See also

21.03.2025 07:42 PM

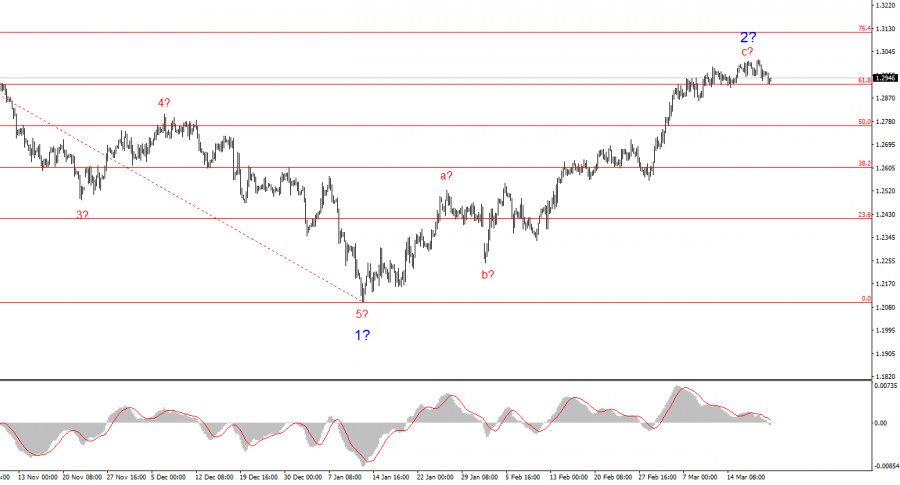

21.03.2025 07:42 PMThe wave structure for GBP/USD remains somewhat ambiguous, but overall manageable. At present, there's still a high probability of a long-term downward trend developing. Wave 5 has taken on a convincing form, which is why I consider senior wave 1 to be complete. If this assumption is correct, wave 2 is currently underway, targeting the 1.26 and 1.28 levels. The first two sub-waves within wave 2 appear to be complete. The third wave could finish at any moment.

Recent demand for the pound has been driven solely by the "Trump factor," which remains the key driver for sterling. However, beyond the short term, the pound still lacks a fundamental basis for sustainable growth. It's important to note that the Bank of England is preparing for four rounds of policy easing in 2025, while the Fed does not plan to cut rates by more than 50 basis points. Of course, these plans could change due to Trump and his policies, but for now, the Fed is sticking to its outlook, and it's too early to assess the economic impact of Trump's approach. The current wave structure remains intact, but any further price increase would raise significant concerns.

Pound Rises on Any Tariff News – For Now

The GBP/USD pair fell by 25 basis points by the start of Friday's U.S. session. Market activity was minimal due to the near absence of any major news. Traders had plenty of opportunities on Wednesday and Thursday to take a position but chose to wait instead. Now, the market's focus shifts to April 2 and the first week of April. This is when the U.S. will publish key reports such as Nonfarm Payrolls, unemployment data, JOLTS, ADP, and ISM indices. These indicators provide insights into the labor market and allow forecasts for broader economic trends. They are crucial.

However, even more important are Donald Trump's tariffs, which continue to steer the markets single-handedly. Let me remind you: the most recent surge in the pound, which contradicts the wave pattern, was triggered solely by Trump's tariff announcements. And on April 2, the U.S. President is expected to introduce new tariffs, particularly against the European Union. What else could we expect on that day but another drop in the dollar?

Meanwhile, the UK is actively negotiating trade terms with Washington. The UK–U.S. trade balance is roughly equal, meaning the UK may avoid the fate of China, Canada, and other "enemies of the American nation." This is yet another argument supporting continued pound strength—which again directly contradicts the current wave count.

The wave pattern of the GBP/USD pair indicates that the downward trend continues, as does its second wave. Right now, I would recommend looking for new entry points for selling, as the current wave count still points to a bearish sequence that began last autumn. However, how Trump and his policy will influence market sentiment going forward—and for how long—remains a mystery. The recent strength of the pound looks excessive relative to the wave outlook. The BoE and FOMC meetings could have served as a launchpad for wave 3, but they appear unlikely to do so now.

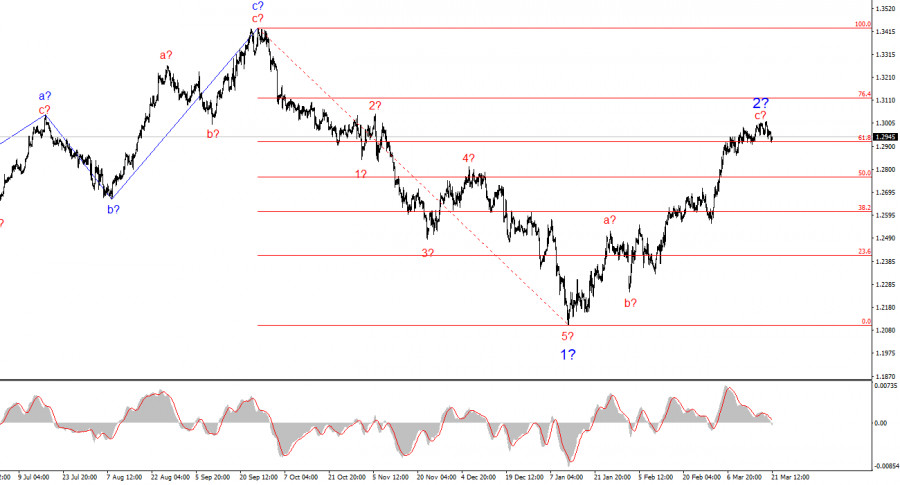

On the higher time frame, the wave structure has shifted. We can now assume that a downward wave sequence is forming, as the previous three-wave upward correction has clearly ended. If this assumption is correct, we should expect a corrective wave 2 or b, followed by an impulsive wave 3 or c.

Core Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.