See also

17.04.2025 11:49 AM

17.04.2025 11:49 AMGold prices continue to receive support amid the fog of uncertainty surrounding the future course of the tariff wars initiated by Donald Trump.

The price of gold has been climbing almost vertically for four months. The main driver is growing fears that the global economy could collapse under the weight of escalating tensions—primarily the confrontation between Beijing and Washington.

From a technical standpoint, the price of the yellow metal is overbought and could collapse at any moment if news emerges of a trade agreement between the U.S. and China. While there is no clear end in sight to the standoff, given Beijing's firm stance, Trump's maneuvering, and the real risks of economic strain—particularly in the U.S.—it's reasonable to expect negotiations between the two nations to begin eventually.

Technical Setup and Trade Idea:

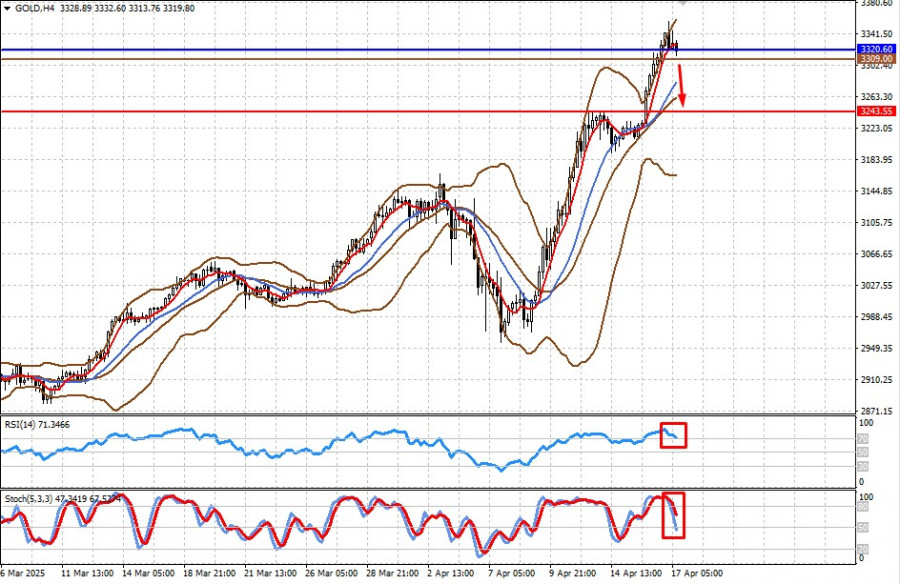

The price is above the middle line of the Bollinger Bands, below the 5-period SMA, but above the 14-period SMA. RSI is turning downward in the overbought zone. The Stochastic indicator has exited the overbought zone and is actively declining, giving a sell signal.

I believe gold prices could drop to 3243.55, which may be a local corrective pullback within the framework of a sustained short-term uptrend. A potential entry point could be considered around the 3309.00 level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Early in the American session, the EUR/USD pair is trading around 1.1378 within the downtrend channel formed on April 17 and showing signs of exhaustion of bullish strength. A technical

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Early in the American session, gold is trading around 3,384, above key support and rebounding after reaching 3,267. Gold is expected to regain strength if it consolidates above 3,381 (6/8

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

With the appearance of Divergent and Descending Broadening Wedge patterns on the 4-hour chart of the AUD/JPY cross currency pair, although its price movement is below the EMA (21) which

On the 4-hour chart of the main currency pair USD/JPY, it can be seen that the Stochastic Oscillator indicator forms a Double Bottom pattern while the price movement of USD/JPY

Early in the American session, gold is trading around the 3,310 level, where it is located at the 21SMA and within a symmetrical triangle pattern formed on April 23. Consolidation

Our trading plan for the coming hours is to sell below 1.1410 with targets at 1.1370 and 1.1230. The eagle indicator is giving a negative signal, so we believe

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.