See also

15.04.2025 12:35 AM

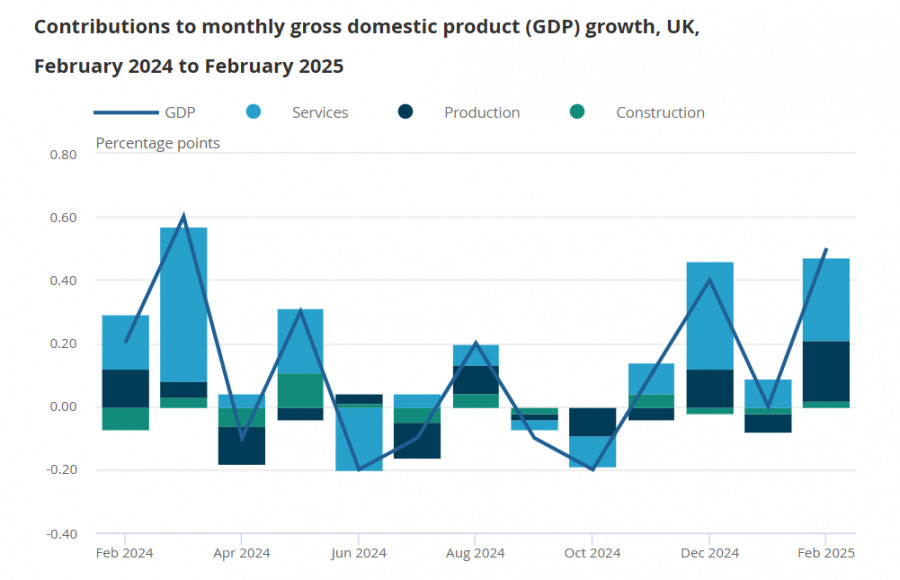

15.04.2025 12:35 AMThe British economy grew by 0.5% in February, rebounding from no growth in January and significantly exceeding the forecast of +0.1%. This was the strongest growth in the last 11 months. Industrial production rose 1.5%, while the quarterly services sector activity index added 0.3%.

This positive momentum was later supported by a forecast from NIESR, which expects continued GDP growth and projects a quarterly figure of +0.6%. While monthly data is not a precise indicator, it contributed to a sharp surge in the pound.

The coming week is no less important—the labor market report is due on Tuesday, followed by the March Consumer Price Index (CPI) on Wednesday. The forecast suggests no change (+3.5% y/y), but surprises are possible, especially since NIESR expects that inflation will not peak until June. Until then, prices are expected to rise due to base effects.

The pound appears strong, but it's important to note that expectations regarding the Federal Reserve's interest rate path have shifted toward a slower pace of cuts. While traders in March were pricing four rate cuts for the year, they now expect only three. Uncertainty remains high, as it's unclear how significant the economic slowdown in the U.S. will be. A potential recession could completely alter interest and currency exchange rates forecasts.

Fed Chair Jerome Powell's key speech is scheduled for Wednesday, and he is unlikely to avoid commenting on the current economic situation. Late last week, Boston Fed President Susan Collins stated that the Fed is "fully prepared" to intervene and stabilize the currency markets using available tools. In light of recent developments, a drop in forex market volatility should not be expected.

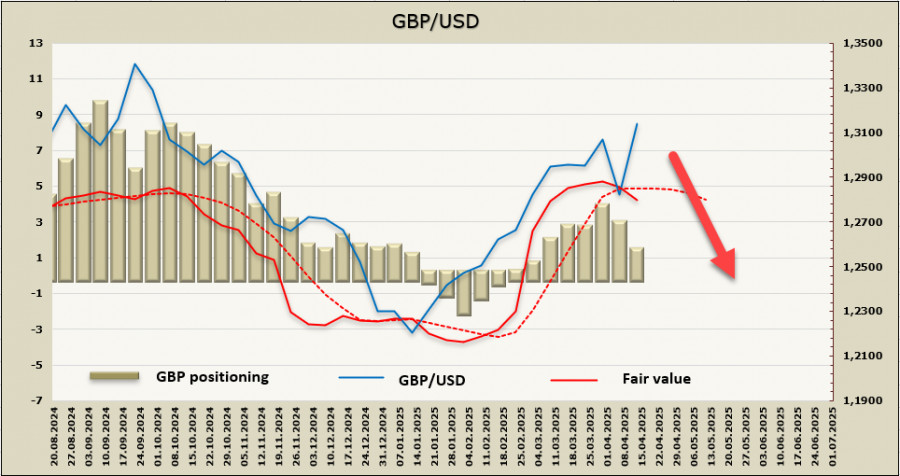

The net long positioning on GBP was halved during the reporting week, going from $2.8 billion to $1.38 billion, and the fair value estimate is moving below the long-term average.

Despite the impressive rally in recent days, the pound has not broken through the upper boundary of the 1.3200 range. The rise has been driven by a surge in optimism following the delay in the trade war and strong GDP and industrial production figures. Although there is strong bullish momentum, we do not expect it to be sustained. A top will likely form near 1.3200, after which the pound may reverse to the downside. We see an opportunity to sell from current levels with a stop just above 1.3200 and a target of 1.3000. The potential for further decline should be supported by increased demand for safe-haven assets and a decrease in market euphoria.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin has broken above the 100,000 mark, entered a consolidation phase, and confirmed the familiar pattern. Previously, after breaking through psychologically significant levels, the cryptocurrency experiences a period of stagnation

On Monday, the United States announced "significant progress" in trade talks with China following a two-day meeting in Switzerland over the weekend. Markets reacted to this news with a gap-up

There are no macroeconomic events scheduled for Monday. Fundamental developments will also be limited, but at this point, it is entirely unclear which factors are influencing price formation. The pound

Graphical patterns

indicator.

Notices things

you never will!

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.