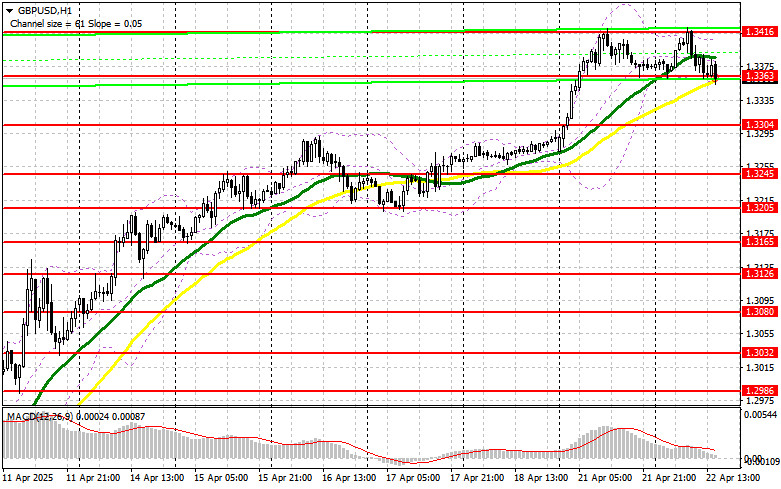

The absence of U.K. news allowed the pound to continue climbing, though buyers failed to break above the weekly highs. In the second half of the day, market direction will be shaped by interviews with FOMC members Philip N. Jefferson and Patrick T. Harker. The Richmond Fed Manufacturing Index will also be released, but only strong data are likely to spark a more significant correction in GBP/USD—something I plan to capitalize on.

If the pair declines, I'll act after a false breakout around the same 1.3363 support level, which has already proven reliable. This will provide a good entry point for long positions with a target of retesting resistance at 1.3416—a level that previously proved difficult to break. Only a breakout and retest of this range from above will provide a new long entry point with the prospect of reaching 1.3462, reinforcing the bullish market. The ultimate target is the 1.3510 area, where I plan to take profit.

If GBP/USD falls and buyers show no interest at 1.3363, pressure on the pair will increase. In this case, only a false breakout around 1.3304 will justify long positions. If no rebound is seen there, I will look to buy from 1.3245 for an intraday correction of 30–35 points.

To open short positions on GBP/USD:

Sellers made their presence known around 1.3416 and are now targeting 1.3363. Only a hawkish stance from Fed officials could help push the pair below this level. If the pound rises again in the second half of the day, I plan to act around the same resistance at 1.3416. A false breakout there would provide an entry point for selling, aiming for a decline to support at 1.3363, which is currently being contested. A breakout and retest of this range from below will trigger stop-loss orders and pave the way to 1.3304. The ultimate target is 1.3245, where I will take profit.

If pound demand returns later in the day and bears fail to act around 1.3416, I will postpone shorts until a test of resistance at 1.3462. I'll open short positions there only on a false breakout. If there's no pullback there either, I'll look to short from 1.3510, aiming for a 30–35 point intraday correction.

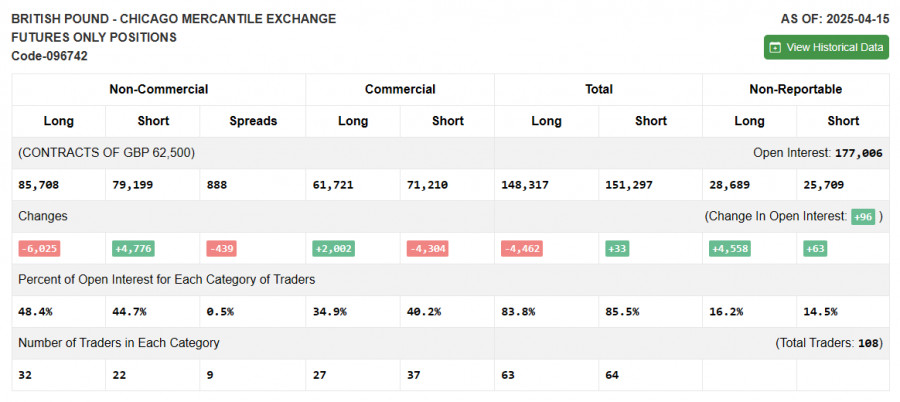

COT Report (Commitment of Traders) – April 15:

The report showed a rise in short positions and a decline in long ones. Interestingly, the pound has continued to grow confidently against the dollar, even with these numbers. However, it's important to understand that this data lags and the recent GBP/USD surge is directly tied to Trump's tariff stance and dissatisfaction with Fed Chair Jerome Powell. These factors weigh more on the dollar than they support the pound. Long non-commercial positions fell by 6,025 to 85,708 and short non-commercial positions increased by 4,776 to 79,199. The net position narrowed by 439.

Indicator Signals:

Moving Averages: Trading is occurring above the 30- and 50-period moving averages, signaling the continuation of the pair's upward trend.

Note: The moving average periods and prices are based on the H1 chart as used by the author, and may differ from the classical daily moving averages on the D1 timeframe.

Bollinger Bands: In case of a decline, the lower band near 1.3363 will act as support.

Indicator Descriptions:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Monday's Trades 1H Chart of GBP/USD On Monday, the GBP/USD pair rose by 130 pips. Such was the "boring Monday" without a macroeconomic report or important speech

Analysis of Monday's Trades 1H Chart of EUR/USD On Monday, the EUR/USD currency pair showed somewhat mixed movements, no matter how you look. On the one hand, the pair demonstrated

On Monday, the GBP/USD currency pair once again traded higher despite having no fundamental reasons. However, by now, all traders should be accustomed to such developments. While the euro tends

On Monday, the EUR/USD currency pair showed a decent upward movement during the day but remained within the narrow sideways channel of 1.1312–1.1414 (Kijun-sen line). Recall that the euro

In my morning forecast, I focused on the 1.1391 level and planned to make trading decisions from there. Let's look at the 5-minute chart and see what happened. Although there

Analysis of Friday's Trades 1H Chart of GBP/USD The GBP/USD pair also showed no interesting movements on Friday. Like the euro, the British pound remained very close to a flat

Analysis of Friday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued to trade sideways on Friday. The market continues to ignore all macroeconomic data, and last week once

The GBP/USD currency pair continued sideways trading on Friday, holding near three-year highs. The fact that the British pound refuses even a slight downward correction shows the market's disbelief

The EUR/USD currency pair continued trading sideways throughout Friday. In the second half of last week, the euro traded exclusively between the levels of 1.1321 and 1.1391, although the overall

InstaTrade video

analytics

Daily analytical reviews

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.