See also

22.04.2025 07:46 AM

22.04.2025 07:46 AMAfter a sharp rise during the Asian session, the euro and the pound grew through the European trading hours. However, by the mid-U.S. session, demand for risk assets declined, leading to a slight correction and strengthening of the U.S. dollar.

Yesterday's comments from Federal Reserve officials offered modest support to the dollar but didn't significantly impact the EUR/USD technical picture or shift the balance of power. The euro still has a chance to continue its upward movement, as does the British pound, but this requires strong economic data—which is again absent today. The market still sees weakness in the U.S. economy due to trade tariffs and expects the Fed to be forced to ease policy earlier than anticipated. In addition to this, there is ongoing pressure from Donald Trump on Powell, and the central bank may soon shift its tone, which would not benefit the dollar.

Financial markets are expected to be relatively calm today. Aside from the Eurozone consumer confidence index release and a scheduled meeting of International Monetary Fund (IMF) representatives, no significant macroeconomic events are forecast. This will significantly limit volatility and the potential for significant market movements.

Yesterday's new yearly high in EUR/USD established a base for optimistic sentiment, but the lack of catalysts for further growth makes a breakout of this level unlikely under current conditions.

If the data aligns with economists' expectations, following a Mean Reversion strategy is best. A Momentum strategy will be more appropriate if the data significantly exceeds or falls short of expectations.

Buy on breakout of 1.1555, targeting 1.1590 and 1.1625.

Sell on breakout of 1.1500, targeting 1.1465 and 1.1400.

Buy on breakout of 1.3420, targeting 1.3465 and 1.3510.

Sell on breakout of 1.3380, targeting 1.3335 and 1.3285.

Buy on breakout of 140.44, targeting 140.90 and 141.35.

Sell on breakout of 140.00, targeting 139.70 and 139.20.

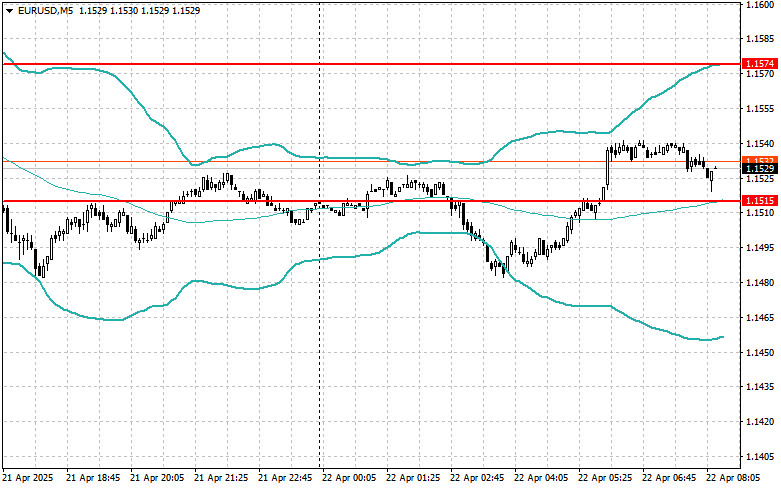

Sell after a failed breakout above 1.1574, on return below the level.

Buy after a failed breakout below 1.1515, on return to this level.

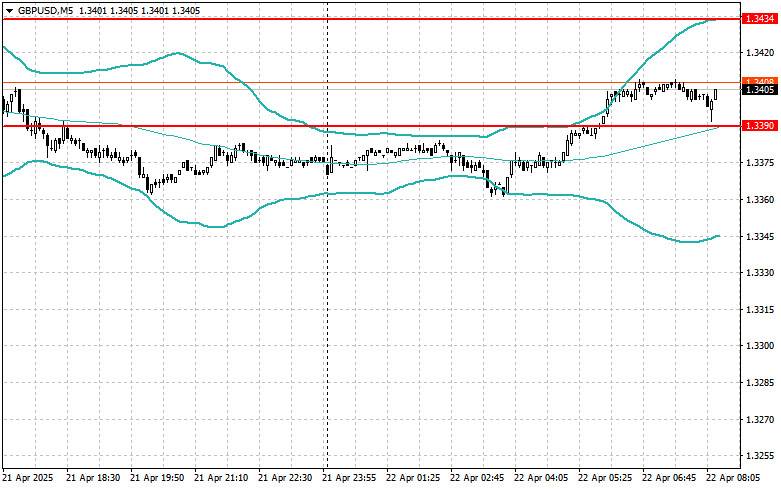

Sell after a failed breakout above 1.3434, on return below the level.

Buy after a failed breakout below 1.3390, on return to this level.

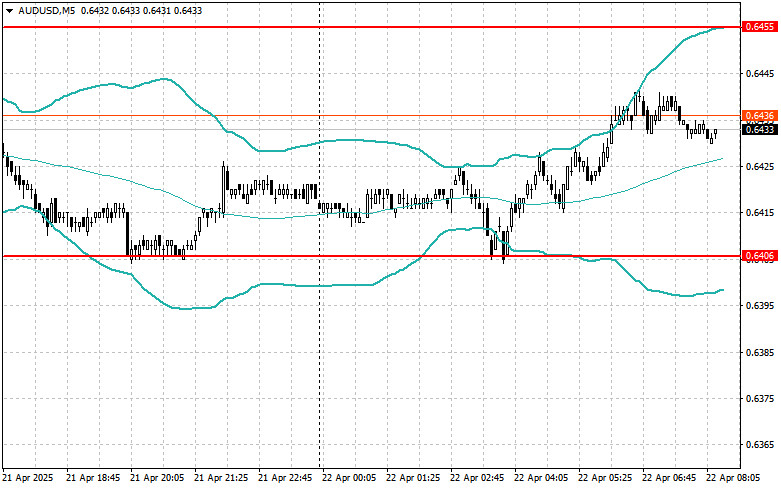

Sell after a failed breakout above 0.6455, on return below the level.

Buy after a failed breakout below 0.6406, on return to this level.

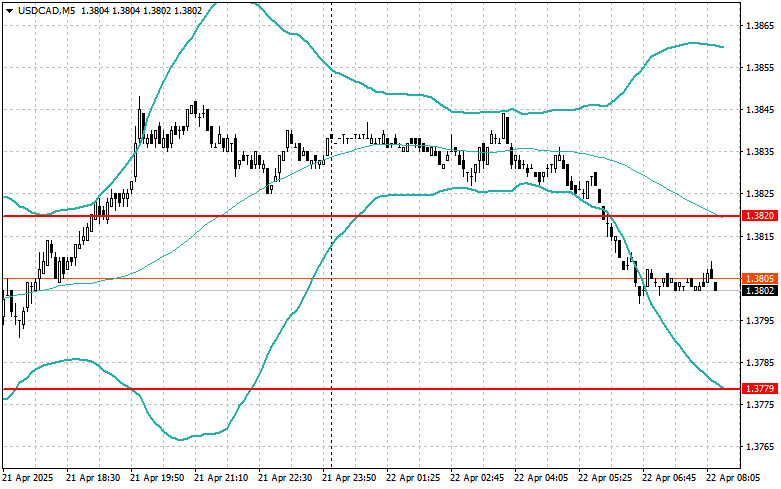

Sell after a failed breakout above 1.3820, on return below the level.

Buy after a failed breakout below 1.3779, on return to this level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The test of the 143.21 price level coincided with the MACD indicator just beginning to move downward from the zero line, confirming a correct entry point for selling the dollar

The test of the 1.3352 price level occurred when the MACD indicator had already moved significantly above the zero line, limiting the pair's upside potential. For this reason

The price test at 143.75 occurred when the MACD indicator had already moved significantly above the zero line, which, in my view, limited the pair's upside potential. For this reason

The price test at 1.3317 occurred when the MACD indicator moved significantly above the zero line, limiting the pair's upward potential. For this reason, I did not buy the pound

The first test of the 1.1340 price level in the second half of the day coincided with the moment when the MACD indicator had already moved significantly below the zero

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.