See also

22.04.2025 07:46 AM

22.04.2025 07:46 AMThe EUR/USD currency pair started Monday with a sharp rally. Overnight, the euro appreciated by 100–120 pips, and the pair traded more calmly during the day. Over the weekend, no events or news could have triggered such a move. Of course, this isn't really about the euro's strength but the U.S. dollar's continued weakness. But who's surprised anymore by the dollar falling? Trump's position remains unchanged: either pay the U.S. more money or face tariffs, sanctions, etc. So on Monday, there wasn't a clear reason to sell the dollar, but overall, the market continues to shed U.S. currency.

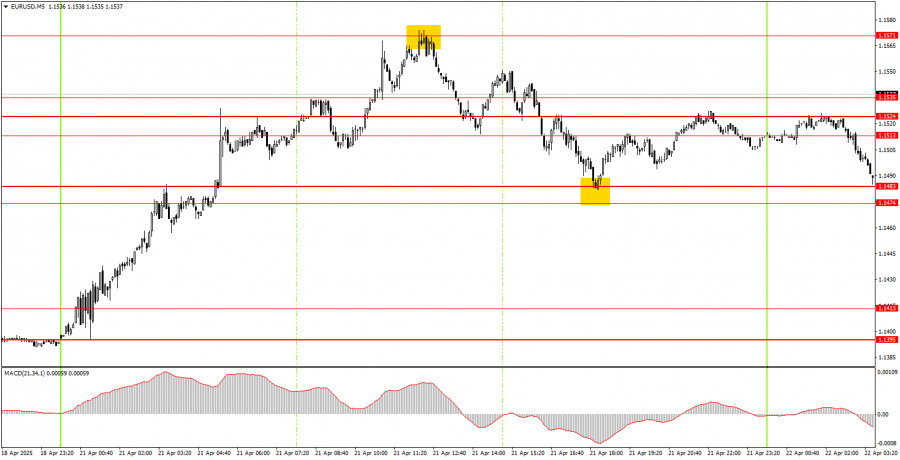

On the 5-minute timeframe Monday, quite a few trading signals were formed, but the main movement occurred during the Asian trading session. Technically, buy trades could have been opened even overnight, as the price rebounded from the 1.1395–1.1413 area. Later in the day, there was a good and precise bounce from the 1.1571 level and another from the 1.1474–1.1481 area. Opening trades within the 1.1513–1.1535 zone didn't make sense, as it was too narrow and acted as a solid range. Overnight, the price bounced once again from the 1.1474–1.1481 area, offering novice traders another opportunity to go long—if they trade during the night.

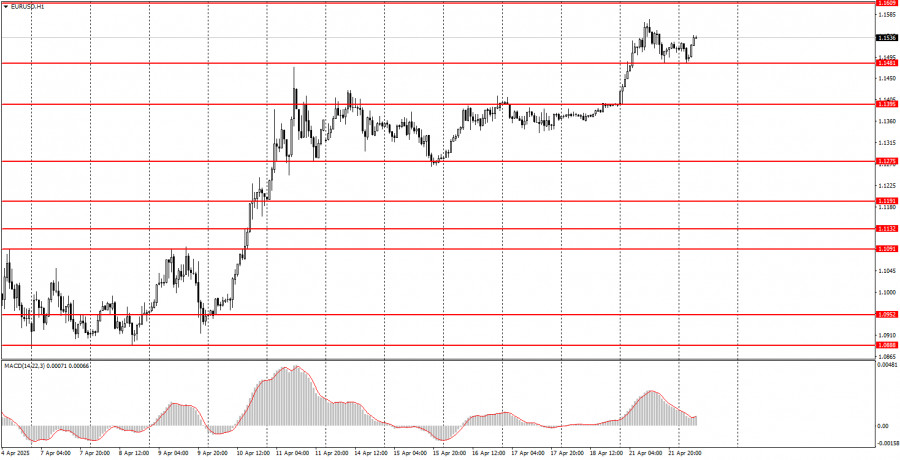

On the hourly timeframe, the EUR/USD pair continues its uptrend. After spending a week in consolidation, the new week began with a fresh surge. The upward movement is expected to continue as long as Trump keeps introducing and raising import tariffs. The market is not interested in anything other than the Global Trade War. When new tariffs are introduced, the dollar falls. When there aren't any, the market stalls—just like last week.

On Tuesday, the pair may continue upward as the market no longer needs new tariff headlines or escalations. As we warned earlier, the price can "spike" anytime.

On the 5-minute timeframe, consider the following trading levels: 1.0940–1.0952, 1.1011, 1.1091, 1.1132–1.1140, 1.1189–1.1191, 1.1275–1.1292, 1.1330, 1.1395–1.1413, 1.1474–1.1481, 1.1513–1.1535, 1.1571, 1.1607–1.1622, 1.1666, 1.1689. No macroeconomic or fundamental events are scheduled for Tuesday, but Monday already showed us that the market may continue selling off the dollar even without any news.

Support and Resistance Levels: These are target levels for opening or closing positions and can also serve as points for placing Take Profit orders.

Red Lines: Channels or trendlines indicating the current trend and the preferred direction for trading.

MACD Indicator (14,22,3): A histogram and signal line used as a supplementary source of trading signals.

Important Events and Reports: Found in the economic calendar, these can heavily influence price movements. Exercise caution or exit the market during their release to avoid sharp reversals.

Forex trading beginners should remember that not every trade will be profitable. Developing a clear strategy and practicing proper money management are essential for long-term trading success.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Monday's Trades 1H Chart of GBP/USD On Monday, the GBP/USD pair rose by 130 pips. Such was the "boring Monday" without a macroeconomic report or important speech

Analysis of Monday's Trades 1H Chart of EUR/USD On Monday, the EUR/USD currency pair showed somewhat mixed movements, no matter how you look. On the one hand, the pair demonstrated

On Monday, the GBP/USD currency pair once again traded higher despite having no fundamental reasons. However, by now, all traders should be accustomed to such developments. While the euro tends

On Monday, the EUR/USD currency pair showed a decent upward movement during the day but remained within the narrow sideways channel of 1.1312–1.1414 (Kijun-sen line). Recall that the euro

In my morning forecast, I focused on the 1.1391 level and planned to make trading decisions from there. Let's look at the 5-minute chart and see what happened. Although there

Analysis of Friday's Trades 1H Chart of GBP/USD The GBP/USD pair also showed no interesting movements on Friday. Like the euro, the British pound remained very close to a flat

Analysis of Friday's Trades 1H Chart of EUR/USD The EUR/USD currency pair continued to trade sideways on Friday. The market continues to ignore all macroeconomic data, and last week once

The GBP/USD currency pair continued sideways trading on Friday, holding near three-year highs. The fact that the British pound refuses even a slight downward correction shows the market's disbelief

The EUR/USD currency pair continued trading sideways throughout Friday. In the second half of last week, the euro traded exclusively between the levels of 1.1321 and 1.1391, although the overall

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.