See also

20.03.2025 09:22 AM

20.03.2025 09:22 AMBitcoin and Ethereum have experienced a rebound following yesterday's Federal Reserve meeting, which indicated that interest rates may need to be lowered. Regardless of how long the Fed intends to maintain a tight monetary policy, slowing economic growth will eventually compel the committee to take action. This expectation has driven the cryptocurrency market upward.

After hitting a low of around $83,500, Bitcoin is now trading at $86,000, while Ethereum, having dipped to $2,000, managed to hold above that level and quickly recovered to around $2,032, where it is currently trading.

A notable survey was released yesterday, revealing that 83% of institutional investors plan to increase their cryptocurrency investments in 2025.

This indicates the growing maturity and acceptance of digital assets as an integral part of the global financial system. This trend also suggests potential increases in volatility, liquidity, and the emergence of regulated investment instruments, making cryptocurrencies more appealing to major players.

Institutional interest in cryptocurrencies is further fueled by the search for alternative income sources amid declining interest rates and uncertainty in traditional markets. This influx of institutional capital is expected to continue supporting the cryptocurrency market, driving its growth.

As for the intraday trading strategy, I will focus on major pullbacks in Bitcoin and Ethereum, anticipating continuing the bullish trend in the medium term.

For short-term trading, the strategy and conditions are outlined below.

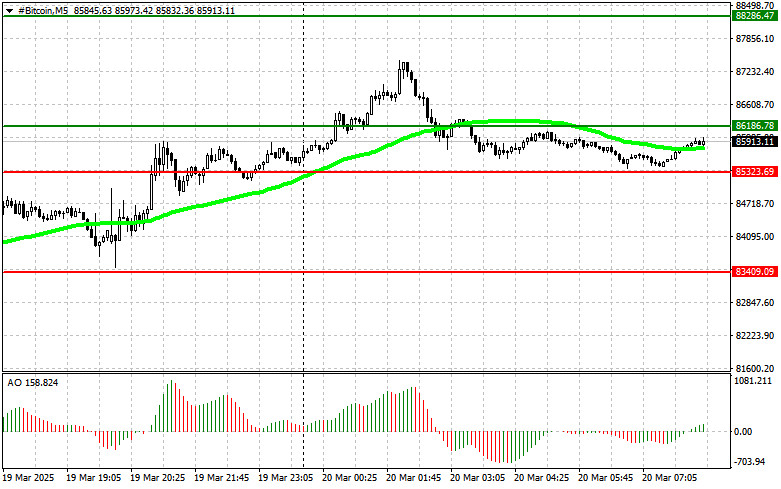

Scenario No. 1: I plan to buy Bitcoin today at an entry point of around $86,200, targeting a rise to $88,300. Around $88,300, I will exit the purchases and sell on a pullback. Before buying on a breakout, ensuring that the 50-day moving average is below the current price and that the Awesome Oscillator is in positive territory is crucial.

Scenario No. 2: Bitcoin can also be bought from the lower boundary at $85,300 if there is no market reaction to a breakout in the opposite direction, with targets at $86,200 and $88,300.

Scenario No. 1: I plan to sell Bitcoin today at an entry point of around $85,200, aiming for a drop to $83,400. Around $83,400, I will exit the sales and buy on a pullback. Before selling on a breakout, ensuring that the 50-day moving average is above the current price and that the Awesome Oscillator is in negative territory is important.

Scenario No. 2: Bitcoin can also be sold from the upper boundary at $86,200 if there is no market reaction to a breakout in the opposite direction, with targets at $85,300 and $83,400.

Scenario No. 1: I plan to buy Ethereum today at an entry point of around $2,032, targeting a rise to $2,087. Around $2,087, I will exit the purchases and sell on a pullback. Before buying on a breakout, ensuring that the 50-day moving average is below the current price and that the Awesome Oscillator is in positive territory is essential.

Scenario No. 2: Ethereum can also be bought from the lower boundary at $2,000 if there is no market reaction to a breakout in the opposite direction, with targets at $2,032 and $2,087.

Scenario No. 1: I plan to sell Ethereum today at an entry point of around $2,001, aiming for a drop to $1,966. Around $1,966, I will exit the sales and buy on a pullback. Before selling on a breakout, ensuring that the 50-day moving average is above the current price and that the Awesome Oscillator is in negative territory is crucial.

Scenario No. 2: Ethereum can also be sold from the upper boundary at $2,032 if there is no market reaction to a breakout in the opposite direction, with targets at $2,001 and $1,986.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Bitcoin is being pressured, but it still holds up quite confidently. After rebounding from the $92,000 mark, the first cryptocurrency returned to the $94,000 area, maintaining good growth prospects

Yesterday's unsuccessful attempt to stay above $94,000 demonstrates that there is still significant buying interest. Ethereum is also holding up quite well, although yesterday's correction during the European session likely

With the condition of the Stochastic Oscillator indicator which is already above the Overbought level (80) even though it is currently still moving above the WMA (30 Shift 2) which

Although currently the Solana cryptocurrency is moving in a strengthening condition which is indicated by its price movement moving above the WMA (30 Shift 2) but with the appearance

Bitcoin failed to hold above the $94,000 level and corrected to the $92,500 area, where it appears more comfortable. Ethereum also pulled back to around $1,769 after briefly climbing above

Bitcoin has successfully pushed above $90,000, while Ethereum added more than 10% in just one day, rebounding to $1800. The main catalyst was Donald Trump's statement yesterday, clarifying that firing

Graphical patterns

indicator.

Notices things

you never will!

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.