See also

02.03.2025 10:47 PM

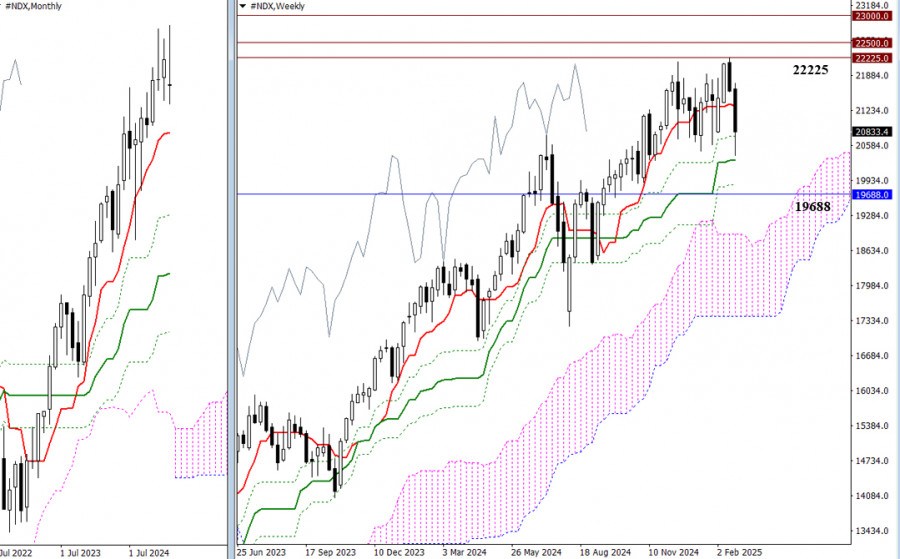

02.03.2025 10:47 PMFebruary marked a new all-time high at 22,225, but the bulls failed to hold and build on this level. The last two weeks of the month led to significant losses for the buyers. The market closed February with an indecision candle and nearly reached the support of the weekly medium-term trend at 20,306.5. Given the current conditions, the monthly downward correction is expected to continue toward its first target at 19,688, while the weekly golden cross may be invalidated at 19,853.80.

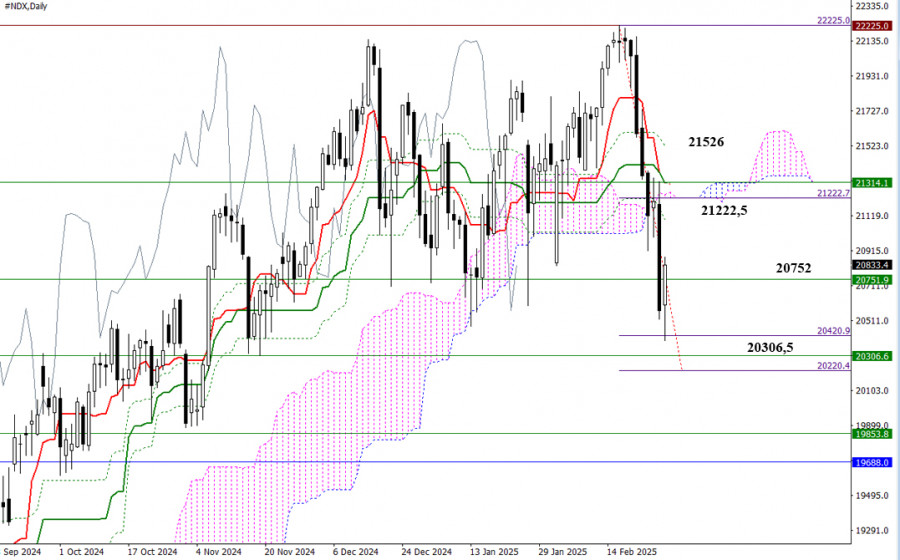

On the daily timeframe, the Ichimoku cloud was broken during the decline, forming a bearish target range of 20,420.9 – 20,220.4. The fulfillment of the first target at 20,420.9 led to a daily rebound. If the bulls continue to restore their positions, their main objective in this area will be to return to the bullish zone relative to the daily Ichimoku cloud at 21,222.5 and retest the broken daily Ichimoku cross at 21,094 – 21,302 – 21,526, aiming for a breakout. If the bears regain control, a breakdown below 20,220.4 and the weekly medium-term trend at 20,306.5 will open new downside prospects.

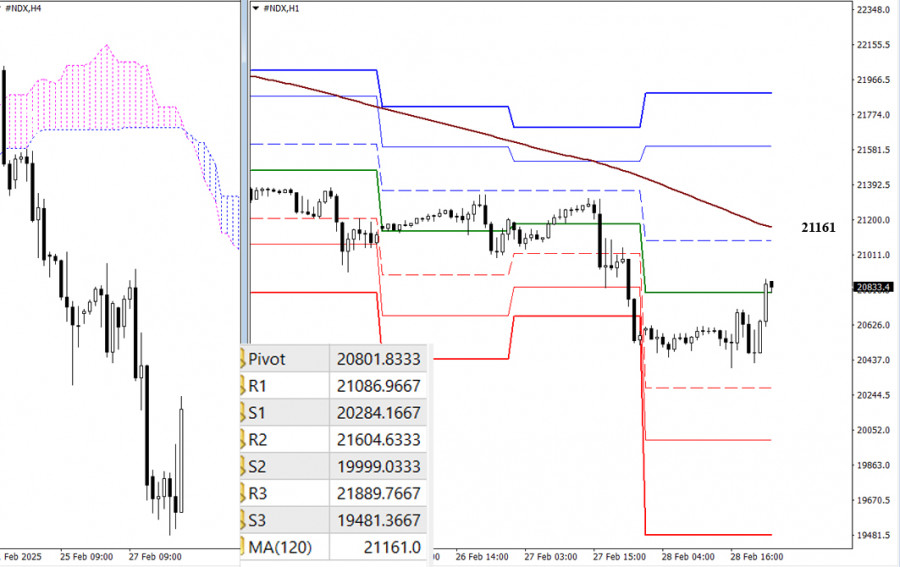

The daily rebound appears as an upward correction on lower timeframes. The bulls have tested the central pivot level of the day. The next correction target is the weekly long-term trend at 21,161, which determines the balance of power, and holding this trend provides a key advantage. Additional intraday reference points include classic pivot levels, which are updated daily when the market opens.

***

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

The Eagle indicator is showing oversold signals, so we believe that gold could resume its bullish cycle in the short term after a technical correction and reach the psychological level

Early in the American session, gold is trading around 3,276 with bearish pressure after finding strong resistance around 3,270, a level that coincided with the 38.2% Fibonacci retracement. Gold could

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Early in the American session, the EUR/USD pair is trading around 1.1358 within the downtrend channel formed on April 18. The pair is under bearish pressure. We believe the instrument

Useful links: My other articles are available in this section InstaForex course for beginners Popular Analytics Open trading account Important: The begginers in forex trading need to be very careful

Graphical patterns

indicator.

Notices things

you never will!

InstaTrade

PAMM accounts

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.