See also

17.04.2025 07:05 PM

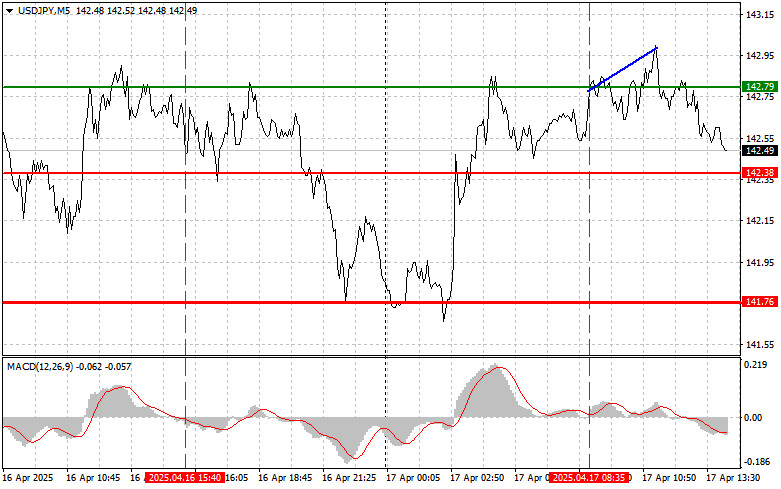

17.04.2025 07:05 PMThe test of the 142.79 level occurred when the MACD indicator had just started moving upward from the zero mark, which confirmed a valid entry point for buying the dollar. As a result, the pair rose by only 15 points.

Today, a number of U.S. economic releases could impact the volatility of the USD/JPY pair. These include initial jobless claims, the Philadelphia Fed Manufacturing Index, building permits, and housing starts. However, a much larger movement may occur if positive news emerges from the ongoing U.S.–Japan trade negotiations, where officials are seeking a deal to reduce tariffs imposed by the U.S. on Japan earlier this year.

The successful conclusion of such an agreement would be a strong signal for the yen, demonstrating the potential for compromise even in the current complex geopolitical climate. Investors weary of uncertainty and trade wars would view this as a sign of stability and predictability—factors that could improve sentiment and influence investment decisions.

For today's intraday strategy, I will focus primarily on implementing Scenarios #1 and #2.

Buy Signal

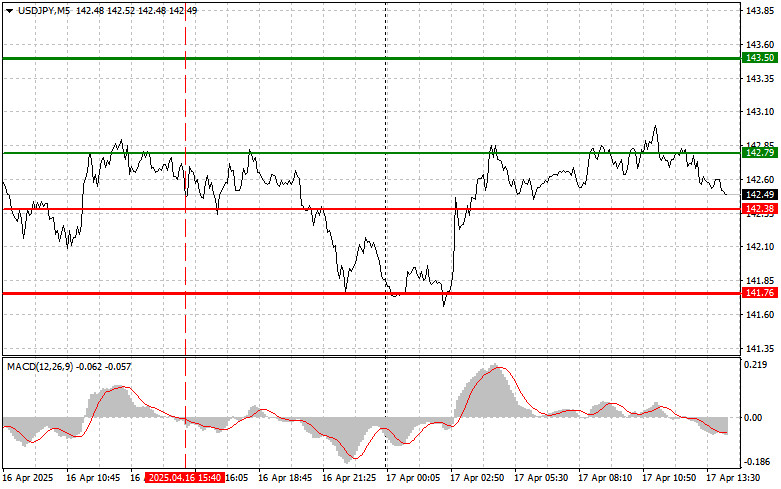

Scenario #1: I plan to buy USD/JPY today when the price reaches 142.79 (thin green line on the chart), with a target of 143.50 (thicker green line). I will exit long positions near 143.50 and open shorts in the opposite direction (targeting a 30–35 point pullback). A continuation of the uptrend is only likely after strong U.S. economic data.Important: Before buying, make sure the MACD indicator is above the zero line and just starting to rise.

Scenario #2: I also plan to buy USD/JPY if the price tests 142.38 twice in a row while the MACD indicator is in oversold territory. This would limit the pair's downside and trigger a bullish reversal. The expected targets are 142.79 and 143.50.

Sell Signal

Scenario #1: I plan to sell USD/JPY today after a drop below 142.38 (thin red line), which could lead to a sharp decline. The key target for sellers is 141.76, where I will exit short positions and consider buying in the opposite direction (anticipating a 20–25 point bounce). Pressure on the pair may return at any moment.Important: Before selling, ensure the MACD indicator is below the zero line and just beginning to decline.

Scenario #2: I also plan to sell USD/JPY in the event of two consecutive tests of the 142.79 level while MACD is in overbought territory. This would cap the pair's upside and trigger a reversal. The expected downside targets are 142.38 and 141.76.

What's on the Chart:

Important for Beginner Traders:

If you're just starting out in Forex, be very cautious with your trade entries. It's best to stay out of the market ahead of important economic reports to avoid getting caught in sudden price swings. If you choose to trade during news releases, always use stop-loss orders to minimize losses. Trading without stops, especially when using large volumes and poor money management, can result in a quick wipeout of your account.

Remember: successful trading requires a clear and structured trading plan—like the one outlined above. Spontaneous decision-making based on short-term price movements is a losing strategy for intraday traders.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The test of the 144.79 level occurred at a time when the MACD indicator had already moved significantly above the zero line, which limited the pair's upside potential. Therefore

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.