See also

18.04.2025 06:52 AM

18.04.2025 06:52 AMEuro and Pound Retain All Prerequisites for Further Growth

The single European currency showed virtually no reaction to yesterday's meeting of European Central Bank officials, during which another interest rate cut was announced. In her speech, ECB President Christine Lagarde emphasized that the economic outlook for the eurozone remains uncertain due to the unpredictability of U.S. actions, which threatens slowing GDP growth. For this reason, the meeting participants unanimously supported the decision to cut the rate. Lagarde also noted that while most indicators suggest inflation is nearing the desired 2% target, the impact of the newly introduced tariffs is still difficult to assess.

Today, consolidation is expected, with minor fluctuations within yesterday's range. Traders will likely adopt a wait-and-see approach, anticipating more substantial market drivers. Attention will probably shift toward news from overseas, where trade policy continues to influence global markets.

Overall, the broader market outlook still favors further euro appreciation. On one hand, the ECB's rate cut should have put pressure on the euro, but this did not materialize. On the other hand, concerns over slowing global economic growth limit investor optimism, but this benefits the euro, as increasing attention is now focused on the weakening U.S. dollar, driven by Trump's actions.

Today's trade balance figures from Italy are unlikely to have any meaningful impact.

The Mean Reversion strategy is preferred if the data matches economists' expectations. If the data significantly exceeds or falls short of expectations, the Momentum strategy is the most effective approach.

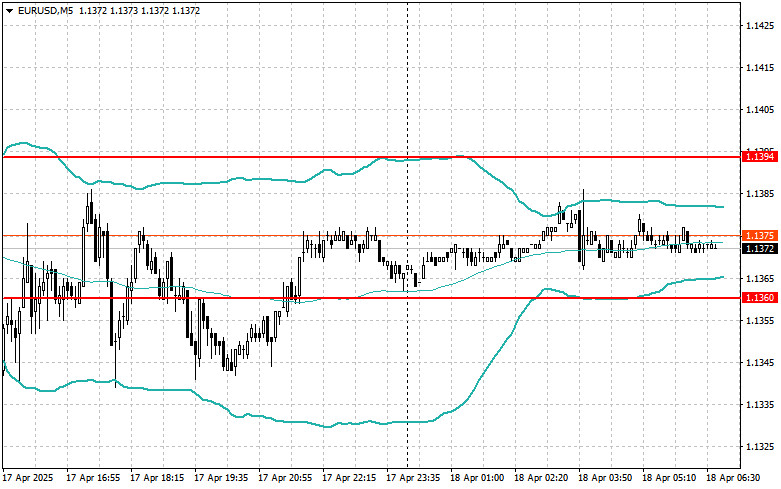

Longs on a breakout above 1.1405 may lead to growth toward 1.1467 and 1.1525.

Shorts on a breakout below 1.1340 may lead to a decline toward 1.1265 and 1.1200.

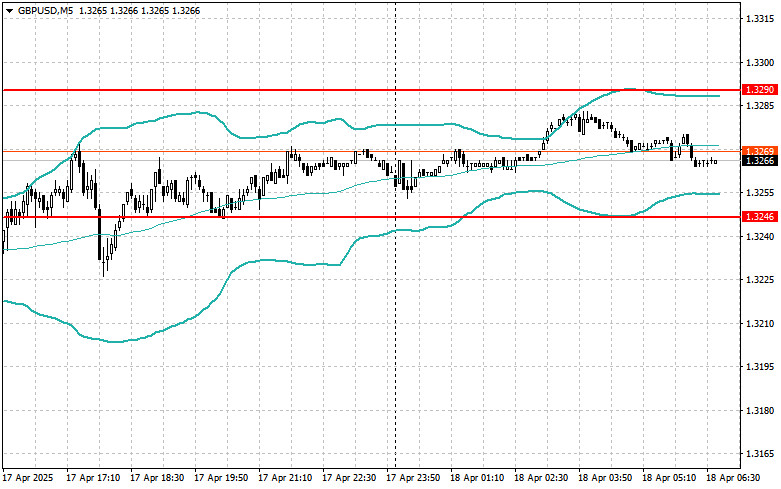

Longs on a breakout above 1.3285 may push the pound toward 1.3335 and 1.3380.

Shorts on a breakout below 1.3245 may push it down toward 1.3205 and 1.3165.

Longs on a breakout above 142.50 may target 143.00 and 143.40.

Shorts on a breakout below 142.20 may lead to a selloff toward 141.80 and 141.35.

Look to sell after a failed breakout above 1.1394 with a return below this level.

Look to buy after a failed breakout below 1.1360 with a return back above this level.

Look to sell after a failed breakout above 1.3290 with a return below this level.

Look to buy after a failed breakout below 1.3246 with a return back above this level.

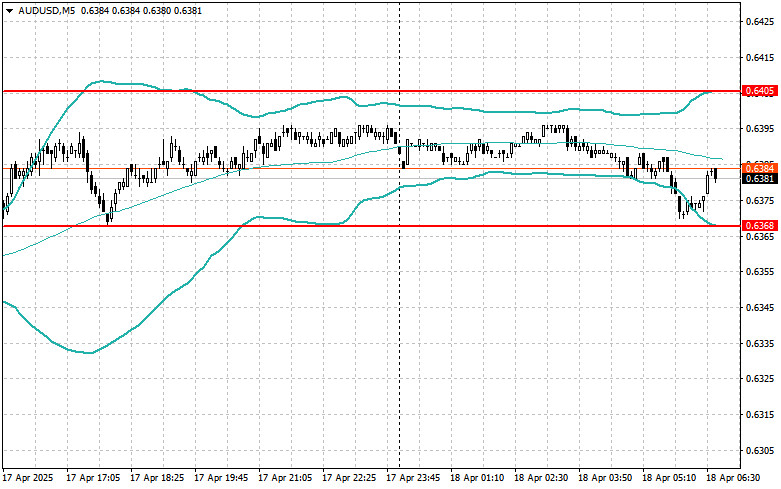

Look to sell after a failed breakout above 0.6405 with a return below this level.

Look to buy after a failed breakout below 0.6368 with a return back above this level.

Look to sell after a failed breakout above 1.3866 with a return below this level.

Look to buy after a failed breakout below 1.3826 with a return back above this level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The test of the 144.79 level occurred at a time when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential. Therefore

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.