See also

18.04.2025 09:00 AM

18.04.2025 09:00 AMToday is Good Friday, a day Christians observe worldwide across all denominations. Market activity has noticeably decreased ahead of the Easter holiday, but this isn't the main reason for market participants' current behavior. Let's take a closer look.

The main theme of the trade war has gradually shifted to mutual demands and threats between China and the United States. In essence, the two sides have reached a stalemate. Neither is willing to make concessions, but it seems they will eventually have to seek a compromise. Investors know this, which explains the wait-and-see stance dominating the markets.

Market sentiment has turned mixed by the end of the week, with trade negotiations remaining in focus. Trump announced "major progress" in trade talks with Japan, reaffirming his desire to strike a deal with China. Concerns about tariffs and fresh critical comments from the U.S. president toward Federal Reserve Chair Jerome Powell—including calls for rate cuts—have only added more uncertainty. On one hand, market participants understand that neither Beijing nor Washington wants to damage their national economies. On the other hand, tensions haven't yet reached their peak. Once a mutually acceptable agreement is reached, strong (and likely positive) market movements should follow.

So why have markets practically frozen?

The answer is straightforward: markets are likely anticipating a trade agreement between the U.S. and China rather than the start of a full-scale conflict. And that agreement could materialize once both parties have finished showcasing their "strength." In this scenario, aggressively pushing asset prices lower is risky—short positions could turn into significant losses. But given the current uncertainty and the unresolved nature of the confrontation, it's also too early and risky to buy. Still, I believe some participants are already quietly accumulating stocks and commodity assets, hoping for a near-term market reversal. In my view, this is a reasonable and justified strategy.

What can we expect today in the markets?

Low activity is likely to persist ahead of Easter. As reflected in the ICE index, the U.S. dollar is expected to consolidate slightly above the 99.00 mark. Major cryptocurrencies are likely to continue trading within narrow, sideways ranges. Gold's rally may pause due to the high likelihood of a U.S.-China agreement—which, if announced, would likely cause gold prices to drop below the $3000 per ounce level. Crude oil, which has seen significant gains amid tensions surrounding Iran, could extend its rally, though that may not happen until the start of next week.

Overall, I remain optimistic about the market outlook. A swift U.S.-China compromise would dramatically shift the landscape across global markets.

The token is consolidating within the 83,024.25–86,045.15 range. A downward correction to the lower boundary is possible, offering a potential buying opportunity with a target rebound toward 86,045.15. The entry level to consider for buying is around 83,201.95.

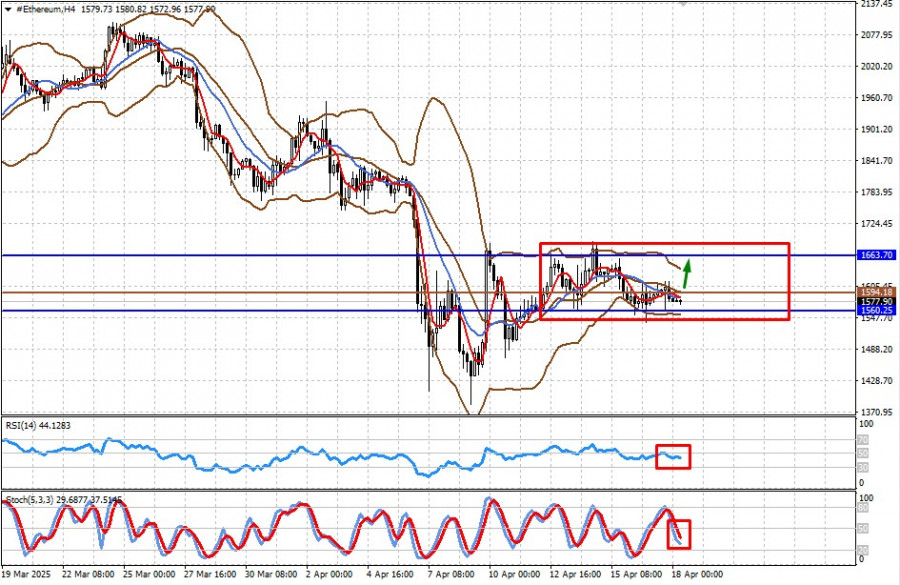

Ethereum is also consolidating within the 1,560.25–1,663.70 range. It may rise toward the upper boundary of this range. 1,594.18 is a potential buy level to watch.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

There are relatively few macroeconomic events scheduled for Thursday, but that no longer matters much. Yesterday, there were plenty of important publications from the Eurozone, Germany, and the U.S. Even

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.