See also

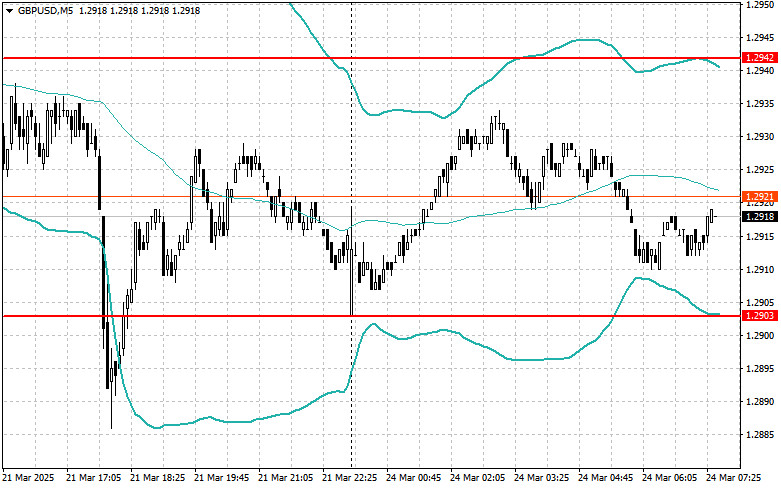

The euro and pound remained under pressure at the end of last week. A correction in these trading instruments had been long overdue, and for now, risk asset buyers have no reason to panic.

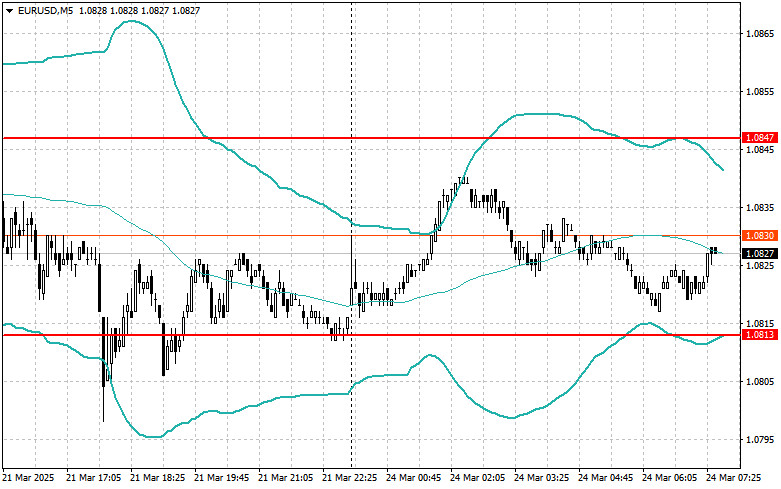

The euro came under additional pressure due to growing concerns about a further slowdown in economic growth in the region. In turn, comments from Federal Reserve officials reinforced expectations for a cautious rate-cutting approach in the U.S., which supported the dollar and negatively affected the euro. In this environment, market participants are showing caution and avoiding riskier assets. The euro's trajectory will largely depend on incoming macroeconomic data and signals from central banks.

This morning, economic reports that could slow the euro's decline will be released — but only if the actual readings exceed expectations. Specifically, the Eurozone's March manufacturing PMI, services PMI, and composite PMI will be published. Given signs of a recovery in manufacturing activity in Eurozone countries, supported by the European Central Bank's more accommodative monetary policy, the outlook for the euro strengthening in the first half of the day appears relatively optimistic.

Close attention will be paid to the manufacturing PMI, a key barometer of the industrial sector's health. An increase in this index may indicate a recovery in production capacity and an improving economy. Conversely, a drop in the PMI could signal slowing economic development or an approaching recession.

Similar data will be released for the UK, with more emphasis on the services sector, which makes up more than 70% of the British economy. The services activity index is crucial, reflecting the state of sectors like commerce, banking, logistics, and others. This indicator provides insights into consumer spending levels and the overall economic landscape.

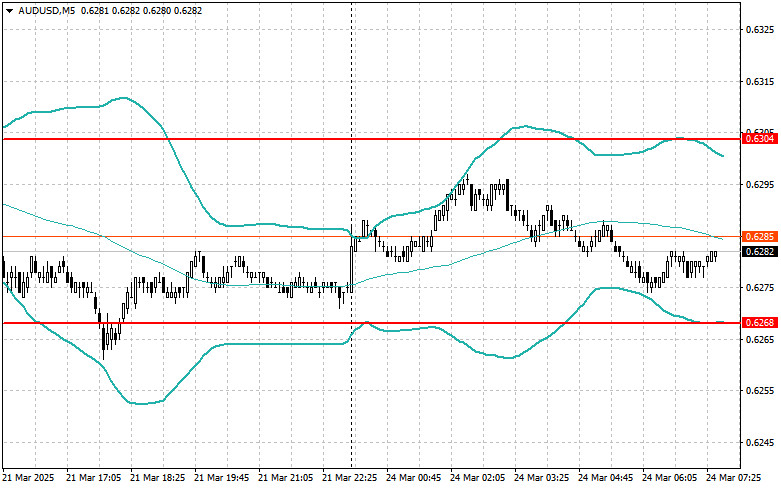

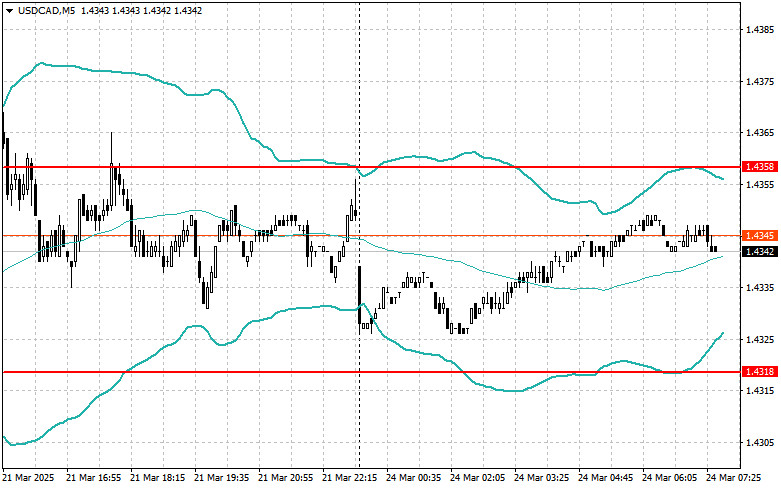

The Mean Reversion strategy is recommended if the data aligns with economists' expectations. If the figures deviate significantly from expectations, the Momentum strategy is preferred.

Buying on a breakout above 1.0840 could lead to a rise toward 1.0870 and 1.0910.

Selling on a breakout below 1.0805 could lead to a decline toward 1.0770 and 1.0740.

Buying on a breakout above 1.2935 could lead to a rise toward 1.2975 and 1.3010.

Selling on a breakout below 1.2910 could lead to a decline toward 1.2875 and 1.2841.

Buying on a breakout above 149.92 could lead to a rise toward 150.18 and 150.49.

Selling on a breakout below 149.62 could lead to a decline toward 149.32 and 148.97.

I'll look to sell after a failed breakout above 1.0847, once price returns below this level.

I'll look to buy after a failed breakout below 1.0813, once price returns to this level.

I'll look to sell after a failed breakout above 1.2942, once price returns below this level.

I'll look to buy after a failed breakout below 1.2903, once price returns to this level.

I'll look to sell after a failed breakout above 0.6304, once price returns below this level.

I'll look to buy after a failed breakout below 0.6268, once price returns to this level.

I'll look to sell after a failed breakout above 1.4358, once price returns below this level.

I'll look to buy after a failed breakout below 1.4318, once price returns to this level.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Forex Chart

Web-version

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.