See also

17.04.2025 07:09 PM

17.04.2025 07:09 PMThe GBP/USD pair remained unchanged on Thursday. While such market behavior might have been expected for Thursday, it was surprising not to see a decline on Wednesday, given the number of fundamental reasons supporting it.

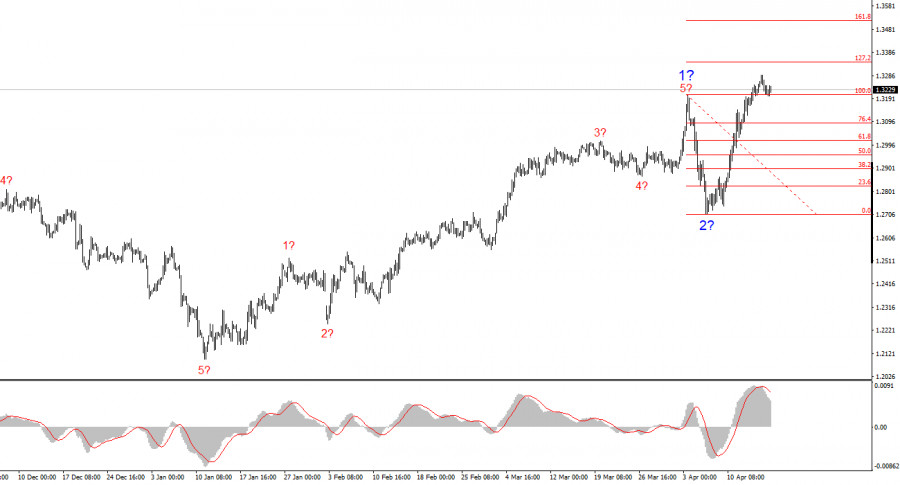

The wave pattern for GBP/USD has also transformed into a bullish, impulsive structure — "thanks" to Donald Trump. The wave picture is nearly identical to that of the EUR/USD pair. Until February 28, a convincing corrective structure had been forming without raising concerns. However, demand for the U.S. dollar then began to drop rapidly. The result was the formation of a five-wave upward structure. Wave 2 took a single-wave form and is now complete. Therefore, we should expect a strong rally in the pound within wave 3, which has already started — and it did so abruptly, without a lengthy build-up.

Considering that the news background from the UK had no effect on the pound's sharp rise, we can conclude that currency rates are being driven solely by Donald Trump. If — theoretically — his trade policy changes direction, the trend could reverse as well. This time, to the downside. That's why in the coming months (and possibly years), close monitoring of the White House's actions is essential.

The GBP/USD pair was flat on Thursday. While this was somewhat expected, there were many reasons to expect a decline on Wednesday. For example, the inflation report from the UK showed a slowdown to 2.6%, which could have been a strong enough reason for a pullback. Likewise, the ECB's rate cut on Thursday could have triggered a decline in the euro. But in both cases, the market chose to ignore the news that clearly suggested selling the euro and the pound — because selling them means buying the dollar. And right now, no one wants the dollar as long as Donald Trump's hand hovers over the red button.

The "red button" refers to new tariffs. The U.S. president loves to talk about this topic. According to him, China is "begging" him to sign a trade deal. At the same time, Trump believes that the U.S. doesn't need a deal — only China does. That's why, in his view, Chinese officials should drop everything and come to the White House with a trade agreement that will satisfy Washington. In contrast, China has stated that Trump's vision is his alone — the objective reality is different. No one from Beijing is rushing to the U.S., let alone offering a deal on clearly unfavorable terms. China's position is simple: if it's war, then so be it. Beijing fully understands that the U.S. will also suffer from the trade conflict. Since there's no fair and honest way to resolve the situation, China will have to resist Trump's protectionist policies.

The wave pattern for GBP/USD has shifted. We are now dealing with a bullish, impulsive segment of the trend. Unfortunately, under Donald Trump, markets may face many more shocks and reversals that won't align with the wave analysis or any technical framework. The supposed wave 2 is complete, as the price has now exceeded the high of wave 1. Therefore, we should expect the formation of wave 3 with near-term targets at 1.3345 and 1.3541, but only if Trump's stance on trade policy doesn't do a 180-degree turn — for which there are currently no signs.

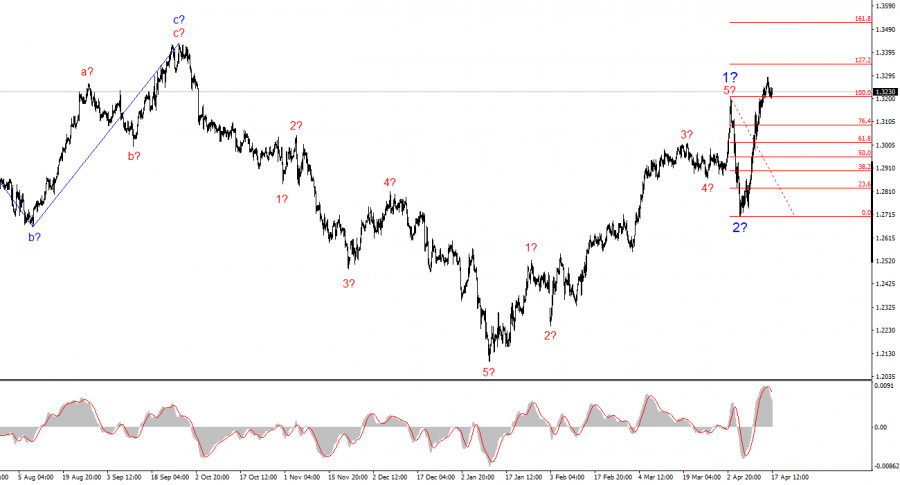

On the higher time frame, the wave picture has also turned bullish. We can now anticipate the development of a longer-term upward trend. The next targets are 1.2782 and 1.2650.

Core Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start

Ferrari F8 TRIBUTO

from InstaTrade

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.