See also

16.04.2025 06:53 PM

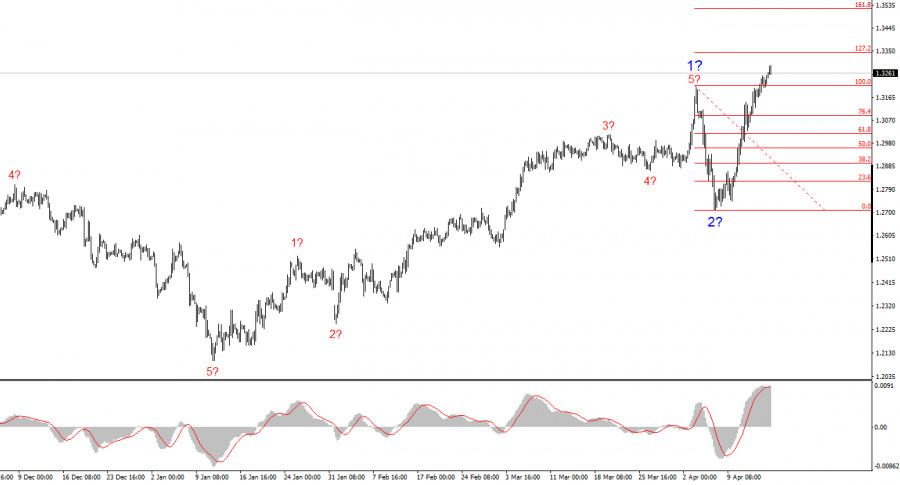

16.04.2025 06:53 PMThe wave structure of the GBP/USD pair has also transformed into a bullish, impulsive formation — "thanks" to Donald Trump. The wave pattern is almost identical to that of EUR/USD. Until February 28, we observed a convincing corrective structure that raised no concerns. However, demand for the U.S. dollar then began to decline rapidly, eventually forming a five-wave bullish structure. Wave 2 took the form of a single wave and is now complete. Accordingly, we can expect a strong rise in the pound within wave 3 — which has already begun, and begun swiftly, without much delay.

If we consider the fact that the news background from the UK has had no impact on the pound's strong rally, we can conclude that it is Donald Trump who is now driving currency markets. If (theoretically) Trump's trade policy changes direction, the trend may reverse — this time to bearish. Therefore, in the coming months (or even years), it will be crucial to closely monitor all actions taken by the White House.

The GBP/USD pair rose by another 30 basis points on Wednesday. The recent gains have been modest but steady. The market isn't rushing into action, yet demand for the pound continues to increase daily. There is no apparent reason for this, even with effort. Many of my readers are used to certain market patterns in analysis and forecasting — but at the moment, almost none of those patterns are working. We're witnessing a rare market situation: not only are movements occurring in one direction (which itself is unusual), but the market's reaction to news is becoming extremely selective.

This morning, the UK released inflation data that turned out weaker than market expectations. Andrew Bailey has previously stoked fears over accelerating inflation in the UK — yet official data shows inflation has once again slowed, now at 2.6% year-on-year. Core inflation also eased to 3.4% y/y, and this likely remains the Bank of England's main concern, as it is still well above the target.

Nevertheless, I would still expect the BoE to consider easing monetary policy at its next meeting. The Bank of England has been in no rush to cut interest rates, but the UK will not be immune to the effects of a global trade war — even if Trump doesn't impose direct tariffs against the country. Thus, the regulator should focus not only on inflation, but also on the economy, just as the ECB has been doing for nearly a year. Demand for the pound could have dropped today, but the market is simply not ready to sell sterling and buy the dollar — it's waiting for Trump's next move in escalating the trade conflict.

The wave pattern of the GBP/USD pair has changed. We are now dealing with a bullish, impulsive segment of the trend. Unfortunately, with Donald Trump in office, the markets may continue to experience shocks and reversals that do not align with wave structures or any kind of technical analysis. The presumed wave 2 is complete, as quotes have surpassed the peak of wave 1. Therefore, we can expect the formation of wave 3 to continue, with the next targets being 1.3345 and 1.3541 — provided Trump's trade policy remains unchanged, which, for now, seems likely.

On a higher wave scale, the pattern has also turned bullish. We may now assume the development of a long-term uptrend. The next targets are 1.2782 and 1.2650.

Core Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.