See also

21.03.2025 07:39 PM

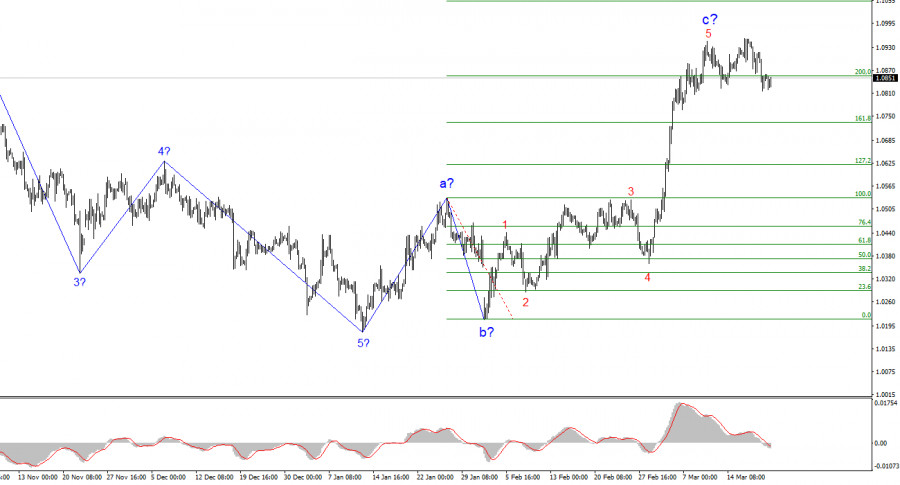

21.03.2025 07:39 PMThe wave structure on the 4-hour chart for EUR/USD threatens to evolve into a more complex formation. On September 25, a new downward structure began to form, taking on an impulsive five-wave shape. Two months ago, an upward corrective structure began, which should consist of at least three waves. The first wave had a fairly clean structure, so I still expect the second wave to take a clear shape as well. However, the current wave has grown so large that there's now a real threat of significant transformation in the overall wave layout.

The news background continues to support sellers more than buyers when it comes to economic data. All U.S. reports in recent months show one thing: the economy is not experiencing any serious problems and is not slowing down to concerning levels. However, the situation may change drastically in 2025 due to Donald Trump's policy. The Fed might cut interest rates more frequently, and tariffs along with retaliatory measures could harm economic growth. If not for recent developments, I would still be expecting a 90% likelihood of a euro decline. Yet, that scenario remains on the table.

The EUR/USD pair was flat throughout Friday. The lack of news today is literal—not metaphorical—leaving the market with nothing to react to, and trader activity extremely low. We can't say the market was active this week either. The Fed meeting could have triggered a significant price shift, but market participants still refuse to increase demand for the U.S. dollar. All the Fed managed to do was stop the dollar's decline. However, even this is debatable, as the dollar had already stabilized by March 11. Since then, the pair has been moving within a horizontal channel, showing no signs of building a corrective wave.

From this, I conclude that the FOMC meeting was simply not of interest to the market. If the Fed and Jerome Powell had shown concern over a potential recession or Trump's tariffs, it's possible the dollar could have continued its decline this week. But Powell tried to calm the markets, asserted there's no need to cut rates, and confirmed the U.S. economy is in good shape. Therefore, the next major event will be "America's Liberation Day," as Donald Trump put it. He's clearly referring to liberation from trade slavery and injustice, which he claims the U.S. has been subjected to. So, new tariff packages may be introduced on April 2—most likely targeting the European Union.

Based on the EUR/USD analysis, I conclude that the pair continues building a downward trend section, but it may soon shift into an upward one. The presumed second wave may be complete, but any upward move in price will transform the entire wave layout. Since the current wave structure is at odds with the news background, I cannot recommend selling the pair—even though the current levels look extremely attractive for shorts, provided the wave picture holds. However, Donald Trump may contribute to another decline in demand for the U.S. dollar, which would make a third wave down unfeasible.

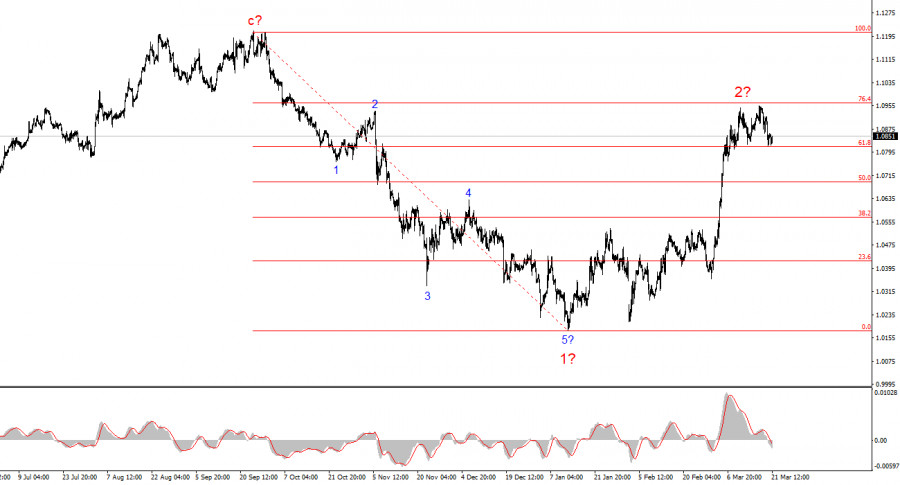

At a higher wave degree, the wave pattern has transformed into an impulsive structure. We are likely headed for a new long-term downward sequence, but the news background—especially from Donald Trump—could turn everything upside down.

Core Principles of My Analysis:

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

In the upcoming week, the British pound is highly likely to follow a general sideways trajectory. A brief price decline is expected early in the week. Toward the weekend, volatility

At the beginning of the upcoming week, the European currency is expected to continue moving sideways along the calculated counter-trend zones. A downward movement is more likely at the start

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.