See also

04.03.2025 10:48 AM

04.03.2025 10:48 AMGas prices spiked sharply after news broke that US President Donald Trump had officially implemented the promised tariffs on Mexico, Canada, and China. This development has raised serious concerns in global markets, as these countries are major trading partners of the US, and the tariff imposition could dent economic activity, leading to a decline in gas demand. Besides, the price surge is driven by other factors, including seasonal demand increases and supply reductions.

Economists warn that a further uptrend in gas prices could negatively affect consumers and businesses, driving up costs for heating, electricity, and manufacturing. This, in turn, could weaken consumer demand and slow economic growth.

According to Gazprom, Europe is depleting its underground gas storage reserves at a brisk pace. The average withdrawal rate is 36% higher than last season and 22% above the 10-year average. Despite efforts to diversify supplies and fill storage facilities, Europe's dependence on stable gas supplies remains critical. The rapid depletion of reserves could lead to shortages sooner than expected, further exacerbated by geopolitical tensions and supply uncertainties. Increased gas withdrawals from storage continue to pressure the European energy market, driving prices higher and worsening inflationary trends.

It is evident that European governments must urgently implement energy-saving measures and seek alternative energy sources. Moreover, close cooperation among EU member states is essential to ensure fair resource distribution and prevent shortages.

Nord Stream 2 Revival? US investors show interest, but the EU resists

Recent discussions about reviving the Nord Stream 2 project, allegedly backed by US investors, were met with strong opposition from EU representatives. Former Nord Stream 2 AG CEO Matthias Warnig has been pushing for the pipeline's revival, arguing that it remains a highly promising direction. Warnig, who has strong ties to Russian business circles, insists that the project could be restarted with US investor participation, despite harsh criticism from European policymakers and existing sanctions. He emphasized that Europe's energy security still depends on gas supplies, and Nord Stream 2 could play a crucial role in meeting demand.

However, the EU authorities maintain a firm stance that Nord Stream 2 is a dead project with no justification for its revival. European officials argue that EU nations have successfully diversified their energy sources and reduced dependence on Russian gas, despite recent data suggesting otherwise. Moreover, any attempts to reboot the project would face severe opposition and additional sanctions. European policymakers insist that Russia has historically used energy as a political weapon, and they are determined to put an end to this practice.

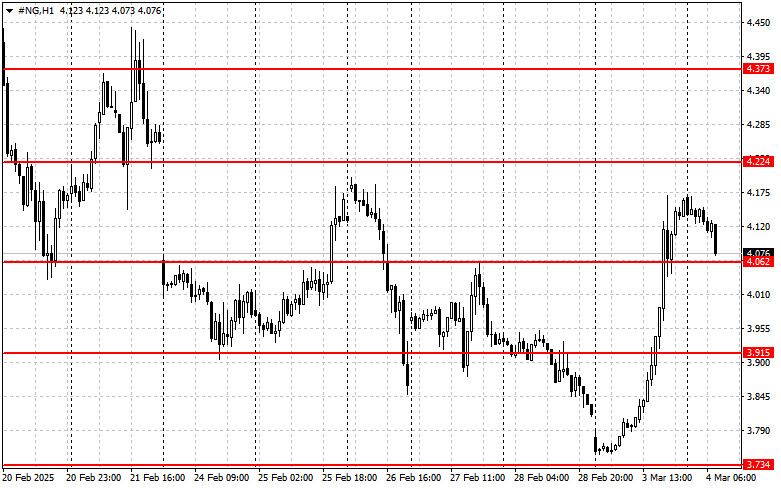

Technical analysis of natural gas

For buyers, reclaiming 4.224 is essential. A breakout above this level would open the way toward 4.373, followed by a larger target at 4.490. The ultimate bullish target stands at 4.510. If the decline continues, the first support level is around 4.062. A breakdown of this range could quickly push prices lower to 3.915, with the final downside target at 3.734.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

The upcoming week will be rich in important economic data releases, which could have a noticeable impact on market dynamics — but will they be able to? Amid the geopolitical

The upcoming week's economic calendar is packed with important releases. As usual, the beginning of a new month brings significant macroeconomic reports from the U.S. and the Eurozone, typically triggering

No macroeconomic events are scheduled for Monday. If the market barely reacted to macroeconomic data last week, there is nothing to expect on Monday. Of course, Donald Trump could make

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.