See also

17.04.2025 07:12 PM

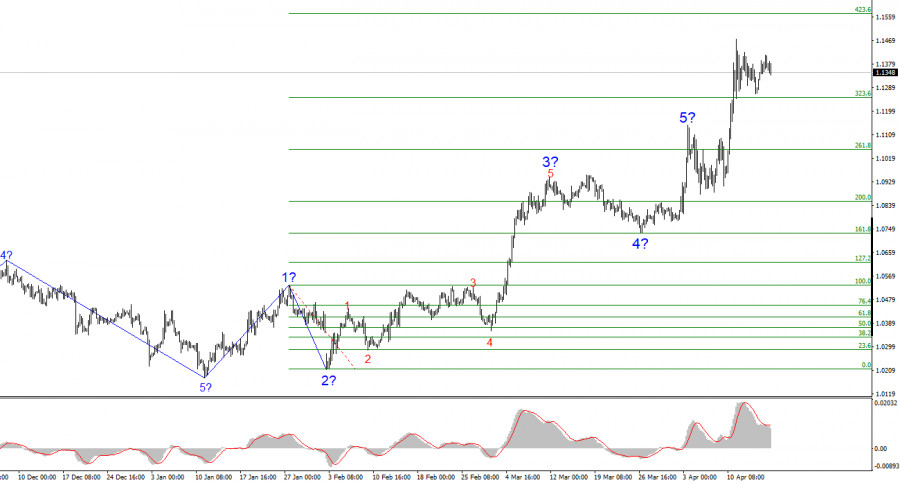

17.04.2025 07:12 PMThe wave structure on the 4-hour EUR/USD chart has shifted into a bullish impulse formation. I believe there's no doubt this transformation occurred solely due to the new U.S. trade policy. Until February 28, when the U.S. dollar began a steep decline, the entire wave structure reflected a convincing bearish trend. A corrective wave 2 was in progress. However, weekly announcements by Donald Trump regarding various tariffs had their effect. Demand for the U.S. dollar dropped rapidly, and now the entire trend segment from January 13 has taken the form of a five-wave impulse.

Moreover, the market didn't even manage to form a convincing wave 2 within the new upward trend. We saw only a minor pullback, smaller than the corrective waves within wave 1. However, the U.S. dollar may continue to weaken unless Donald Trump reverses his trade policy 180 degrees. We've already seen how the news backdrop changed the wave structure once — it can happen again.

The EUR/USD pair declined by 40 basis points on Thursday. The decline occurred well before the ECB's meeting results were announced — which was essentially the only significant event of the day. But even a school student could have predicted the outcome. Some analysts speculated that the ECB might pause in April due to uncertainty around trade tariffs and their global economic impact, or due to a potential surge in global inflation. However, the inflation report for the Eurozone published on Wednesday clearly showed that the Consumer Price Index continues to slow. Since it's now just 0.2% above the target and the eurozone economy is still struggling more than growing, the decision to proceed with another round of monetary easing was 100% expected.

Interestingly, the market didn't react to this important event at all. After all, an ECB meeting is not the same as a routine report on retail sales or business activity. The ECB has been easing policy since last summer, but over the past three months, these moves have had no effect on the market. This confirms the most obvious of all facts — the market remains focused only on the Global Trade War instigated by Donald Trump. Just this week, the U.S. president warned of his readiness to impose tariffs on semiconductors and raise tariffs on Chinese imports to 245%. The market expects nothing good and is not willing to increase demand for the U.S. dollar — regardless of the ECB's decisions.

Based on the current EUR/USD analysis, I conclude that the pair continues building a new upward trend segment. Donald Trump's actions have reversed the previous bearish trend. Therefore, in the near future, the wave pattern will depend entirely on the position and actions of the U.S. president — a fact that must be kept in mind at all times. Based solely on wave analysis, I initially expected a three-wave correction as part of wave 2. However, wave 2 has already ended and took the form of a single wave. Thus, wave 3 of the upward trend has begun. Its potential targets may reach as high as the 1.25 area, but that will depend entirely on Trump.

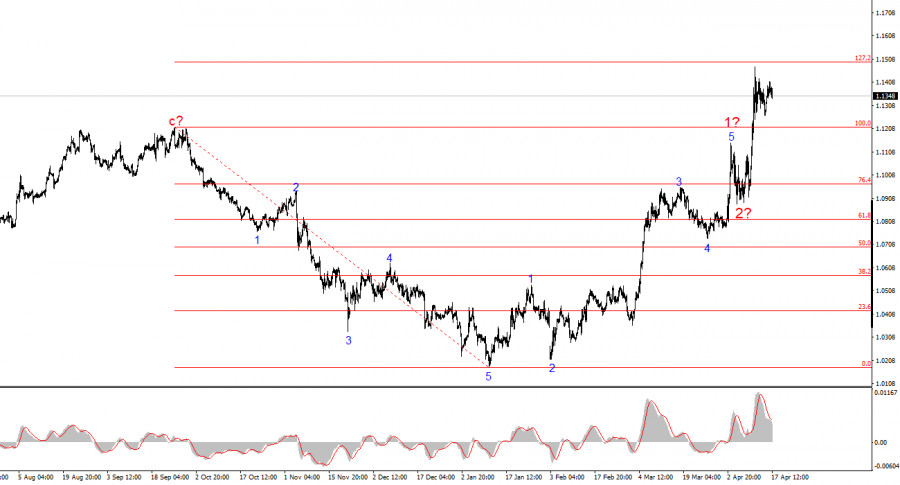

On the higher time frame, the wave structure has also turned bullish. A long-term upward sequence of waves is now likely, though Donald Trump's news flow still has the potential to flip the market upside down again.

Core Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.