See also

22.04.2025 07:46 AM

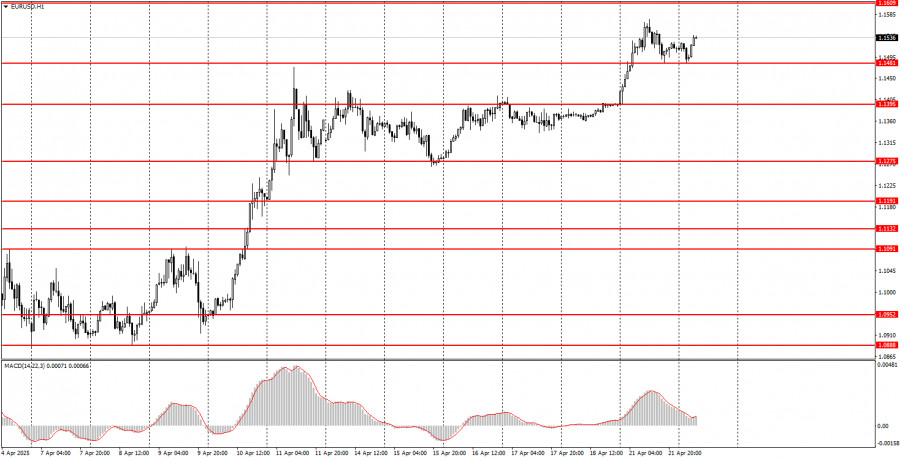

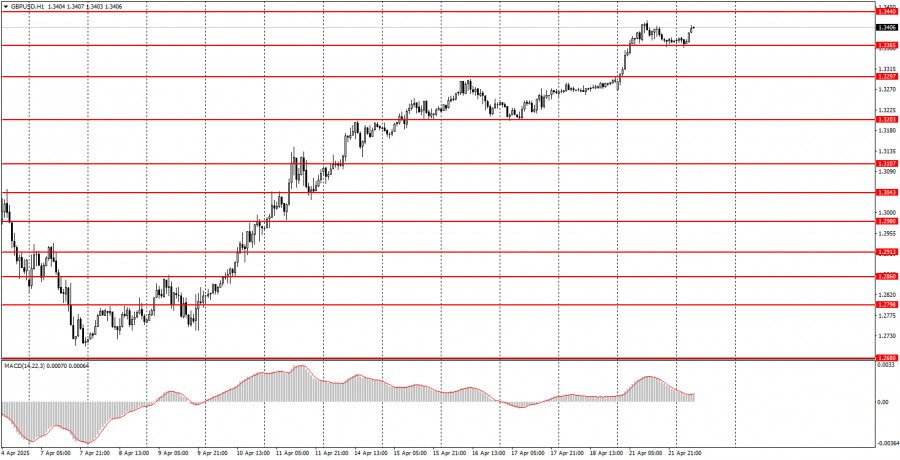

22.04.2025 07:46 AMNo macroeconomic events are scheduled for Tuesday—neither in the U.S., the Eurozone, Germany, nor the U.K. Thus, even if the market were paying any attention to macroeconomic data, it simply isn't available today. The market continues to trade solely on the "Trump factor." Moreover, Monday showed that the dollar can experience a significant drop even in the absence of news from the White House. We wouldn't be surprised if the U.S. currency continues its decline today.

There's no point in discussing any fundamental developments apart from Trump's trade war. The dollar's decline can continue indefinitely if Trump keeps imposing new or increasing existing tariffs. We advise traders to monitor statements by top officials of major countries and alliances regarding tariffs. Any escalation could lead to another drop in the dollar. Any signs of de-escalation—though currently absent—would support the greenback. However, the dollar may continue falling even without fresh headlines.

Last week, Donald Trump announced plans to impose tariffs on semiconductors, affecting many countries globally. The trade conflict with China remains unresolved and carries the most weight in the market's eyes. Trump is also once again pressuring the Federal Reserve to cut interest rates and has even threatened to fire Jerome Powell, though he lacks the authority to do so. The market continues to respond to Trump's actions in a clear-cut way—by selling the dollar.

Both currency pairs could move in any direction during the second trading day of the week. As we can see, the British pound continues to rise steadily, and the euro followed suit on Monday. Any potential market-moving news today will likely come only from the White House. If there are no updates from Trump, the nature of movement in both currency pairs is unlikely to change. As before, trading should be based solely on technical levels.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important speeches and reports, which are consistently featured in the news calendar, can significantly influence the movement of a currency pair. Therefore, during their release, it is advisable to trade with caution or consider exiting the market to avoid potential sharp price reversals against the prior trend.

Beginners in the Forex market should understand that not every transaction will be profitable. Developing a clear trading strategy and practicing effective money management are crucial for achieving long-term success in trading.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Markets have once again paused amid uncertainty over whether a trade agreement between the U.S. and China will be reached anytime soon. The cloud of uncertainty that Donald Trump

Very few macroeconomic events are scheduled for Tuesday, and none are significant. If we set aside all the tertiary reports, such as the GfK Consumer Confidence Index in Germany

On Monday, the GBP/USD currency pair also traded with low volatility and mainly moved sideways, although the British pound maintained a slight upward bias. Despite the lack of market-relevant news

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.