See also

10.04.2025 05:08 AM

10.04.2025 05:08 AMYesterday, U.S. President Donald Trump lowered tariffs to 10% for 90 days for countries that did not retaliate to the initial U.S. tariffs (more than 75 in total). Meanwhile, tariffs on China were raised to 125%. The S&P 500 stock index surged by 9.51%, the U.S. dollar index dipped slightly by 0.08%, and the euro closed with a modest decline after previously forming a 130-point upper shadow during the session.

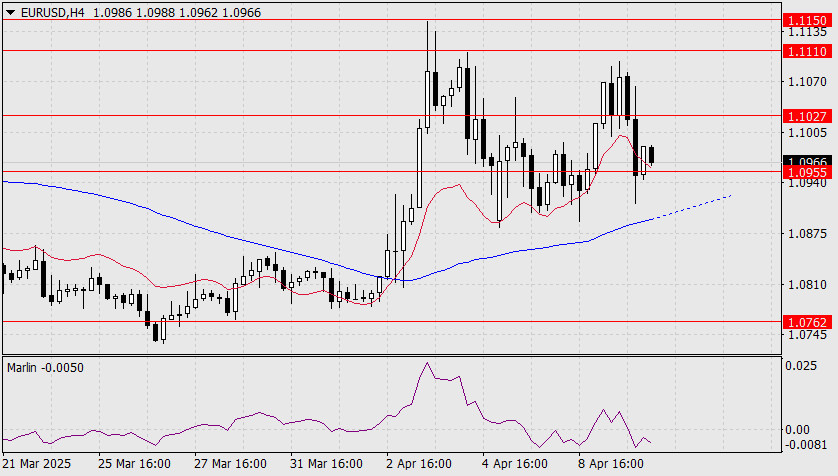

Thursday has begun with renewed growth. After breaking above resistance at 1.1027, we expect the price to move toward the 1.1110/50 range. The Marlin oscillator is slowly turning upward.

On the H4 chart, the price briefly held above 1.1027 but then dipped below support at 1.0955. The bullish sentiment remains intact since there was no sustained close below this level.

We expect another firm move above 1.1027 and further growth toward the mentioned target range.

The Marlin oscillator has weakened and is currently lagging. A consolidation above 1.1027 would help the oscillator recover and support the uptrend.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

On the hourly chart, the GBP/USD pair on Wednesday failed to continue its upward movement. Overnight, it consolidated below the 1.3344–1.3357 level, then quickly recovered to this zone and rebounded

On the 4-hour chart of the main currency pair USD/JPY, although it appears to be strengthening, is indicated by the movement of the USD/JPY price moving above the EMA (21)

With the appearance of Divergence between the Nasdaq 100 index price movement with the Stochastic Oscillator indicator and its price movement moving above the SMA (50) which has an upward

Early in the American session, gold is trading around 3,382, rebounding after reaching a low of 3,359 during the opening session. A strong technical rebound suggests a rally

InstaTrade

video analytics

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.