See also

25.03.2025 09:18 AM

25.03.2025 09:18 AMIs the worst behind us? As the S&P 500 surged to a three-week high amid easing tariff threats from Donald Trump, banks and investment firms rushed to the bulls' side, jostling for position. According to JP Morgan and Evercore, the worst stock sell-off of 2025 is over, and Bank of America sees signs of capital flows reversing. Previously, money was flowing from North America to Europe—now, it's time for a reversal.

Necessity is the mother of invention. While it's hard to call Donald Trump a poor man, one can certainly admire the Republican's inventiveness. He introduced a new concept in trade wars by announcing a 25% tariff on anyone purchasing oil from Venezuela. This approach could later be applied against Russia if it continues to stall on ending the armed conflict in Ukraine.

However, what energized markets wasn't this new "weapon." What mattered more for the S&P 500 was the White House's decision not to impose tariffs on imports of cars, semiconductors, and pharmaceuticals starting April 2. Additionally, any mutual tariffs will be selective in nature. If that's the case, the chances of a U.S. recession will decline, and capital will begin to return to the U.S.

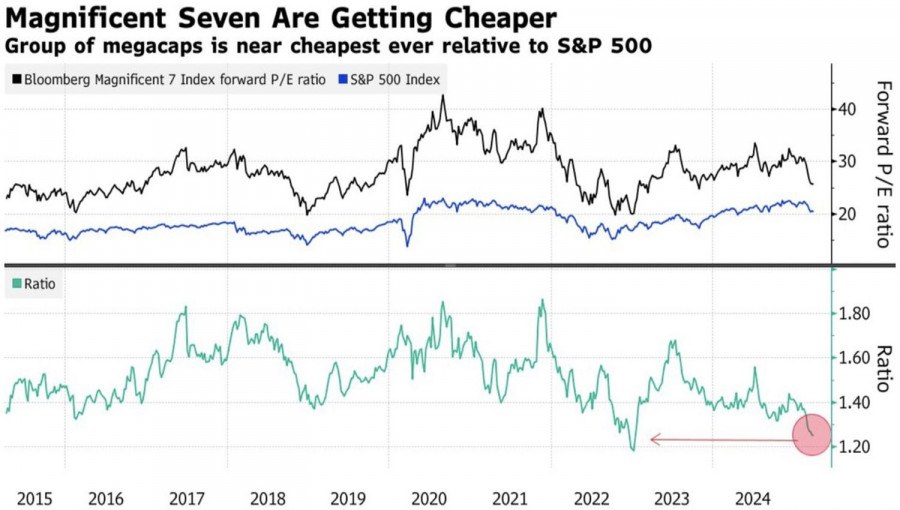

S&P 500 and the Magnificent Seven Stocks Performance

According to Bank of America, the main reason for the capital flight to Europe was the sell-off in the "Magnificent Seven" stocks, which dropped by 14%. As a result, Tesla and other tech giants shed a significant portion of their gains and are now beginning to look attractive again. Their valuation relative to the broader market has dropped to its lowest level since late 2022. Is it time to buy?

JP Morgan believes so, pointing to seasonal factors, the decline of the U.S. dollar and Treasury yields, as well as deeply pessimistic sentiment among retail investors—all of which pave the way for an S&P 500 rally. Evercore notes that this negative sentiment stems from White House actions, as tariff threats fueled recession fears.

A U.S. economic downturn could have become a self-fulfilling prophecy. Historically, whenever media interest in the topic surged, a recession wasn't far behind. On average, a recession occurred around seven months after peak user search activity. This means U.S. GDP could have risked contracting by October if the White House had continued to frighten markets with tariff threats.

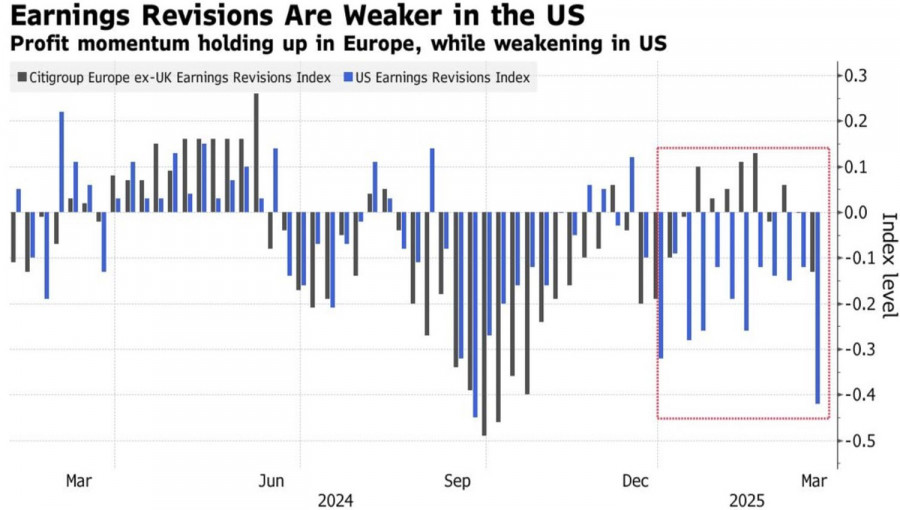

Corporate Earnings Forecast Dynamics

The S&P 500 has its own kind of safety cushion—a weak U.S. dollar. Roughly 30% of companies in the index generate revenue from overseas, and a declining USD index supports their financial performance. In fact, it was the revision of earnings forecasts that catalyzed the capital shift from North America to Europe. Is it time to return home?

On the S&P 500's daily chart, the bulls have launched a counterattack. However, a rejection at resistance levels of 5815, 5835, or 5885 would be a signal to sell.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to? Amid the geopolitical

The upcoming week's economic calendar is packed with important releases. As usual, the beginning of a new month brings significant macroeconomic reports from the U.S. and the Eurozone, typically triggering

No macroeconomic events are scheduled for Monday. If the market barely reacted to macroeconomic data last week, there is nothing to expect on Monday. Of course, Donald Trump could make

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.