See also

17.04.2025 11:31 AM

17.04.2025 11:31 AMFollowing the previous regular session, US stock indices closed with a sharp decline. The S&P 500 fell by 2.24%, the Nasdaq 100 dropped by 3.07%, and the Dow Jones Industrial Average lost 1.87%.

However, during today's Asian trading session, stock index futures showed a decent recovery amid rumors of positive outcomes from negotiations between the US and several key trading partners.

Japan's stock indices also posted solid gains after President Donald Trump stated that significant progress had been made in talks toward reaching an agreement with Japan.

Yesterday, financial markets were shaken by statements from Jerome Powell, who emphasized that the central bank must ensure tariffs do not lead to a more sustained rise in inflation. "It is our duty to keep long-term inflation expectations anchored and ensure that a one-time price level increase does not become a persistent inflation problem," Powell said Wednesday at the Economic Club of Chicago. He also noted that policymakers would continue reviewing their dual mandate of promoting full employment and steady prices, bearing in mind that stable prices are essential to achieving strong labor market conditions.

Statements suggesting that interest rates may remain unchanged through the end of the year triggered a broad sell-off in the equity market.

JPMorgan Chase & Co. commented that the Federal Reserve is now framing price stability as a prerequisite for sustainably fulfilling its employment mandate, as the recently announced tariffs earlier this month could end up with significant inflationary pressure in the US.

One of the major uncertainties remains the outcome of negotiations with China, after Beijing indicated it wants to see a series of steps from the Trump administration before agreeing to resume trade talks.

Against this backdrop, gold hit a new all-time high. So far this year, bullion has gained 28%, surpassing the 27% growth recorded for the entire year of 2024. US Treasuries climbed for the third consecutive day on Wednesday, as investors shifted focus to the asset as a risk hedge. Last week, government bonds were sold off amid speculation that hedge funds were unwinding their positions.

As for commodities, oil prices rose for a second day in a row after Washington pledged to cut Iran's energy exports to zero.

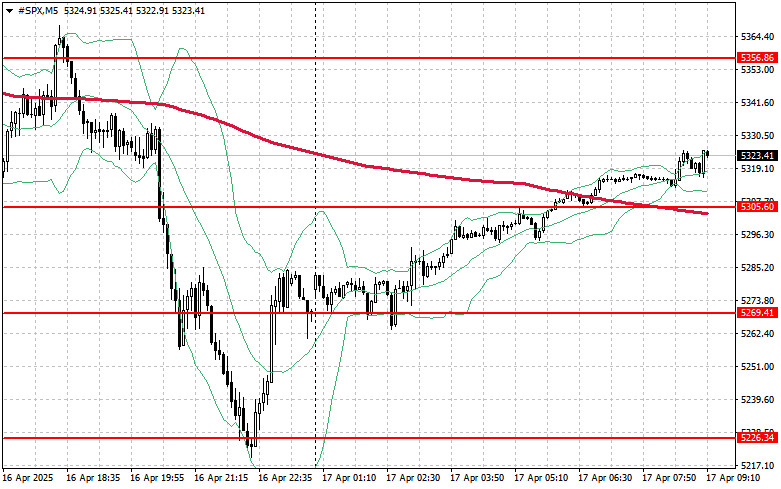

In terms of the S&P 500 technical outlook, the index has declined. The main task for buyers today will be to overcome the nearest resistance at 5,356. A breakthrough would signal growth and open the way toward a push to the next level at 5,399. An equally important task for the bulls will be regaining control over 5,443, which would further reinforce the buyers' positions.

In case of a downward move amid fading risk appetite, buyers will need to gain control over the 5,305 area. A breakdown below this level could quickly push the index back to 5,269 and open the road toward 5,226.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

At the close of the previous regular session, U.S. stock indices ended mixed. The S&P 500 gained 0.13%, while the Nasdaq 100 slipped 0.13%. The industrial Dow Jones dropped 1.33%

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.