See also

20.02.2025 10:23 AM

20.02.2025 10:23 AMThe minutes from the Federal Reserve's latest monetary policy meeting, released on Wednesday, indicate that the central bank is significantly concerned about the lack of progress in reducing inflation, as well as the risk of it rising further.

Overall, the minutes did not present any groundbreaking news. Inflation reports since late last year have shown that current economic conditions in the U.S. are not supportive of lowering inflation. The primary reasons for this remain the same: the unique structure of the U.S. economy, which relies heavily on imports due to insufficient domestic production, along with a growing service sector that is creating more jobs. This increased job growth fuels demand for goods and services, placing upward pressure on inflation. The minutes reaffirmed Fed Chair Jerome Powell's earlier statement that the central bank is not in a hurry to cut interest rates.

While the Federal Reserve remains focused on inflation, Donald Trump has announced plans to impose a new 25% tariff on imports of automobiles, semiconductors, and pharmaceuticals, set to take effect on April 2. This announcement has added to global trade uncertainty and intensified existing protectionist measures aimed at supporting domestic producers.

With economic data at the center of market attention, investors are now awaiting the release of today's weekly jobless claims report and the February Philadelphia Fed Manufacturing Index for further insights into the state of the U.S. economy.

Meanwhile, an intriguing trend is emerging in the markets. The U.S. dollar remains under pressure despite the Fed's clear signals that interest rate cuts should not be expected until at least summer. If inflation worsens, rate hikes may even resume.

So why is the dollar not receiving support in such an obvious situation?

Looking at gold's performance, its price resumed upward after a brief pullback driven by hopes of resolving the Ukraine crisis between the U.S. and Russia. Given these dynamics, the dollar, as a safe-haven currency, should also be strengthening in the Forex market, but it isn't. Why? With the Fed's stance and rising U.S. inflation, all signs indicate a need for dollar purchases.

In my opinion, this situation primarily arises from growing concerns about the uncertain outlook of the U.S. economy under Trump's increasingly isolationist policies. Investors are unsettled by the ambiguity surrounding the U.S.'s future in this environment, which makes it challenging to assess potential risks. The last time isolationist policies were prominent in America was in the 1930s. Nearly a century has passed since then, and after a long era of globalization, the trajectory of this new phase of U.S. economic development remains unclear.

The rise of the euro, the pound sterling, and other currencies in the Forex market is not due to their inherent strength but rather to the temporary weakness of the U.S. dollar. Additionally, this uncertainty is affecting cryptocurrencies, leading crypto traders to exercise caution as the risk of a fall in these assets has significantly increased in recent weeks.

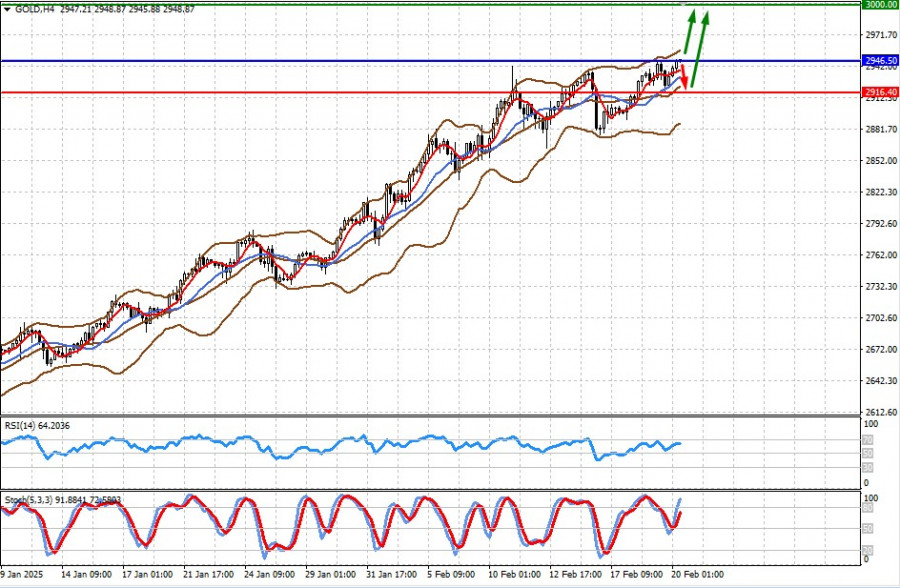

Gold prices are finding support amid global economic uncertainty, driven by large-scale political and economic shifts in the U.S. The price has broken through the resistance level of $2,946.50, and if it consolidates above this mark, further growth toward $3,000.00 is likely in the near future.

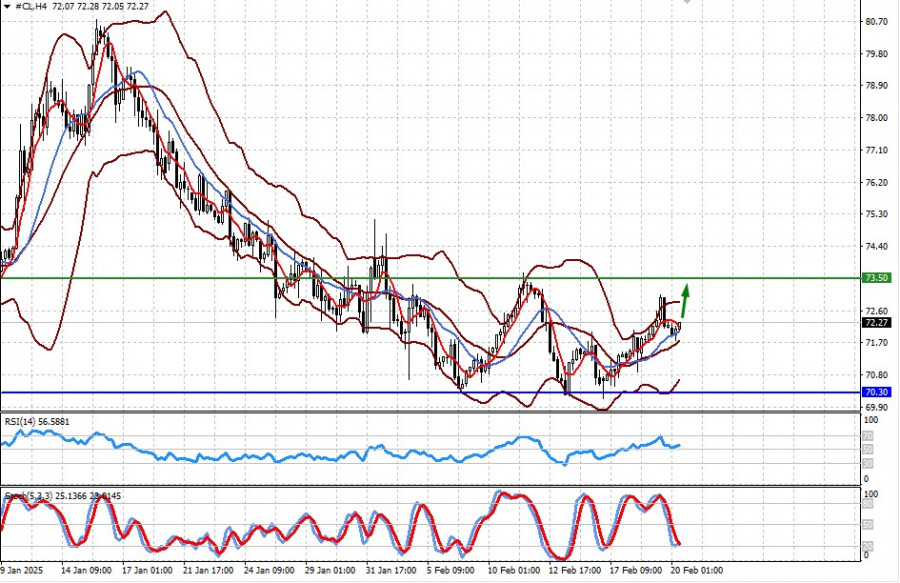

WTI crude oil is rising amid OPEC+ and Russia's active stance on price regulation, although it remains within a broad two-year sideways range. Prices are also supported by the local weakening of the U.S. dollar. Given this backdrop, WTI crude could climb toward $73.50.

You have already liked this post today

*The market analysis posted here is meant to increase your awareness, but not to give instructions to make a trade.

Today is Good Friday, a day Christians observe worldwide across all denominations. Market activity has noticeably decreased ahead of the Easter holiday, but this isn't the main reason for market

There are no macroeconomic events scheduled for Friday—not in the US, the Eurozone, Germany, or the UK. Therefore, even if the market were paying any attention to the macroeconomic backdrop

The GBP/USD currency pair continued to trade relatively calmly on Thursday, showing only a minimal downward bias. We still can't classify the current movement as a "pullback" or "correction."

The EUR/USD currency pair spent most of the day moving sideways. When the European Central Bank meeting results were released, the market saw a small emotional reaction, but nothing fundamentally

InstaTrade in figures

Your IP address shows that you are currently located in the USA. If you are a resident of the United States, you are prohibited from using the services of InstaFintech Group including online trading, online transfers, deposit/withdrawal of funds, etc.

If you think you are seeing this message by mistake and your location is not the US, kindly proceed to the website. Otherwise, you must leave the website in order to comply with government restrictions.

Why does your IP address show your location as the USA?

Please confirm whether you are a US resident or not by clicking the relevant button below. If you choose the wrong option, being a US resident, you will not be able to open an account with InstaTrade anyway.

We are sorry for any inconvenience caused by this message.