See also

21.04.2025 07:46 PM

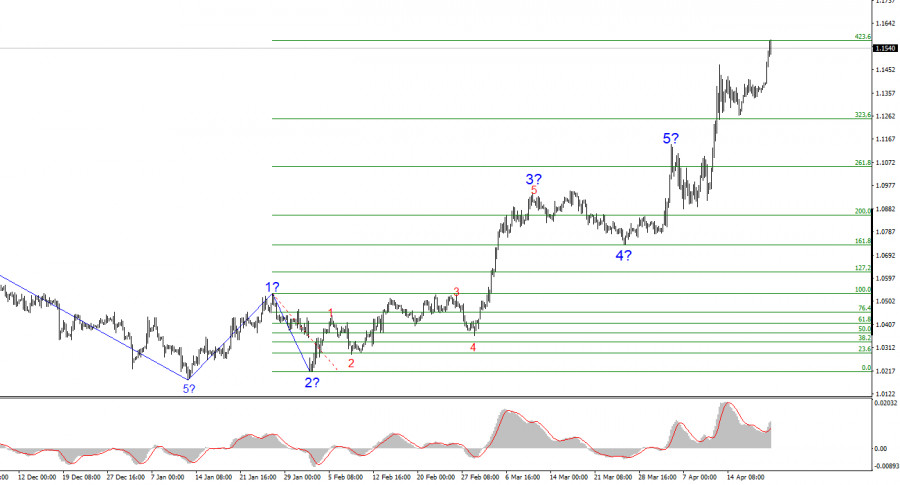

21.04.2025 07:46 PMThe wave structure on the 4-hour chart for EUR/USD has transformed into a bullish formation. I believe there's little doubt that this transformation occurred solely due to the new U.S. trade policy. Prior to February 28, when the sharp decline of the U.S. dollar began, the entire wave layout looked like a solid downward trend. Wave 2 of a corrective structure was forming. However, Donald Trump's weekly announcements of various tariffs did their job. Demand for the U.S. dollar began to plummet, and now the entire trend segment, which started back on January 13, has taken on a five-wave impulsive structure.

Moreover, the market failed to even build a convincing Wave 2 within the new upward trend. We only saw a minor pullback—smaller than the corrective waves within Wave 1. However, the U.S. dollar may continue to decline unless Donald Trump completely reverses his trade policy. We've already seen one instance where the news cycle changed the wave structure—another such shift remains entirely possible.

The EUR/USD pair rose by 130 basis points on Monday—without any news, right after the holidays, and without new tariffs from Donald Trump. Finding a specific reason for Monday's decline in demand for the U.S. dollar is virtually impossible. Most likely, today's dollar drop can be seen as part of the ongoing devaluation of the American currency. In simpler terms, the market began selling off the U.S. dollar 2–3 months ago, and Monday was simply a continuation of that trend.

Before Trump took office, analyzing price movements was more complex. You had to consider a wide range of news and economic data, correlate them with various forms of technical analysis, and then draw conclusions. Now, it's simpler: the U.S. dollar consistently declines, and any new speech by Trump in which he threatens anyone becomes another reason for market participants to reduce demand for the dollar. Statements from the U.S. president about a "bright future," negotiations, tariff freezes, or grace periods bring no positive change for the dollar. The market doesn't believe in any of it.

Positive changes don't come after a declaration of war—even a trade war. Therefore, the market is convinced that the U.S. economy faces nothing good in the near term, which explains the ongoing weakness of the U.S. currency.

Based on the conducted EUR/USD analysis, I conclude that the instrument continues to form a new upward wave trend. Donald Trump's actions have reversed the previous bearish trend. Therefore, the wave pattern in the near term will depend entirely on the stance and actions of the U.S. president. This must be constantly kept in mind. Based purely on wave structure, I expected three corrective waves in Wave 2. However, Wave 2 has already ended, having taken the form of a single wave. This means the formation of Wave 3 in the bullish trend is now underway. Its targets could reach as high as the 1.25 area, but achieving those levels will depend entirely on Trump.

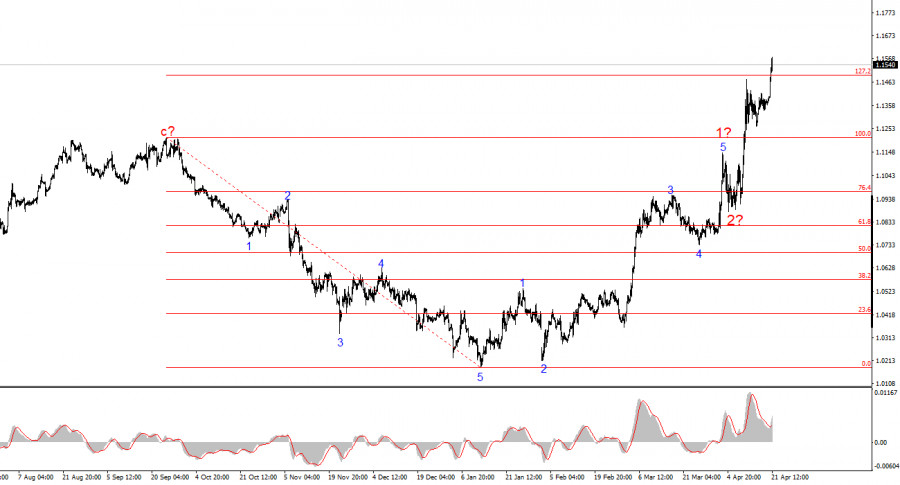

On a higher time frame, the wave structure has also shifted to a bullish formation. A long-term upward wave sequence is likely, though Trump-related news could once again turn everything upside down.

Key Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.