See also

21.04.2025 11:57 AM

21.04.2025 11:57 AMAt the close of the previous regular session, U.S. stock indices ended mixed. The S&P 500 gained 0.13%, while the Nasdaq 100 slipped 0.13%. The industrial Dow Jones dropped 1.33%.

The U.S. dollar fell to its lowest levels since the beginning of 2024, while futures for major U.S. stock indices declined. This movement was triggered by criticism of the Federal Reserve by President Donald Trump, raising concerns about the central bank's independence. After National Economic Council Director Kevin Hassett stated that Trump was considering the possible dismissal of Fed Chair Jerome Powell, the dollar weakened against all major currencies, reigniting pressure on U.S. stock index futures during the Asian session.

Data shows that these comments prompted hedge funds to actively sell the dollar on Monday. Gold, which typically has an inverse correlation with the dollar, reached record highs. Treasury bonds fell in value, while the yen strengthened.

At the end of last week, frustrated by the central bank's refusal to cut interest rates, Trump voiced his displeasure on social media, saying Powell's dismissal couldn't come fast enough—though he didn't rule it out. These attacks on the Fed not only undermine the principle of central bank independence but also pose a risk of politicizing U.S. monetary policy, which could raise serious concerns in the markets. However, it's worth recalling that similar statements were made during Trump's first term, also directed at Powell, but no actual dismissal occurred.

That said, the current situation is somewhat different. Inflation in the U.S. is decreasing, but interest rates are not. Moreover, economic data point to a possible recession, creating a challenging environment for the Fed. On one hand, it must continue tightening monetary policy to combat inflation, which may rise again soon due to Trump's new tariffs. On the other hand, it must also consider the risks to economic growth.

Such pressure from the U.S. president could undermine the Fed's independence, which in the long run may negatively affect the stability of the financial system. If Powell were to be dismissed, it could cause serious turbulence in financial markets. Investors would fear uncertainty regarding future monetary policy and might react negatively to a change in the Fed's leadership. Additionally, this could erode overall confidence in the U.S. economy.

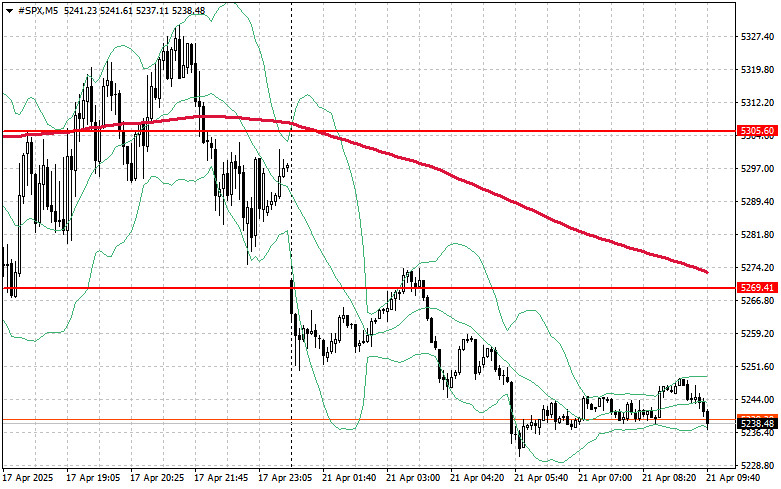

As for the technical picture of the S&P 500: Buyers' main objective today will be to overcome the nearest resistance at $5269. Achieving this would support further growth and pave the way for a breakout to a new level at $5305. Equally important for the bulls will be maintaining control over $5342, which would further strengthen their position. If the index moves lower amid waning risk appetite, buyers will need to step in around $5226. A breakdown of this level would quickly push the instrument back to $5164 and open the path toward $5084.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Ferrari F8 TRIBUTO

from InstaTrade

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.