See also

15.04.2025 12:35 AM

15.04.2025 12:35 AMThis week, the European Central Bank's meeting in April is happening, and the euro is in high spirits. The euro has been doing exceptionally well for at least two months—seemingly without much effort. In other words, if you look solely at the economic data from the Eurozone, I wouldn't predict even a 200-pip rise. Yet, over the past two months, the euro has gained 1000 points—all thanks to the U.S. president.

Under the current circumstances, the only realistic expectation from the ECB is another interest rate cut. Inflation is slowing, and the threat of recession due to Donald Trump's tariffs is growing. Therefore, the ECB can combine the pleasant with the useful. Let me remind you: economic stimulus requires low interest rates, and when inflation is declining, there's no need for high rates. Consequently, the ECB is likely to launch another round of monetary easing. These are not the best possible news for the euro, but it hardly matters in the current environment. The market is ready to invest in any currency — as long as it's not the dollar. Whether the ECB cuts, raises, or leaves rates unchanged, the euro's direction will depend entirely on how the global trade war unfolds.

Trump kicked off the new week with enthusiasm by announcing new tariffs, this time targeting all semiconductors. It's still unclear whether Washington and Beijing are tired of raising tariffs against each other every day. It's also unclear what other all-encompassing tariffs Trump is preparing in addition to those on automobiles, steel, and aluminum. There are enough flashpoints in this trade war to expect more surprises.

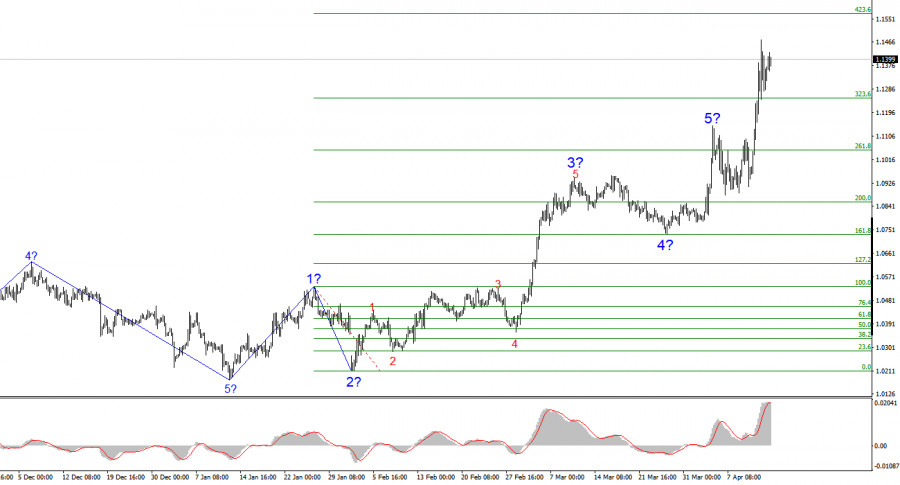

Considering all this, I expect further growth in EUR/USD quotes, even though the current wave count is starting to look unreadable due to the one-sided market movement. Wave 2 in the correction is smaller than the internal corrective waves in Wave 1. And for now, the market isn't showing signs of stopping or ending the dollar sell-off.

Based on the analysis of EUR/USD, the pair continues to build a new bullish trend segment. Trump's actions have reversed the downward trend. Therefore, the wave structure will soon depend entirely on the U.S. president's stance and actions. This must constantly be kept in mind. From a wave perspective, we should now expect the formation of a corrective wave set, which typically consists of three waves. However, Wave 2 may already be complete. If this assumption is correct, Wave 3 of the upward trend has begun, with potential targets reaching the 1.25 area.

The wave picture of GBP/USD has changed. We are now dealing with a bullish, impulsive segment of the trend. Unfortunately, with Trump in office, markets may face countless shocks and reversals that do not align with wave structure or technical analysis. Therefore, at this point, a corrective wave pattern should be expected, the size of which will also depend on Trump. After that, we can anticipate the construction of an upward Wave 3 — but only if Trump's stance on trade policy does not suddenly do a complete 180, which there are currently no signs of.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

On Monday, the United States announced "significant progress" in trade talks with China following a two-day meeting in Switzerland over the weekend. Markets reacted to this news with a gap-up

There are no macroeconomic events scheduled for Monday. Fundamental developments will also be limited, but at this point, it is entirely unclear which factors are influencing price formation. The pound

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.