See also

10.03.2025 11:40 AM

10.03.2025 11:40 AMIs now the right time to buy US stocks? Even though the S&P 500 nearly entered correction territory, investor pessimism has reached extreme levels, making it worth considering long positions on the broad equity index. Large investors typically expand their portfolios during times of market stress—and right now, financial markets are undoubtedly in a state of distress.

When Donald Trump won the US presidential election, investors were in euphoria. Hopes for massive fiscal stimulus and deregulation drove the S&P 500 to record highs. Markets gradually began to believe that the Republican president was using tariff threats merely as a negotiation tactic.

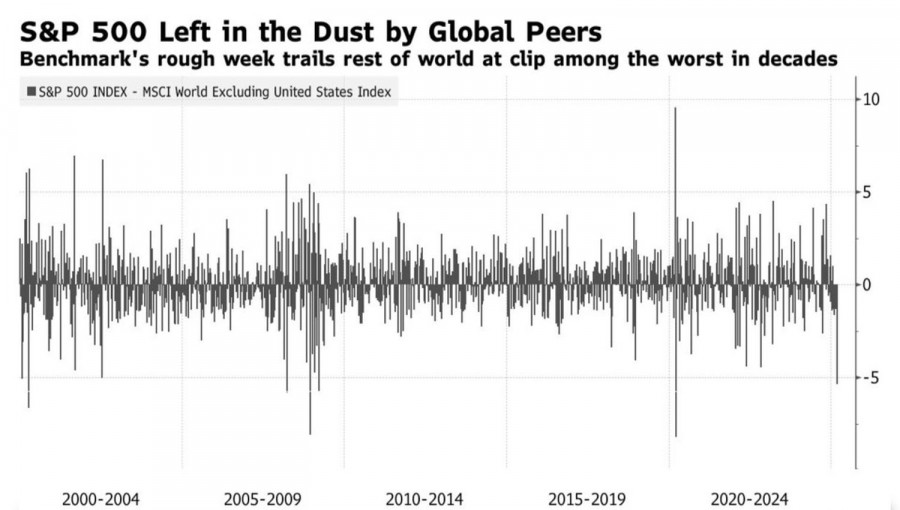

But as often happens, failed expectations led to sell-offs in the broader stock index. As a result, the S&P 500 has been significantly underperforming its international counterparts.

S&P 500 vs. MSCI performance

Simply put, after the November elections, investors became overly enthusiastic about good news and ignored the bad. Now, as spring begins, the situation has flipped 180 degrees—the majority now believes everything is negative for US stocks, disregarding any positive developments.

Does this make it the perfect time to buy the S&P 500—especially for those who still believe Trump's fiscal stimulus measures are on the horizon?

Three reasons to think twice before buying

Before making a decision, it's worth carefully reconsidering the risks:

Equities are still expensive relative to historical averages. The S&P 500's price-to-earnings (P/E) ratio is currently at 21, while the historical peak of 25 was last seen during the dot-com bubble 25 years ago.

The negative side of Trump's policy agenda—particularly tariffs—is unsettling businesses and consumers alike. This uncertainty is slowing economic growth. The Atlanta Fed's leading indicator predicts a nearly 3% decline in US GDP for Q1, signaling a potential downturn.

Despite the "red wave" securing Republican control of the White House and Congress, there's no guarantee that Trump's fiscal stimulus proposals will pass through the House and Senate. Any hurdles in implementing these measures could deal a blow to the S&P 500.

Markets at a crossroads

Markets are torn. On the one hand, they want to buy stocks amid market stress, but on the other, risks remain high. One factor supporting bullish sentiment was the US labor market report for February. Nonfarm payrolls increased by 151,000, which was seen as positive news for the S&P 500. Prior to the report, Goldman Sachs warned that weaker numbers could have sent the index down by 2.5%. Fed Chair Jerome Powell defined the latest labor data as "solid."

Technical outlook for the S&P 500

On the daily chart, a rebound from the pivot level at 5,670 increases the likelihood of forming point 5 of the Expanding Wedge pattern. Traders should shift from short-term buying to opening short positions at resistance levels of 5,800, 5,832, and 5,885.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

There are relatively few macroeconomic events scheduled for Thursday, but that no longer matters much. Yesterday, there were plenty of important publications from the Eurozone, Germany, and the U.S. Even

Markets are already fatigued by the chaos unfolding in Donald Trump's mind and among his followers. Everything remains extremely unclear, so market participants are now fully focused on today's important

A considerable number of macroeconomic events are scheduled for Wednesday, but we doubt they will have any meaningful impact on currency pair movements. The market continues to ignore most macroeconomic

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.