See also

07.04.2025 07:02 PM

07.04.2025 07:02 PMTo Open Long Positions on GBP/USD:

Pound buyers attempted to regain control, but their efforts weren't strong enough to reverse the bearish trend from the end of last week. Even weak U.S. consumer credit data is unlikely to change sentiment in the second half of the day, so rushing into long positions is not advisable. Better to listen to FOMC member Adriana D. Kugler, although she's unlikely to say anything that wasn't already said by Jerome Powell last Friday.

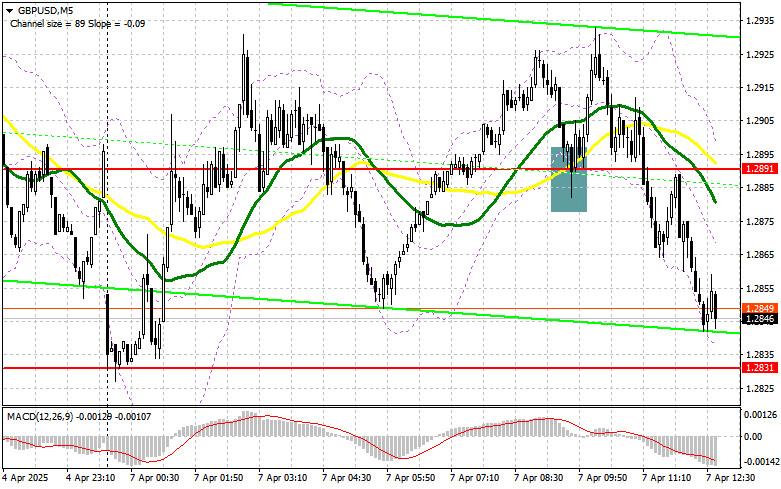

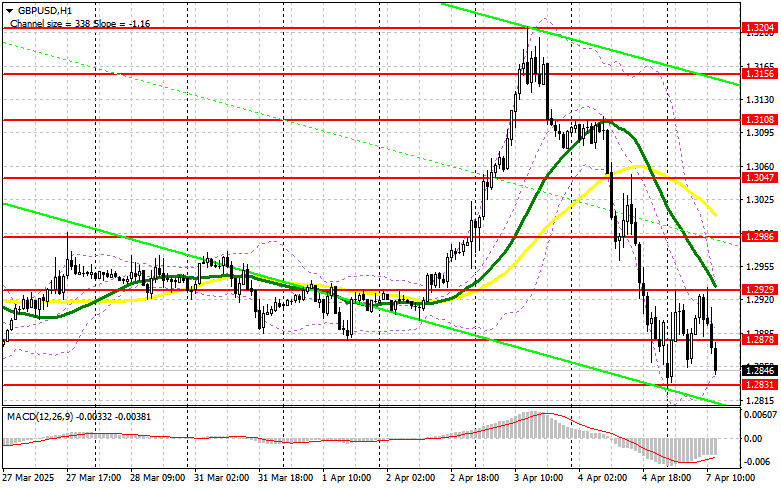

If the pair declines, I prefer to act near the 1.2831 support, formed during the early Asian session today. A false breakout at that level, similar to what I discussed earlier, will provide a good entry point for long positions with the goal of recovering toward the 1.2878 resistance. A breakout and retest of this range from top to bottom would signal a new long entry opportunity, aiming to update 1.2929. The furthest target will be the 1.2986 area, where I plan to take profit.

If GBP/USD continues to fall and bulls are inactive around 1.2831, things could go very badly for buyers, and pressure on the pound will likely intensify at the start of the week. In that case, only a false breakout near 1.2766 would provide a reason to open long positions. I also plan to buy GBP/USD on a rebound from 1.2721 with an intraday correction target of 30–35 points.

To Open Short Positions on GBP/USD:

Pound sellers made their presence known in the first half of the day, even without relevant UK statistics. If GBP/USD rises during the U.S. session following Fed commentary, only a false breakout around 1.2878 will offer an entry point for shorts, aiming for a drop toward the new support at 1.2831.

A breakout and retest of this range from the bottom up will trigger stop-loss orders, opening the way to 1.2766, which would deal a serious blow to pound buyers. The furthest target will be 1.2721, where I plan to take profit. A test of this level may push the pair back into a broader bearish market.

If demand for the pound returns in the second half of the day and bears fail to act near 1.2878, then I will delay short positions until a test of resistance at 1.2929, where the moving averages are located, currently favoring the sellers. I will open short positions there only after a failed breakout. If there's no downward move there either, I'll look for shorts on a rebound from 1.2986, aiming for a 30–35 point intraday correction.

COT (Commitment of Traders) Report:

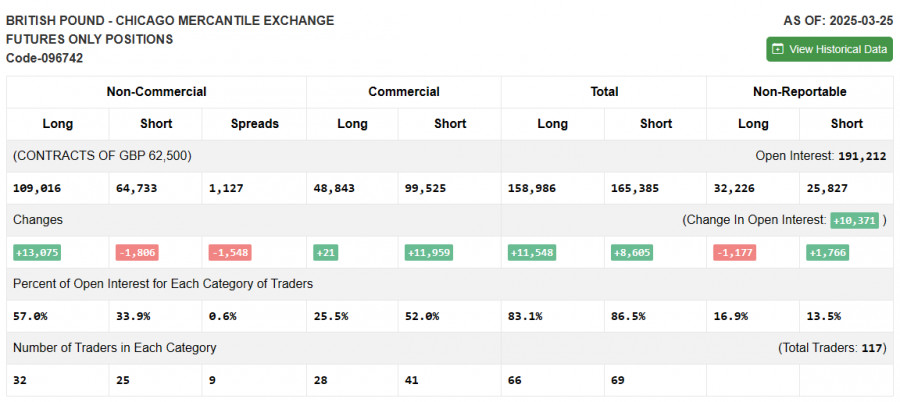

The March 25 report showed an increase in long positions and a decrease in short ones. Buying pressure on the pound continues, which is evident on the chart. While many risk assets have declined, GBP/USD shows stability.

Taking into account recent inflation data from the UK and comments from Bank of England officials, the regulator will likely keep its current policy unchanged at the upcoming April meeting, which could temporarily support the pound. However, much will depend on the broader impact of U.S. tariffs. If the threat of a global economic slowdown increases, pressure on risk assets—including the pound—will also grow.

The latest COT report shows that long non-commercial positions rose by 13,075 to 109,016 and short non-commercial positions decreased by 1,806 to 64,733. The net gap between long and short positions narrowed by 1,548.

Indicator Signals:

Moving Averages: Trading is occurring below the 30- and 50-day moving averages, indicating a bearish market for the pair.

Note: The moving averages are based on the H1 chart and may differ from the classic D1 moving averages.

Bollinger Bands: In the event of a decline, the lower boundary of the indicator near 1.2831 will act as support.

Indicator Descriptions:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Analysis of Thursday's Trades 1H Chart of EUR/USD On Thursday, the EUR/USD currency pair resumed its upward movement and posted a gain of more than 300 pips. As Friday began

The EUR/USD currency pair showed ultra-strong growth on Thursday—a move that, by now, probably surprised no one. Just as we reported that tariffs on China had been raised to 125%

Analysis of Wednesday's Trades 1H Chart of GBP/USD The GBP/USD pair spent the past 24 hours rising, then falling again, and then rising again. As before, it's impossible to identify

Analysis of Wednesday's Trades 1H Chart of EUR/USD The EUR/USD currency pair showed strong growth and decline on Wednesday. Lately, both moves have been triggered by Donald Trump. First, news

On Wednesday, the GBP/USD currency pair showed mixed movements throughout the day but generally maintained a downward trend — if we can even call the current behavior a "trend." There

On Wednesday, the EUR/USD currency pair moved exactly as expected — in several aspects. First, let's start with the "triangle" pattern we discussed yesterday. We warned that such formations often

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.